Here is what you need to know on Friday, January 14:

Bank stocks just went boom and not in a good way. As predicted by us in our large preview note here, we saw earnings coming in ahead of estimates but the stock prices falling back on those earnings.

Why? First, the beat was priced in. Look at the performance so far of financials for the year. It is better to travel than arrive. Second, some nice reserve releases are adding to the boost in bank profits. However, it is not all doom and gloom for banks. The Fed was increasingly hawkish yesterday in its commentary, something that should serve to underpin financial stocks this year. Indeed, this sell off may present a nice entry opportunity. We remain overweight financials for the year relative to other sectors. Goldman Sachs (GS) is up on Monday, and we can usually expect the master of the universe to deliver.

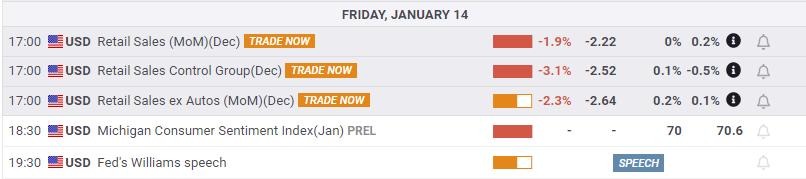

Markets are fearful though with the Nasdaq taking a pounding yesterday on no news. Many are saying the Fed has turned increasingly hawkish, but fed funds futures were already pricing in near 90% certainty of a March hike before equities sold off on Thursday. The retail sales number just out is not going to help sentiment as the number misses by quite a leap: -1.9% monthly versus -0.1% forecast.

The dollar is where the big money is at, and this had already signaled that risk was off (the real reason for the equity slide) as it slumped in the second half of the week to 1.1450 now versus the euro. Equity markets have been propelled to current heights by risk assets, the likes of Tesla (TSLA), etc. When the rally has been so narrowly concentrated, it is no surprise that risk aversion leads to large losses. Bitcoin is back to $42,000, and oil is holding at $82.10. Gold is steady at $1,827. Yields actually fell yesterday despite the hawkish Fed comments.

European markets are lower: Eurostoxx -0.2%, FTSE -0.1% and Dax -1%.

US futures are lower too: S&P and Dow are both -0.6%, while the Nasdaq is -0.7%.

Wall Street (QQQ) (SPY) Stocks News

US retail sales -1.9% versus -0.1% forecast. Core -2.3% versus 0.1% forecast.

ECB Lagarde says inflation to moderate later this year.

Citigroup (C) beats on top and bottom lines, but stock falls 4%.

Wells Fargo (WFC) beats on top and bottom lines but stock flat.

JPMorgan (JPM) beats on EPS, but revenue miss hits stock, now down 4% premarket.

Las Vegas Sands (LVS) up 9% on report of new laws in Macau. MGM up 4%.

Pfizer (PFE), BioNTech (BNTX), Moderna (MRNA): Pfizer down 2% premarket, Moderna and BioNTech down 4% as US Supreme Court blocked Biden's vaccine or test mandate and officials question if Omicron boosters are needed.

BlackRock (BLK) missed on revenue, but EPS ahead.

Sherwin Williams (SHW) down 3% on cutting forecasts.

Boston Beer (SAM) cut earnings outlook, down 8% premarket.

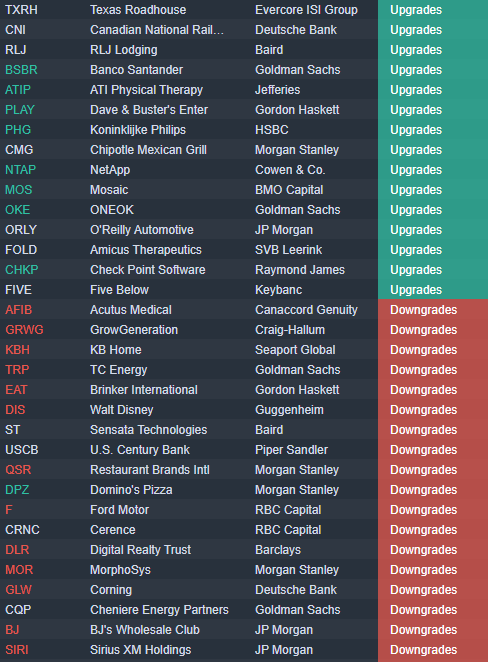

Upgrades and Downgrades

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.