Here is what you need to know on Wednesday, October 13:

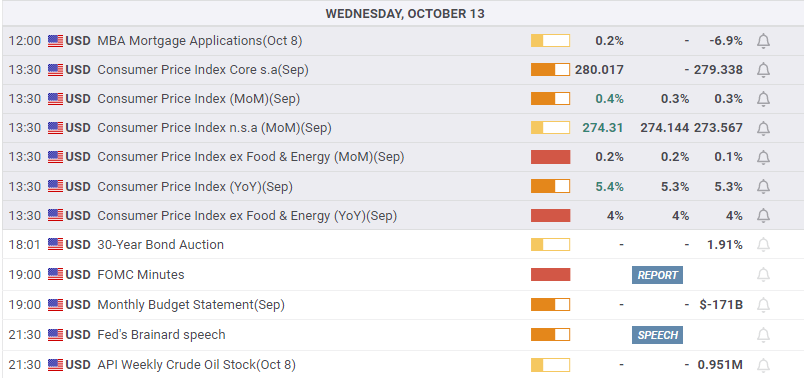

So far so good after another inflation-confirming CPI report. Inflation is here for a bit longer than transitory, but so far the yield on the 10-year is remaining stable at 1.57%. The bond market may have been asleep at the wheel, but the dollar knew what to do and ralllied hard. The Nasdaq did not like that as the dollar is preempting higher yields. Later today the Fed releases minutes of its last meeting, which may give some clues as to just how hawkish it plans to become after its massive stimulus program.

Stocks are likely to tread water ahead of that. Well, not all stocks. With earnings season now upon us, those making the news will likely see some activity. JPMorgan kicks off the investment banking round with a positive tone. Higher yields should suit the banking sector anyway, and with record dealmaking investment banking revenues should be strong, certainly the JPMorgan case.

Supply chain issues once again jump to the forefront with a Bloomberg report yesterday on Apple having to curtail production of the new iPhone 13 due to supply issues around semiconductor chips, see more here. We will hear more of this in the coming earnings season.

The dollar remains strong at 1.1530 versus the euro and is rallying further as we speak post CPI data. Oil is at $80, gold at $1,762, and Bitcoin lower but still above $55,000.

See forex today.

European markets are higher: Eurostoxx +0.8%, FTSE +0.2% and DAX +0.8%.

US Futures are flat, having dropped now on the dollar strength and CPI.

Wall Street (SPY) (QQQ) top news

US CPI monthly 0.4% versus 0.3% expected. Yearly 5.4% versus 5.3% expected.

Iraq's oil minister says the price of oil is unlikely to go higher. President Putin says we do not want oil prices to skyrocket.

President Putin says Russia is ready to meet Europe's gas needs.

Port of LA to go 24/7 to try to alleviate shortages and supply chain issues. CNBC.

US to end the ban on non-essential travel to the US next month, all international travelers will need to be vaccinated. (DAL, AAL, IAG etc)

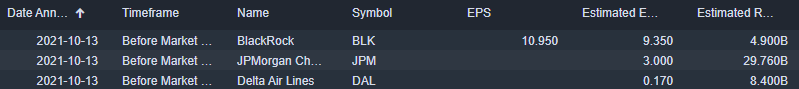

Blackrock (BLK): beats on EPS and revenue. AUM grew less than expected.

JPMorgan Chase (JPM): EPS well ahead of estimates, revenue also beats. Investment banking was strong.

SAP raises outlook.

Delta (DAL): EPS beats estimates, revenue also ahead.

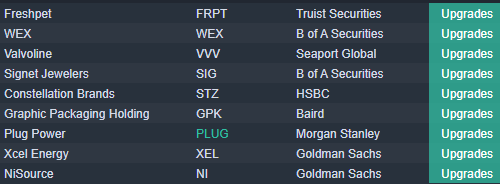

Plug Power (PLUG) announces partnership with Airbus. Morgan Stanley upgrades.

Boeing (BA), American Airlines (AAL), and Southwest (LUV) to require workers to be vaccinated against covid.

Qualcomm (QCOM) announces share buyback.

Amazon (AMZN): British workers delivering for Amazon should get minimum wage among other entitlements, according to a lawyer launching an employee rights claim-Reuters.

Apple (AAPL) likely to cut iPhone 13 production by up to 10 million units, according to Bloomberg report, see more.

British American Tobacco (BTI) (BATS): US FDA authorized some e-cigarettes.

Blackberry (BB) up 3% premarket after a report on Tuesday announcing a collaboration with Google and Qualcomm for next-gen vehicle cockpits.

Earnings, Upgrades, Downgrades and premarket movers

Source: Benzinga Pro

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.