- The main US stock indices fell on Tuesday as US President Donald Trump said he was not satisfied with the US-China trade talks.

- Trump said that the historic meeting with the North Korean leader Kim Jong Un in Singapore on June 12 had a "very substantial chance" of not happening.

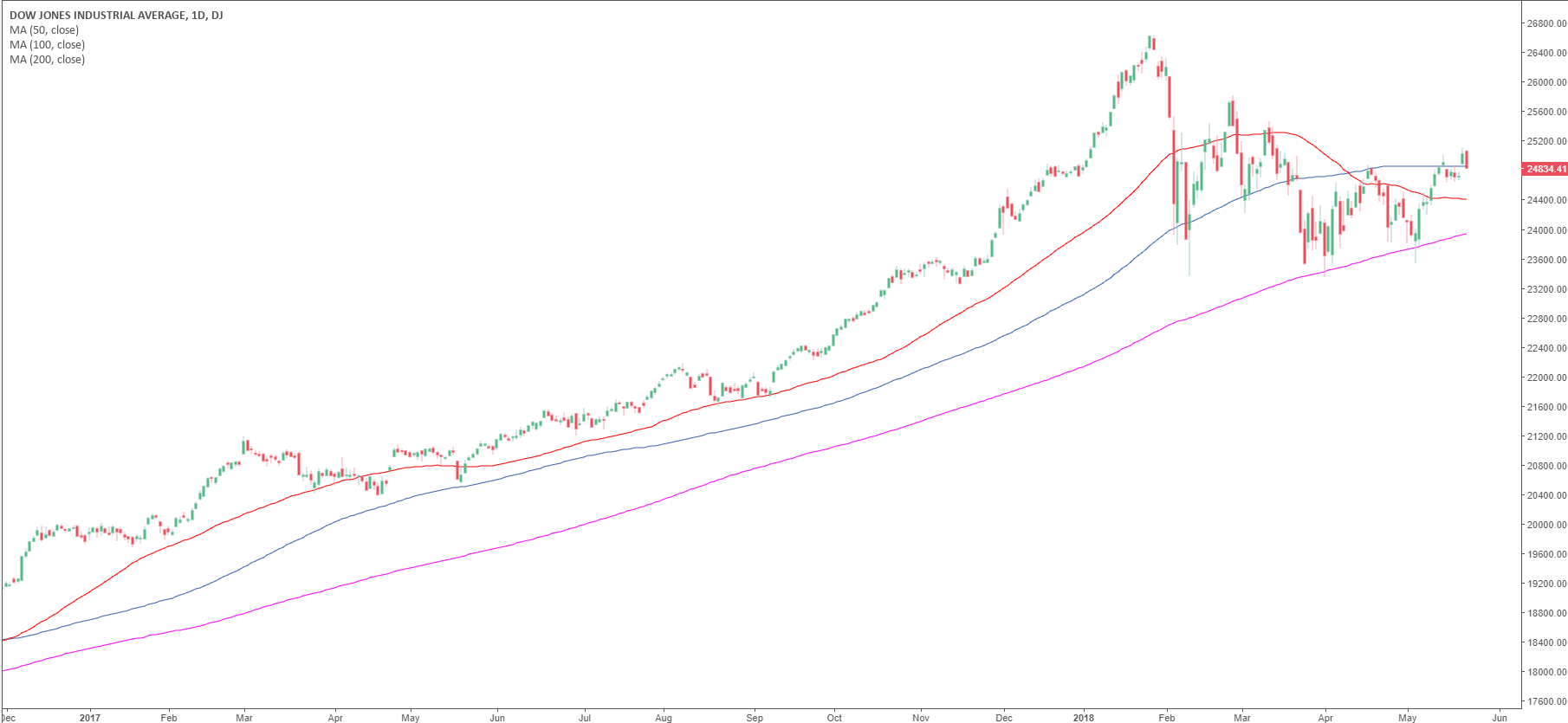

The three main US indices closed the day in the red on Tuesday. The S&P 500 Index lost 0.31% to 2,724.44 while the Dow Jones Industrial Average dropped 0.72% or 178.88 points to 24,834.41. The Nasdaq Composite Index lost 0.21% to close at 7,378.46.

The US stock indices fell on Tuesday as the US President Donald Trump said that he was “not satisfied” with the talks between the United States and China. He called the negotiations of last week “a start” while the US administration is finalizing a deal to find a solution to the trade imbalances with China.

He additionally said that the meeting with Kim Jong Un in Singapore on June 12 had a "very substantial chance" of not happening. Trump said that North Korea has to meet conditions for the summit to take place and if there are not met the meeting might happen “later”.

Meanwhile, on the commodities front, crude oil West Texas Intermediate (WTI) benchmark hit a new three-year high at $70.83 a barrel on Venezuela and Iran sanctions while gold stabilized its recent decline around the $1290 a troy ounce as the greenback is having a pause.

Indeed, the US Dollar Index (DXY) is ending the day slightly up at 93.59 while the 10-year Treasury yield also traded sideways closing at 3.062% on Tuesday’s trading.

Dow Jones Industrial Average: daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.