Here is what you need to know on Monday, November 8:

Tesla (TSLA) is once again stealing the headlines, but this time good old Elon is sending the stock sliding as he runs a Twitter poll to sell 10% of his holding. The guy is pure box office and gives great copy, so keep it coming Elon. Tesla shares were down 7% premarket but have bounced to -5% currently. See more here.

Equities just keep going up, and now that it is winter bears have gone into total hibernation for fear of being completely mauled. This year is close to breaking 1995's record for record-setting with 65 all-time high closes in the S&P 500 so far with two months left. It looks good today for more gains as futures point north. The market is in a buoyant mood after Friday's strong jobs report. We always like to dampen the spirits though and note with interest the surge in yields this morning. The two-year is up a cool 6%, so let us see how tech stocks react to that.

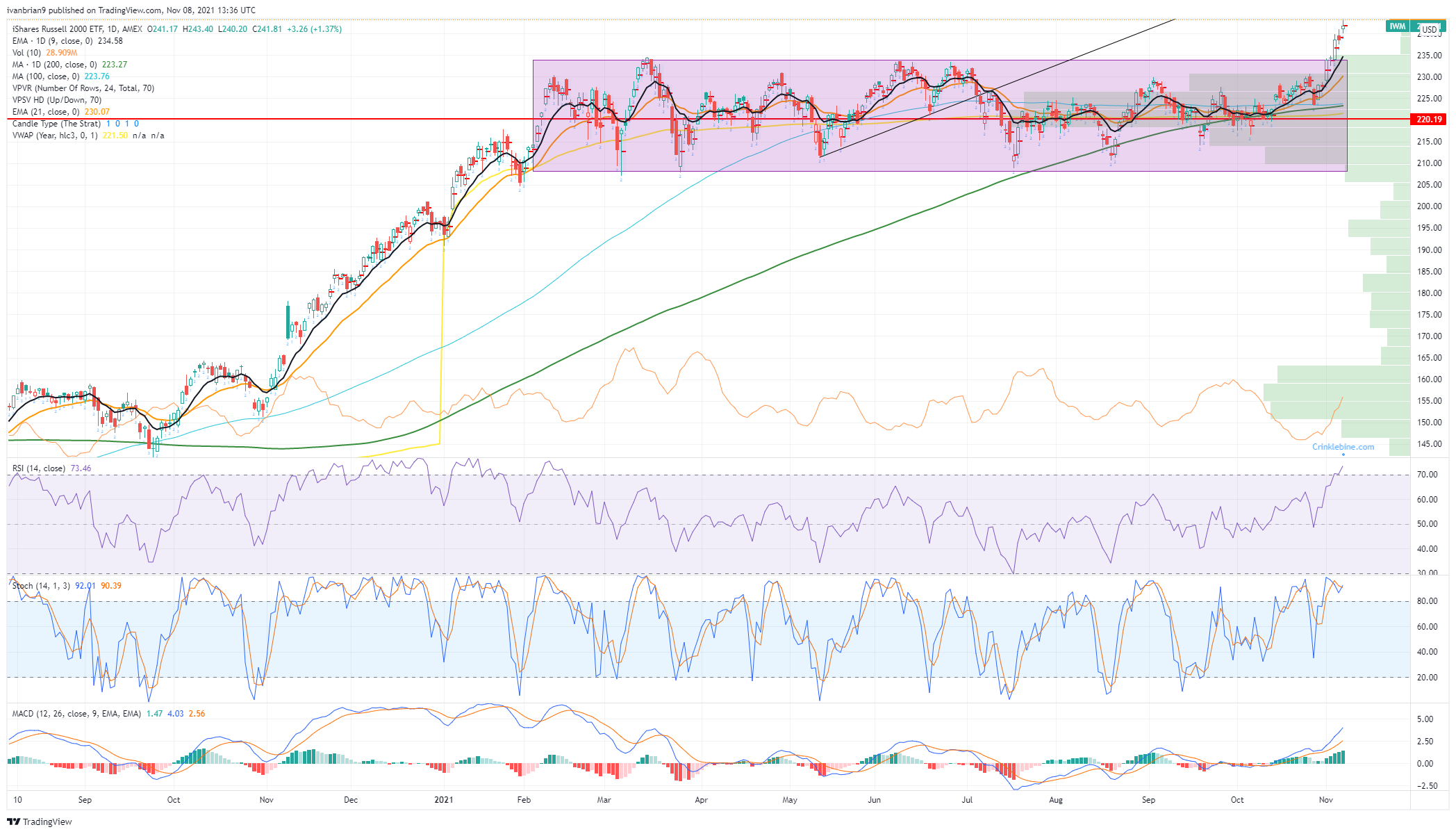

Evergrande also looks to have missed another overseas coupon payment. Tech stocks may not be where all the fun is at over the coming weeks as the Russell 2000 (IWM) finally breaks out of its year-long range play. This could rally into year-end as small caps may catch some bids once tech and mega caps peter out. Sector rotation, they call that one.

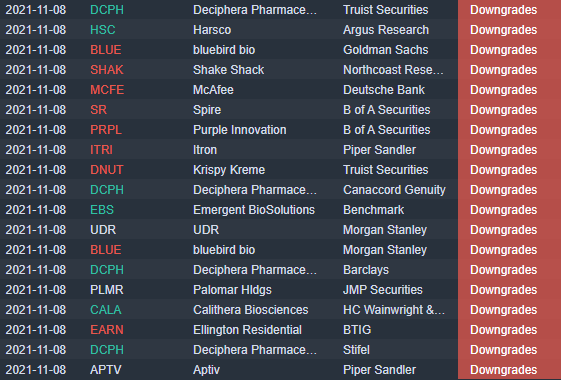

Inflation data is out later in the week and will put Fed policy back in the limelight. Now that the Fed meeting is done, Fed officials are out of a blackout and take to the wires big time this week to explain their thought process. Keep an eye on Powell and Clarida today.

Russell 2000 (IWM) daily chart

The dollar is flat but consolidating after recent gains, at 1.1580 versus the euro. Oil recovers slightly to $81.90. Bitcoin is seeking out more records at $65,700, and Gold is $1,820.

