The UK Dec CPI Overview

The UK docket has the CPI report, which will be published later this session at 0930GMT. The consumer prices in the British economy are expected to ease slightly to 3.0% in Dec y/y. While core figures, excluding volatile food and fuel costs, are also expected to decelerate to 2.6% in the reported month.

On monthly basis, the consumer prices are expected to arrive at 0.4%, when compared to 0.3% seen in the month of November.

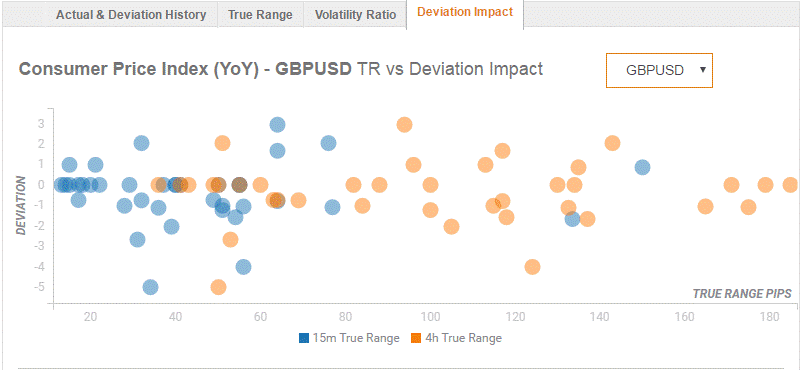

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 15 and 60 pips in deviations up to 2 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 75 pips.

How could affect GBP/USD?

On a positive surprise, we could see Cable retesting 1.3820/36 (multi-month tops/ Fed 2016 low), beyond which 1.3850 resistance area (psychological levels) could be tested, opening doors towards the natural resistance at 1.3900.

Conversely, a bigger-than-expected drop in the headline CPI figures will cause GBP/USD pair to extend the downslide towards 1.3779/81 (NY low/ daily pivot), below which a test of 1.3717 (5-DMA) will be imminent.

Key notes

UK: Key economic events ahead – Nomura

UK CPI: Headline and core inflation to edge down - Barclays

Main market movers today - Danske Bank

About the UK CPI

The Consumer Price Index released by the Office for National Statistics (ONS) is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

USD/JPY climbs relentlessly ahead of BoJ meeting

The USD/JPY extends its uptrend despite verbal intervention from the Minister of Finance. The wide differential between US and Japanese interest rates is seen as a major factor contributing to the rise. The idea that a lot is already priced into the US Dollar could limit USD/JPY upside.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.