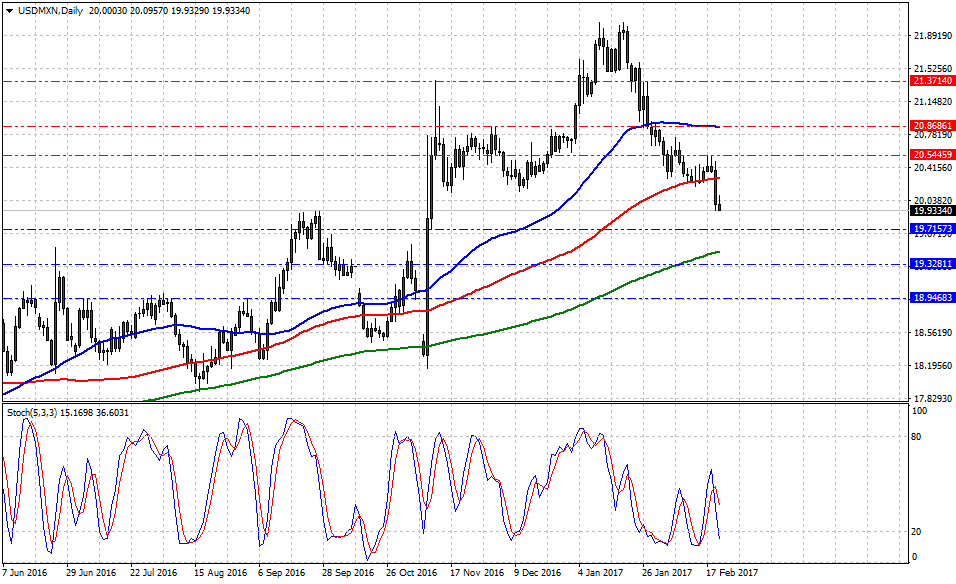

Currently, USD/MXN is trading at 19.91, down -0.42% or (829)-pips on the day, having posted a daily high at 20.09 and low at 19.91.

The American dollar vs. Mexican peso clocked, as of writing, another trading session in red due to Banxicos 'fix' via a $20 billion auction in FX hedges. The peso appreciation accelerated as prices broke the 100-DMA. Hence, the central bank decided to intervene the exotic avoiding additional rate hikes, but such solution has little to no impact in the country's economy.

On the data front, the US docket had limited ammo to counter-attack Banxico's short-term strategy to aid a weak and vulnerable Mexican peso. However, FOMC minutes due in the next 2-hours could provide traders evidence to add dollar-long positions if there is any wording related to a rate hike in March.

Banxico Implements Fancy Pants Intervention!

Historical data available for traders and investors indicates during the last 8-weeks that USD/MXN, a commodity-linked and exotic currency, had the best trading day at +1.83% (Jan.10) or 3983-pips, and the worst at -2.22% (Jan.25) or (4684)-pips. Furthermore, the US 10yr treasury yields have traded from 2.45% to 2.38%, down -1.10% on the day at 2.40% or -0.0268.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 20.28 (100-DMA), then at 20.53 (high Feb.20) and above that at 20.86 (50-DMA). While supports are aligned at 20.24 (low Feb.10), later at 19.72 (low Nov.10) and below that at 19.11 (low Nov.3). On the other hand, Stochastic Oscillator (5,3,3) seems to accelerate the pace into the oversold territory, but 'extreme attention' over US Treasuries to avoid a market trap. Therefore, there is evidence to expect more Mexican Peso gains in the near term.

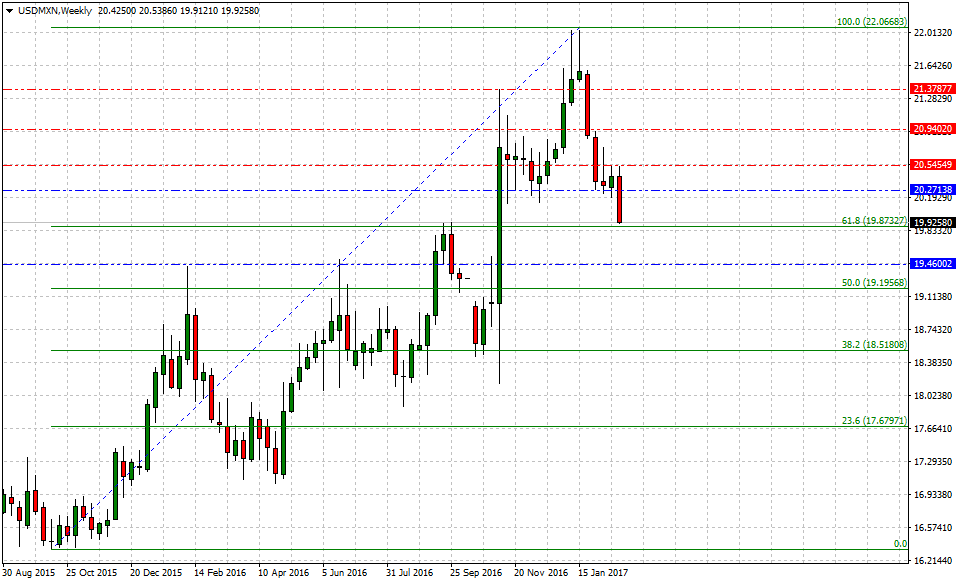

On the medium-term view, if 22.03 (high Jan.15) is in fact, the top during the first semester in 2017, then traders and investors would have allocated risk around the following support levels: 19.87 (short-term 61.8% Fib), then at 19.46 (low Sep.18) and finally below that at 19.19 (short-term 50.0% Fib). On the other hand, upside barriers are aligned at 20.53 (high Feb.2), later at 20.92 (high Jan.29) and above that at 21.38 (high Nov.6).

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.