- USD/JPY looks weaker below the 109.00 hurdle.

- US Retail Sales surprised to the downside in February.

- US Industrial Production contracted more than expected.

The corrective downside in US yields lends some buying interest to the Japanese yen and drags USD/JPY back below 109.00 the figure on Tuesday.

USD/JPY looks to yields

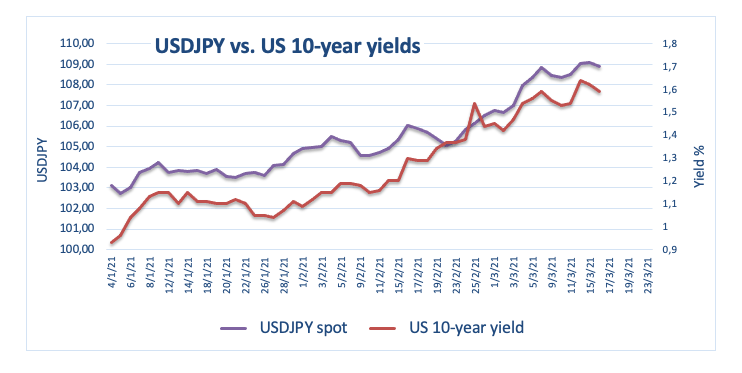

USD/JPY corrects lower following three daily advances in a row and slips back below the 109.00 hurdle after recently failing to extend the upside momentum further north of the 109.50 area, levels last visited in June 2020.

The steep climb of the pair follows the sharp increase in US yields seen in past weeks. Indeed, yields of the key US 10-year benchmark rose well past the 1.60% region earlier in the week. The last time these yields traded at that level was back in February last year.

Later in the week, the Bank of Japan is seen keeping the monetary policy stance unchanged, although investors still have in mid a potential increase of the bond purchase programme later in the year, particularly if the growth prospects deteriorate in the wake of the pandemic.

What to look for around JPY

The yearly rally in USD/JPY navigates its third consecutive month, sharply bouncing off January’s lows in the vicinity of 102.50. The pair’s upside remains mainly sustained by the improved sentiment in US yields, which in turn appears underpinned by higher inflation expectations in the US. Furthermore, the mega-loose stance from the BoJ – which is seen in place for the foreseeable future - also collaborates with the softer yen, while speculative net longs in the safe haven have been scaled back strongly in past weeks.

Key events in Japan this week: Trade Balance figures (Wednesday) – Inflation figures/BoJ Monetary Policy meeting (Friday).

USD/JPY levels to consider

As of writing the pair is losing 0.24% at 108.86 and faces the next support at 103.33 (low Mar.10) seconded by 107.18 (20-day SMA) and then 106.22 (high Feb.17). On the upside, a surpass of 109.36 (2021 high Mar.15) would aim to 109.85 (monthly high Jun.5 2020) and finally 110.00 (psychological level).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.