See forex today

Europen markets are a tad lower: EuroStoxx flat, FTSE -0.1%, and Dax -0.2%.

US futures are green: S&P +0.2%, Dow +0.3% and Nasdaq +0.1%.

Wall Street (SPY) (QQQ) stock news

Tesla (TSLA) shares are falling as Elon tweets about selling 10% of his stake, see more.

Caterpillar (CAT) is up 4% on a bullish note from Baird.

AMC reports earnings after the close tonight. See preview here.

Coty (COTY) reports strong results, stock up 5% premarket.

Moderna (MRNA) down again in premarket after Pfizer antiviral pill news hammers stock. See here.

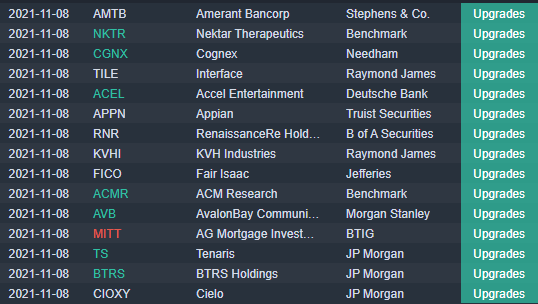

Krispy Kreme (DNUT): Truist downgrades (how dare they, I love those donuts). Truist downgrades the stock on tight labor market. The donuts remain tasty as ever, I am sure.

SoftBank fell in Japan after reporting a $10 billion hit from Vision Fund on losses in Chinese tech.

Canopy Growth (CGC) was downgraded by Cowen & Co and Cannacord.

Berkshire Hathaway (BRK) boosts its cash hoard to a record high, uh oh!

Rivian (RIVN) is due to IPO on Wednesday at $72-74 now as demand appears to increase.

Apple (AAPL) hires a former Tesla engineer to help with moving into auto, see more here.

Virgin Galactic (SPCE) reports earnings after the close, see a preview here.

Merck (MRK): the UK approves antiviral pill for use against covid.

Disney (DIS) offering streaming Disney+ for $1.99 for a limited time to stem a slowdown in subscriber growth.

Sources: Reuters, CNBC, Benzinga Pro, Bloomberg.

Upgrades and Downgrades

Source: Benzinga Pro

Economic releases

That is all. Seriously, go trade. Only the editor reads down here, and I am not even sure he makes it this far! (I do.)

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.