Here is what you need to know on Friday, June 17:

Finally, the end of yet another exhausting week for investors and traders alike. Direction remains lower, but those swings are wild and hard to fathom for many portfolio managers, traders and investors. The market surged on Wednesday in a so-called relief rally as the Fed raised rates by 75 basis points. This was the highest such raise since the 1990s. That should really have been the clue for what transpired on Thursday. We are now back in peak doom, the end is nigh mode, and that feels about right for the foreseeable future.

The macro economic picture is deteriorating sharply with housing data now the latest to turn south. This is not surprising given where mortgage rates have been lately and are heading. The average price of a home has surged due to a lack of supply and building costs as well. The wealth effect that encourages consumers to go out and spend, spend, spend is largely due to rising housing and stock prices. Now when both turn lower, so spending will also turn lower.

The last cog in the wheel to go will be corporate earnings. We touched on this in our S&P 500 (SPY) note on Thursday. The SPX has retraced to trade at 15 times forward earnings, and this is more or less the historical average. A 10% reduction in EPS from $250 to $225 times 15 gives us 3,375, but in times of recession, the P/E can slip lower to nearer 10, or EPS can easily fall more than 10%. Current earnings forecasts are pie in the sky from the Wall Street analyst community. They have not meaningfully changed for 2022. In fact, they have been revised up despite the rapidly worsening geopolitical and macro economic environment we have witnessed this year. EPS outlook has also failed to grasp the CEO gloom and doom, and usually those are the ones with their finger on the pulse of their particular industry. The next quarter should see reality hit those EPS estimates with downgrades all around. The S&P dividend futures contract is already pricing in lower dividends, which would be a logical assumption of lower earnings.

Back to current events now. This morning sees a revival of sorts with markets in Europe moving higher. Bond yields are still moving higher but the acceleration and volatility have slowed. Next week could once again prove challenging with long term investors continuing to reposition. But then we enter the quarter end period when traditionally the quarter ends with a reversal of the dominant trend. Also of note is the relative underweight positioning into quarter end which should add to the strong potential for a bear market bounce.

The Bank of Japan held the line overnight as the only dove in a sea of hawks, and the dollar regained its strength as a result. The Dollar Index is up to 104.40, and dollar/yen is back to 134.50. Gold trades at $1,850, and Bitcoin is holding at $20,800. Oil is lower at $116, and yields are steady across the board.

European markets are higher: Eurostoxx +1.6%, Dax +1.4% and FTSE +1.1%.

US futures are also higher: S&P +0.8%, Dow +0.7% and Nasdaq +1.1%.

Wall Street top news (SPY) (QQQ)

EU recommends Ukraine for candidacy status.

Germany getting 60% less gas than ordered.

Russia says EU may face serious gas issues this fall and winter.

Tesla (TSLA): Elon Musk sued for alleged Dogecoin pyramid scheme.

Twitter (TWTR): Elon Musk addressed Twitter employees on Thursday in a Q&A.

Adobe (ADBE) falls on profit guidance.

US Steel (X) soars on strong earnings.

ROKU announces partnership with Walmart (WMT).

Alibaba (BABA) up on news that China central bank approves ANT Group application to form a financial holding company.

SNAP testing a paid subscription model.

Centene (CNC) up on earnings and share buyback.

Redbox (RDBX): latest meme squeeze continues as it closes up 6.6%.

Rivian (RIVN) to use wind turbines to give EVs first charge.

Vita Coco (COCO): CFO to leave company.

