- Equity markets continue to steadily move higher.

- More record highs for major indices.

- China cracks down on tech companies, and Delta causes more lockdowns.

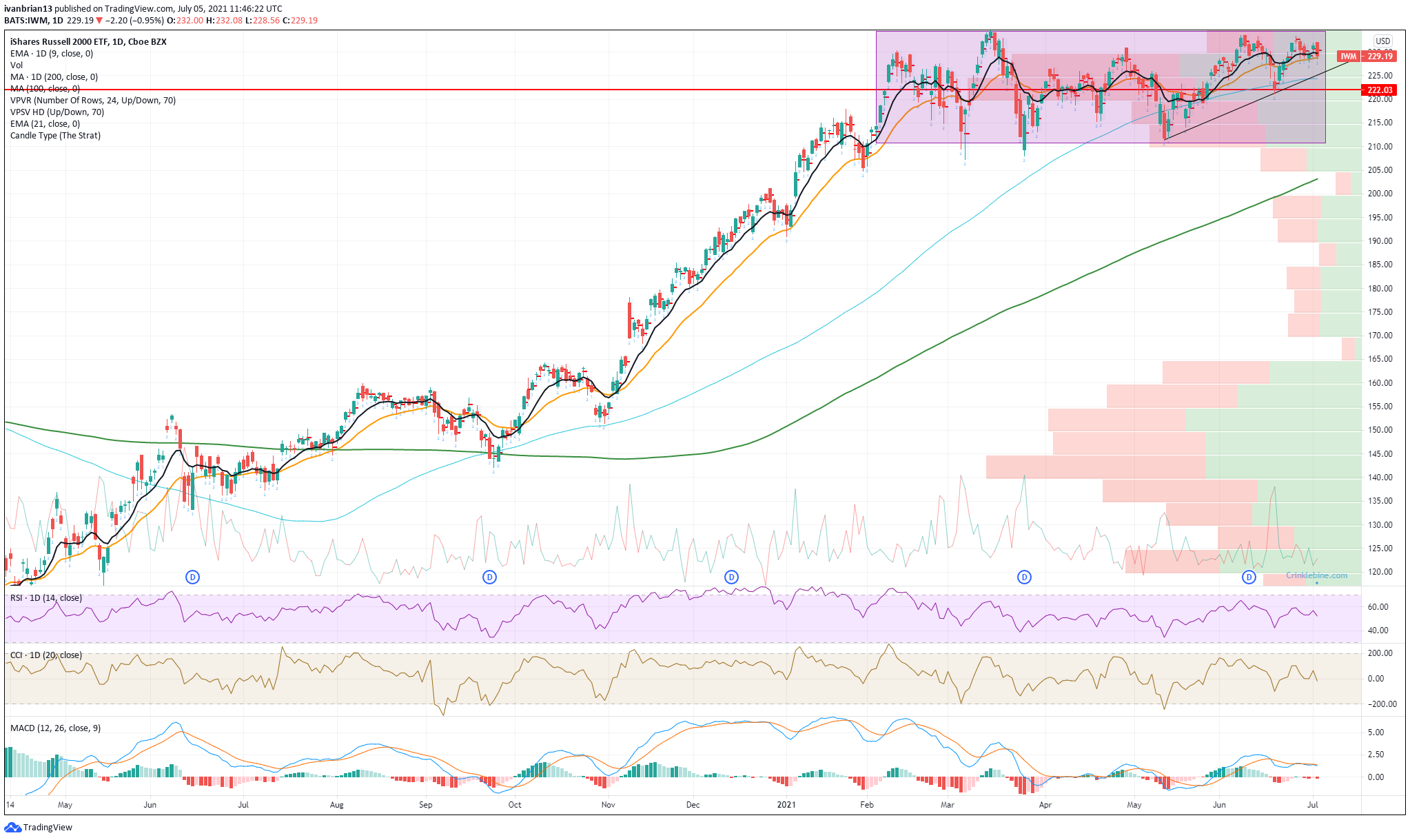

Equity markets continue to probe higher and higher levels as Friday's jobs report came in strong, despite the unemployment rate being higher than expected. Once again most major indices closed at record highs, with the Nasdaq being the star performer yet again. The tech index rose 1.15% on Friday to close out the week 2.67% higher. The S&P 500 rose 1.67% on the week, and the Dow rose a fraction over 1%. By comparison, the broader Russell 2000 Index (IWM) was down 1.33% for the week. This widening gulf between the Russell and the index leaders has been a recurring theme in June and now into July as the big mega tech names flex their collective muscles. How long the rest of the stock market can be left behind remains to be seen. Either the Russell needs to break out of its long-term range (see below) or it forms a triple top and drags everything crashing down.

