Here is what you need to know on Thursday, December 30:

Stocks look set for another modest day on Thursday as investors increasingly flee risk assets and look to position themselves for 2022. Many meme stocks suffered in an otherwise quiet Wednesday session with riskier assets being ignored or seeing book closing. The year appears to be ending on a calm note with investors happy to take the strong gains offered and start again next week. Covid still lurks over the next quarter with JetBlue (JBLU) announcing a raft of cancellations for January. China supply chain issues could be back for the first quarter of next year as China looks to take an increasingly hardline stance against the super transmissible omicron variant. China likely does not want its showcasing of the Winter Olympics in February to be in any way affected and has ordered sharp lockdowns.

The dollar meanwhile is at 1.1310 versus the euro while gold is flat at $1803. Oil is lower at $76.40 and bitcoin recovering to $47,300.

See forex today

European markets are higher: Eurostoxx +0.65, FTSE +0.01% and Dax +0.2%.

US futures are also higher: S&P, Dow and Nasdaq all up a meager 0.15%.

Wall Street (SPY) (QQQ) top news

ECB Holzmann says in 2022 the ECB should abandon negative rates.

Spanish inflation up to 6.7%, highest since 1989.

US jobless claims hit multi decade low.

Micron (MU) says China shutdown will create supply delays for memory chips.

JetBlue (JBLU) to cancel over 1,000 in next two weeks.

Biogen (BIIB) Samsung Biologics denies report or merger talks.

Didi Global (DIDI) down on earnings report.

RR Donnelley (RRD) receives an unsolicited acquisition proposal according to CNBC.

Johnson and Johnson (JNJ) South African study shows booster was 85% effective.

Vector Group (VGR) down 25% premarket on spin-off of Douglas Elliman unit.

Ford (F) and General Motors (GM) Citi increases analyst price targets for both.

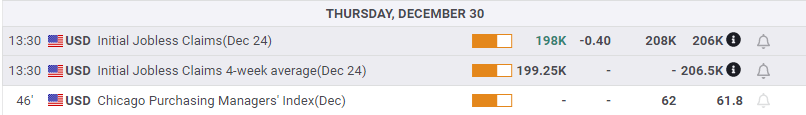

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.