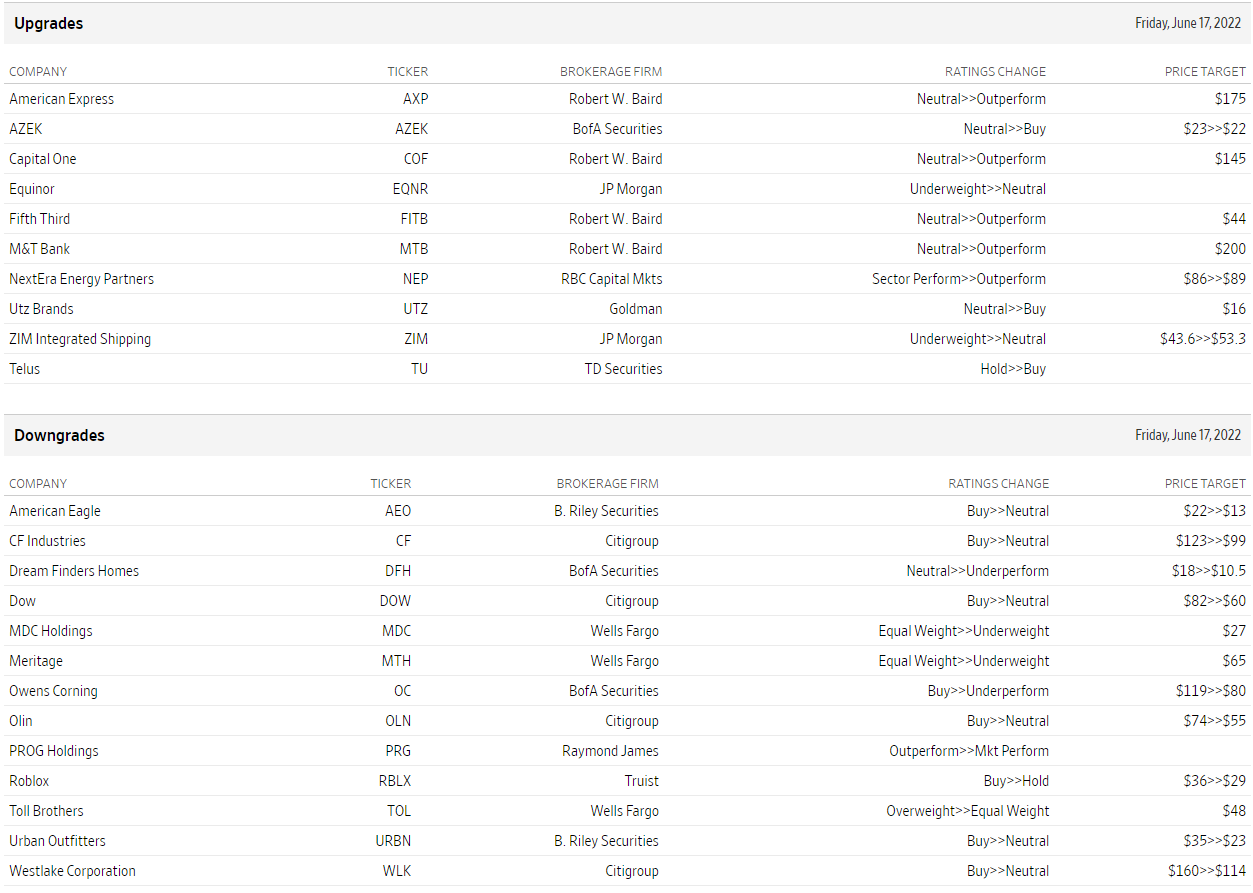

Upgrades and downgrades

Source: WSJ.com and Briefing.com

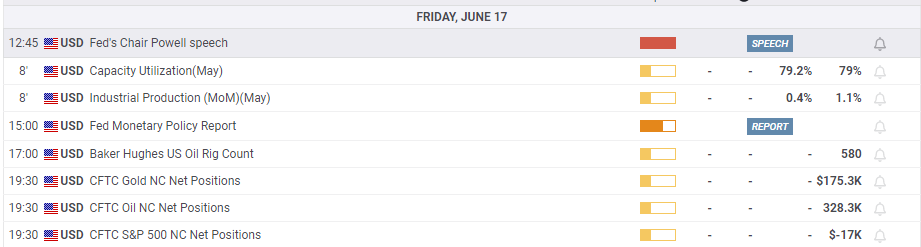

Economic releases

The author is short Twitter and Tesla, as well as long OTM puts and short OTM calls on Redbox.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.