The chart below shows the strong relative outperformance of the Nasdaq in June and continuance of this trend so far in July. Apple (AAPL) has broken out of levels we had been identifying (see here), and Friday saw this move continue with a powerful surge through $137. This brings the mega tech name into light volume territory, meaning a push for record highs is firmly on track. About time too after languishing in the low $120s.

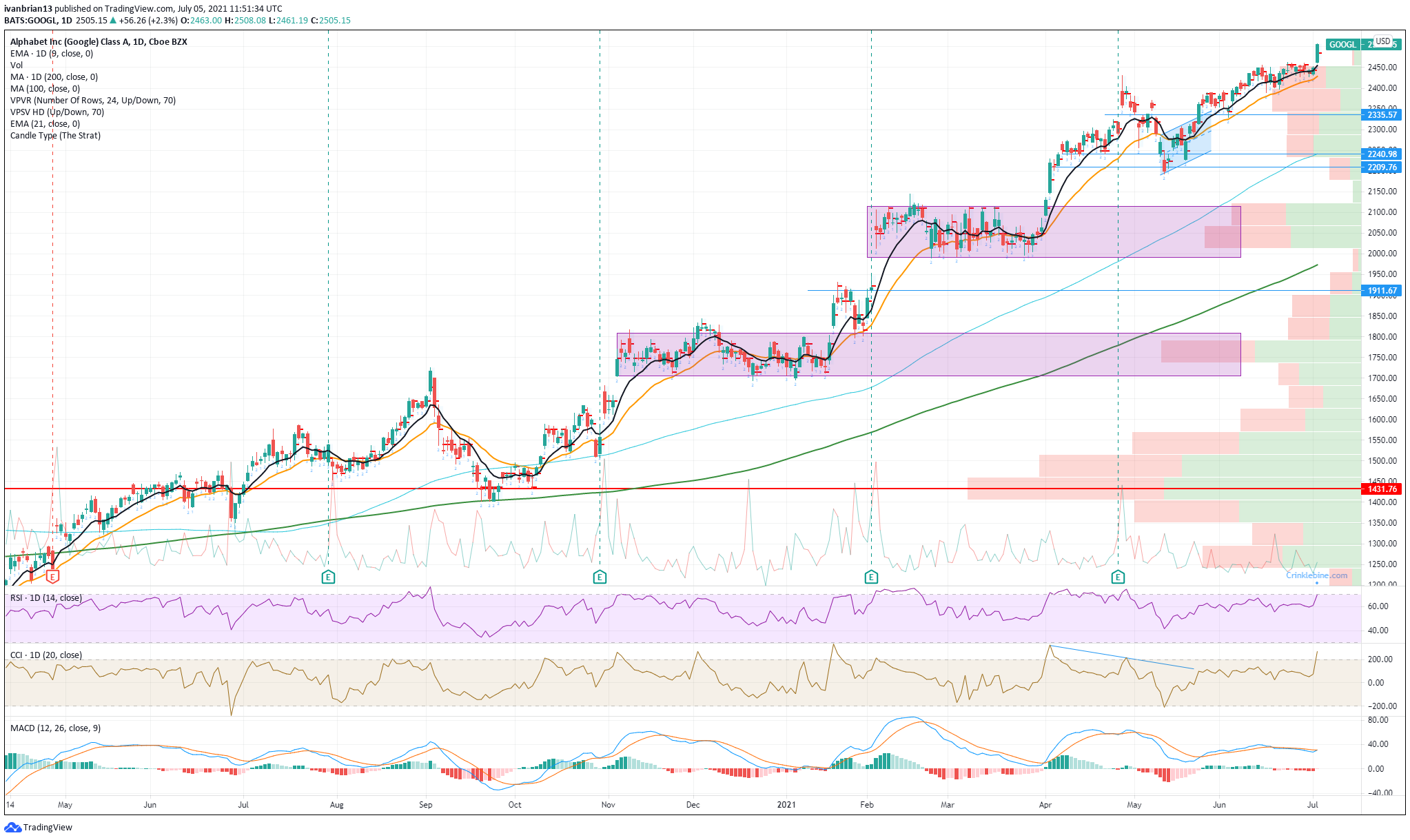

Alphabet (GOOGL) has also been surging and popped to more record highs on Friday, breaking above some interim resistance at $2,450.

Meme stocks lost some luster on Friday, continuing a quietening trend this past week. Is this a summertime lull or just a consolidation? Time will tell, but at some stage the music will stop and many stocks will not have a seat.

