Here is what you need to know on Tuesday, June 22:

Monday provided an interesting before-and-after contrast as traders returned from lunch in bullish mood and lifted the major indices into positive territory. Maybe a lunchtime conference on "buy the dip" was held as this has been the theme of equity markets since the pandemic lows in March 2020. The move enables the key trend line support from October 2020 to be held for the S&P 500.

Bitcoin stocks however are not so fortunate with the sector set for further losses on Tuesday. The crypto leader is trading at $29,600, down 6%. Tesla (TSLA) has been struggling for momentum, and its bitcoin investment is likely to be seized upon by bears as it underperformed the market on Monday.

The dollar remains steady at 1.1890 versus the euro as US 10-year yields are steady at 1.5%. Gold drops to $1,774, while Oil is weaker at $72.90 as rumours swirl of OPEC+ production increases in August.

European markets are heading for flat territory, having been lower earlier in the session. The EuroStoxx is -0.3%, while the Dax and FTSE are flat.

US futures are mostly unchanged.

Wall Street top news

OPEC+ is thinking about increasing oil production from August onwards, according to sources.

Top White House officials are reportedly having talks on President Biden's infrastructure plan, according to Punchbowl.

The EU is to open an anti-trust probe into Google (GOOGL) as the EU is examining if Google favours its own online display ad services, according to CNBC.

Also, YouTube (GOOGL) gets a ruling from the top EU court that it should not be held liable for copyright infringing uploads in some cases. Platforms“do not, in principle, themselves make a communication to the public of copyright-protected content illegally posted online by users of those platforms,” the European Court of Justice said, but online platforms could be liable if it “has specific knowledge that protected content is available illegally on its platform and refrains from expeditiously deleting it or blocking access to it,” the ECJ said.

Sally Beauty (SBH) is certainly beautiful, according to Oppenheimer and Cowen & Co, who both upgraded the stock on Tuesday.

Microstrategy (MSTR) drops 10% premarket on Bitcoin woes. Citigroup lowers the price target to $360 from $450.

Focus Financial (FOCS) drops 8% premarket on a stock offering.

GameStop (GME) is up 7% premarket as it raises $1 billion through a share sale.

Starbulk Carriers (SBLK) down 3% in premarket on secondary stock offering news.

Microvision (MVIS) drops 10% premarket on equity offering. Is it stock offering day as well as Prime Day!

CrowdStike (CRWD) upgraded by Stifel, stock up 2.5% premarket.

NVIDIA price target increased by Raymond James.

Sanderson Farms (SAFM): JP Morgan raises price target. Rumours on a potential sale of the company circulate. Shares up 11% premarket.

Target (TGT) plans to make 100% of its private-label goods environmentally sustainable by 2040, according to CNBC.

Corcept Therapeutics (CORT) down 18% premarket as the company stops enrollment in Reliant trial, saying "the apparent level of benefit does not justify its further study as a treatment for end-stage pancreatic cancer."

Splunk (SPLK) pops 8% in premarket on a $1 billion investment from Silver Lake.

Korn Ferry (KFY) up 4% premarket on Q4 EPS beat.

Intellia Therapeutics (NTLA) up 3.5% premarket, company and Blackstone to launch a CAR T-Cell company.

PLUG Power revenue and earnings per share for Q1 came in below estimates. Conference call ongoing.

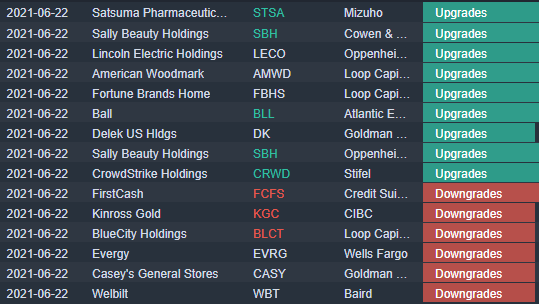

Upgrades, downgrades and premarket movers

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.

-637599635336395371.png)