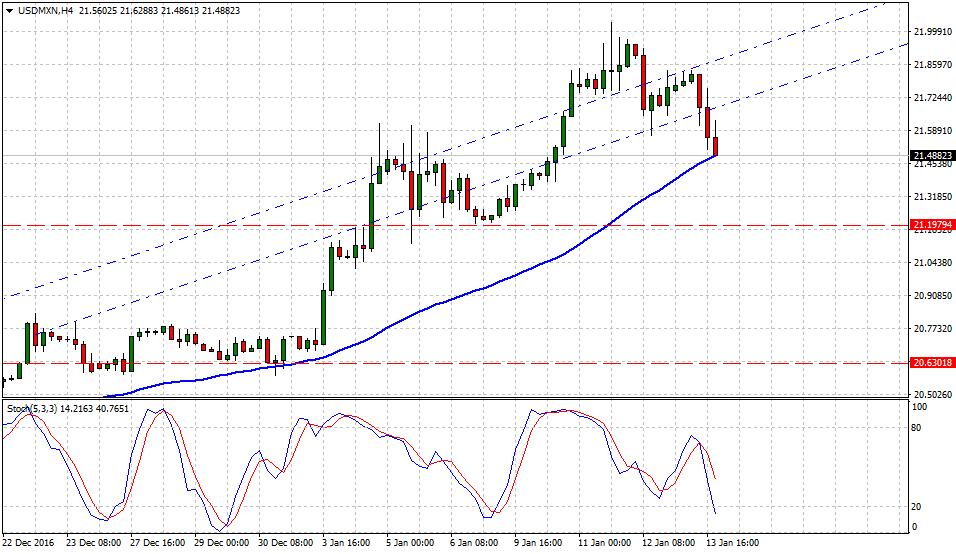

Closing Friday's trading session, USD/MXN traded at 21.49, down -1.39% on the day, having posted a daily high at 21.83 and low at 21.47.

Goldman Sachs' Mexican peso view

Bloomberg reports, "Against the most 'Trumpian' of odds, Goldman Sachs Group Inc. is defying bearish bets and predicting Mexico’s peso will make a comeback this year. The worst performer among the world’s 16 major currencies so far in 2017 will rally 13 percent to 19 per dollar over the next 12 months on the view that the protectionist impact of the new U.S. administration will be less severe than the rhetoric of President-elect Donald Trump. The currency touched a record low of 22.04 per dollar this week after he reiterated during a press conference that Mexico would be paying for a border wall and that companies that relocate operations there would have to pay a border tax."

USD/MXN Technical Levels

To the upside, the peso says goodbye for now to important resistance levels: 21.58/60 zone (previous triple top resistance; Jan. 2016), then 21.80/85 (Right Shoulder from a technical Head and Shoulders pattern). To the downside, if prices close and open below its 50 SMA (blue color) would open doors for a fallen angel (non-stop correction) towards a previous congestion zone and support; 21.18/20. At this point, the worst-case is similar consolidation phase and continuation reverting to the mean all the way to 20.60 and lower.

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.