Speaking of the music stopping, China has certainly put the dancing on hold for a few stocks over the weekend with the announcement of an investigation into DiDi (DIDI). Backers include Softbank and Tencent as well as UBER, and many tech stocks suffered a tough day in Asian trading on Monday, see more. This follows on from Jack Ma and BABA being put under the microscope in late 2020 as China clearly wants to keep an eye on its burgeoning companies.

Equity flow data

The latest data from Refinitiv/LipperAlpha shows equity exchange traded funds (ETFs) took in $10.4 billion in the week to June 30th. This is the largest inflow in seven weeks. Financial ETFs were the biggest losers despite the Fed paving the way for banks to resume buybacks and dividend payments. The biggest net inflows were unsurprisingly to the S&P 500 ETF (SPY) and the Nasdaq Q's (QQQ). The financial ETF (XLF) was the biggest loser, closely followed by the Mid Cap Value Index (MDYV), perhaps adding to our Russell story above.

S&P 500 (SPY ES) technical analysis

Not a whole lot to say – the indices keep on trucking higher nice and steady. The 9-day moving average is working well for the S&P 500 (ES), and we have not seen a red candle for eight sessions. The Relative Strength Index (RSI) has strayed into overbought territory for the S&P 500. The top of the channel is still a long way off but shows the strength of the trend. 4,250 is a support area of high relative volume and matches the 21-day moving average.

