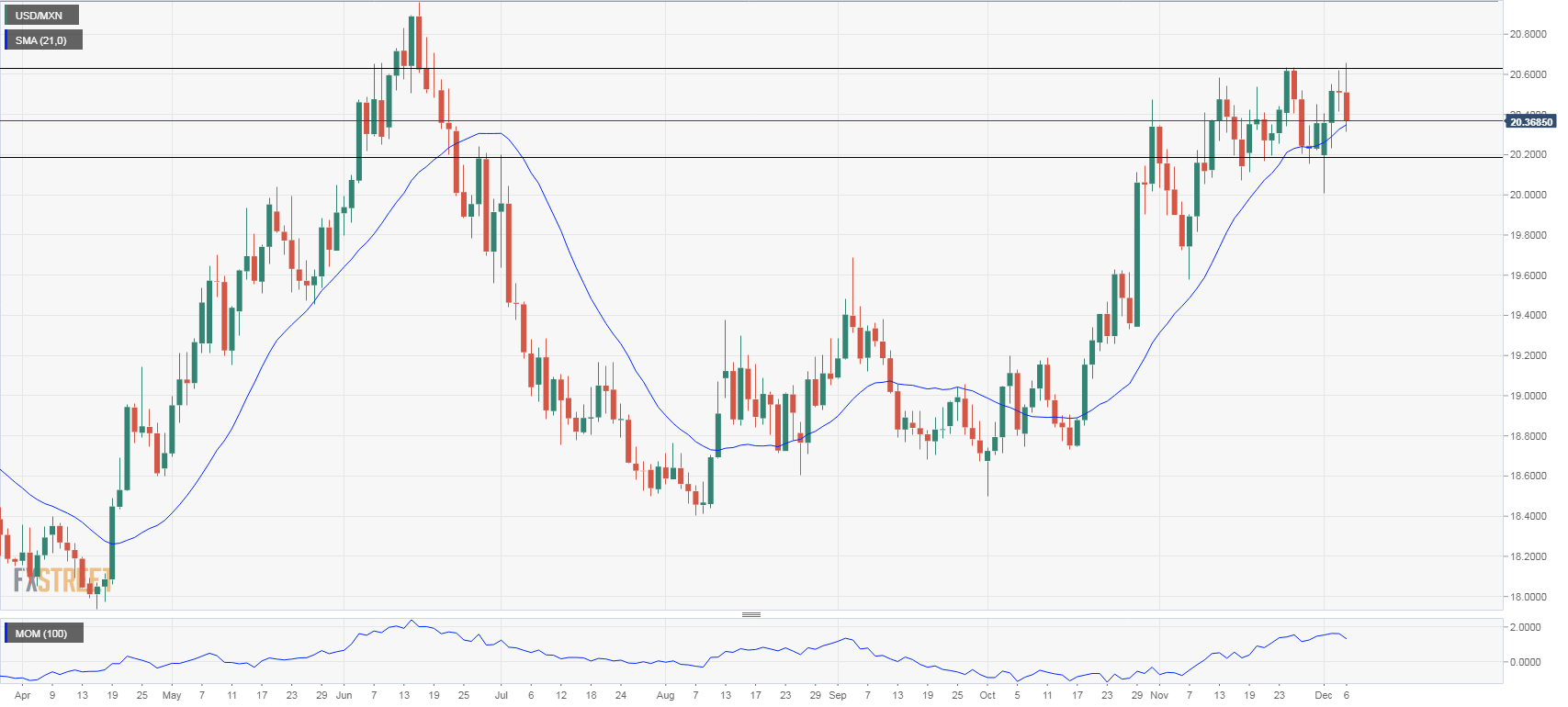

- The USD/MXN hit earlier today at 20.65, the highest level since June but then pulled back making a reversal. The momentum indicator turned to the downside and price dropped to test the 20-day moving average, showing lack of strength so far for a move above 20.65.

- A daily close above 20.50 could reinforce the bullish trend, but a breakout on top of 20.65 is needed to open the doors to further gains.

- After today’s reversal and the failure at 20.60, the Mexican peso could recover further, particularity if the pair drops firmly under 20.35 (20-day moving average). The next support to watch is 20.20; below the 20.00 area would be exposed.

- The main trend still points to the upside in USD/MXN, but the US dollar positive tone in the short-term eased after today’s reversal, and now the bias is skewed toward an extension of the bearish correction.

USD/MXN

Overview:

Today Last Price: 20.3748

Today Daily change %: -0.657%

Today Daily Open: 20.5096

Trends:

Previous Daily SMA20: 20.349

Previous Daily SMA50: 19.724

Previous Daily SMA100: 19.3117

Previous Daily SMA200: 19.2546

Levels:

Previous Daily High: 20.6183

Previous Daily Low: 20.417

Previous Weekly High: 20.6355

Previous Weekly Low: 20.156

Previous Monthly High: 20.6355

Previous Monthly Low: 19.576

Previous Daily Fibonacci 38.2%: 20.4939

Previous Daily Fibonacci 61.8%: 20.5414

Previous Daily Pivot Point S1: 20.4117

Previous Daily Pivot Point S2: 20.3137

Previous Daily Pivot Point S3: 20.2103

Previous Daily Pivot Point R1: 20.613

Previous Daily Pivot Point R2: 20.7163

Previous Daily Pivot Point R3: 20.8143

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.