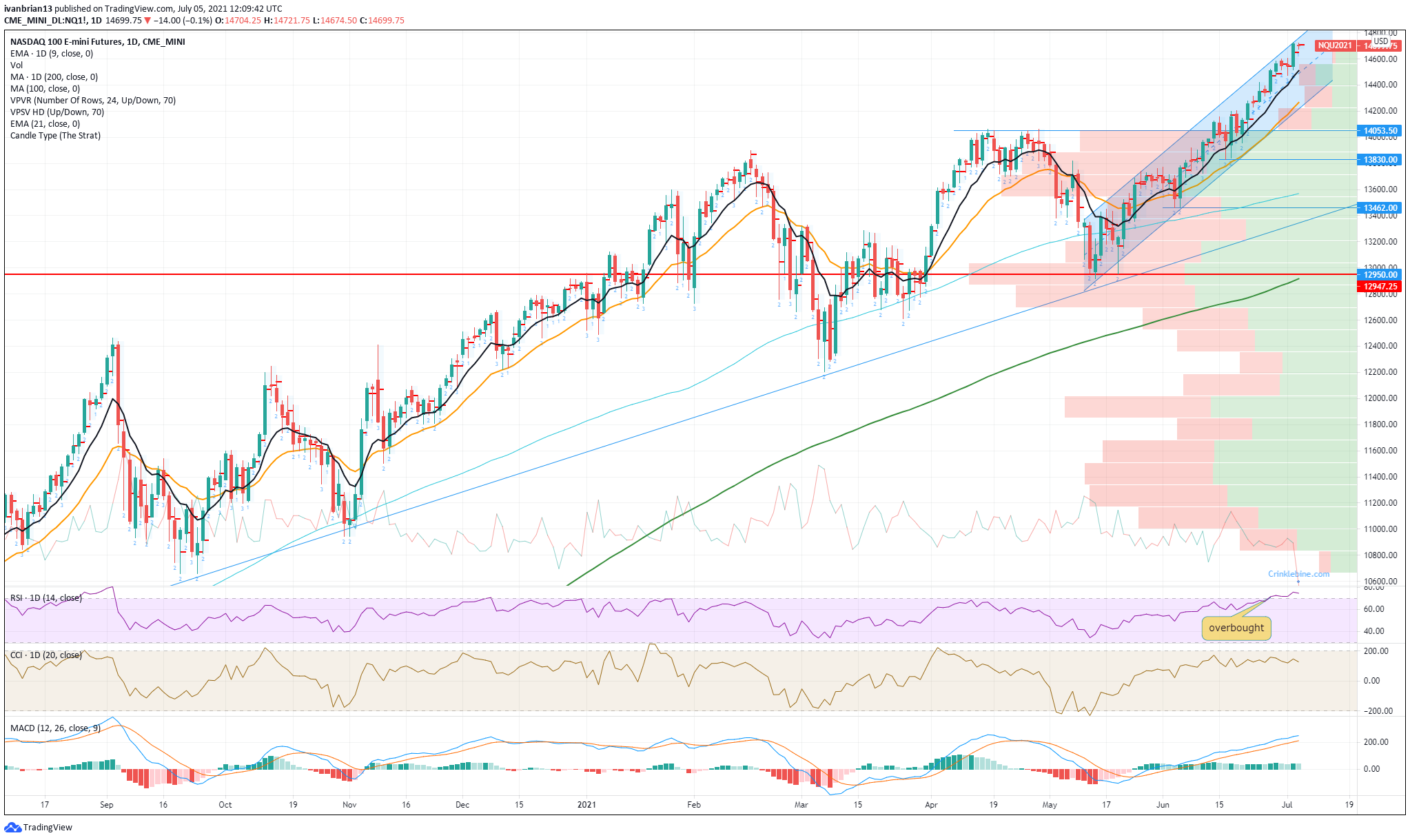

Nasdaq (NQ, QQQ) technical analysis

The Nasdaq has already achieved the upper end of the trend channel and is showing as significantly overbought on the RSI. Small support at 14,510 on the volume profile and 9-day moving average. 14,300 is the bottom of the trend channel and the 21-day moving average, but nothing is strong until 14,053 and 13,830.

Week ahead on Wall Street

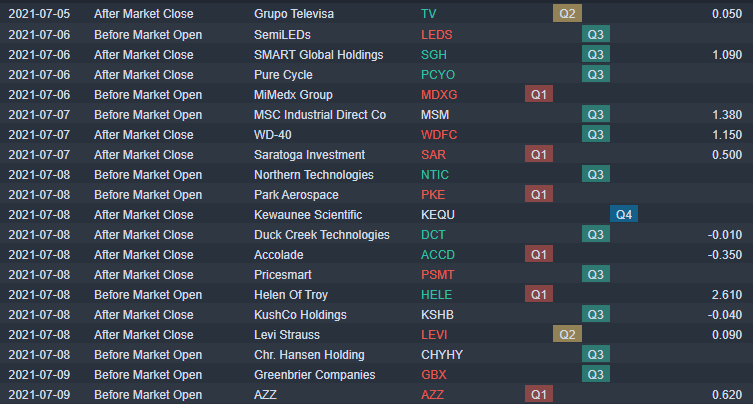

Earnings season gets closer, but a few lesser-known lights report this week – Levi Strauss (LEVI) probably being the most notable on Thursday.

Source: Benzinga Pro

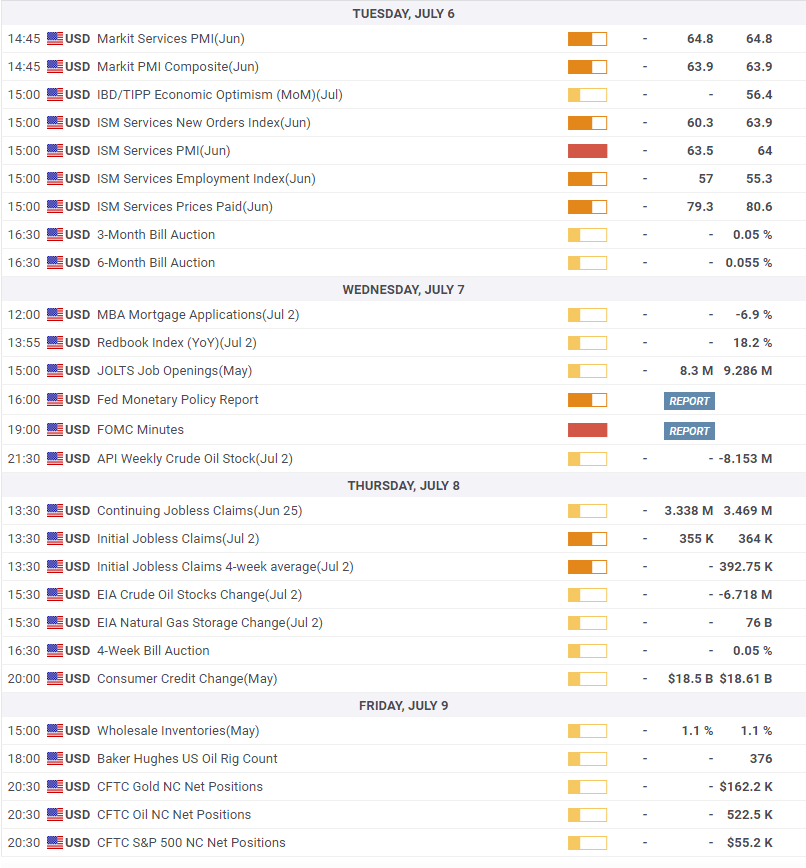

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.

-637610825255325313.png)