- USD/JPY holds in bullish territory into the Fed.

- Bulls eye an upside extension following the event's volatility.

Further to the prior analysis, USD/JPY Price Analysis: Bulls throwing in the towel? 103.50 is the big test, bulls have taken the reins and broken the dynamic resistance which opens the doors for an upside continuation.

However, it is rare that a market will break the structure and keep running on the first test of the seller's commitments.

Instead, a battle of control would be expected between the recent highs and buyer's commitments within the recent ranges.

That being said, anything can happen around the Federal Reserve's interest rate decision.

Watch the Fed presser live

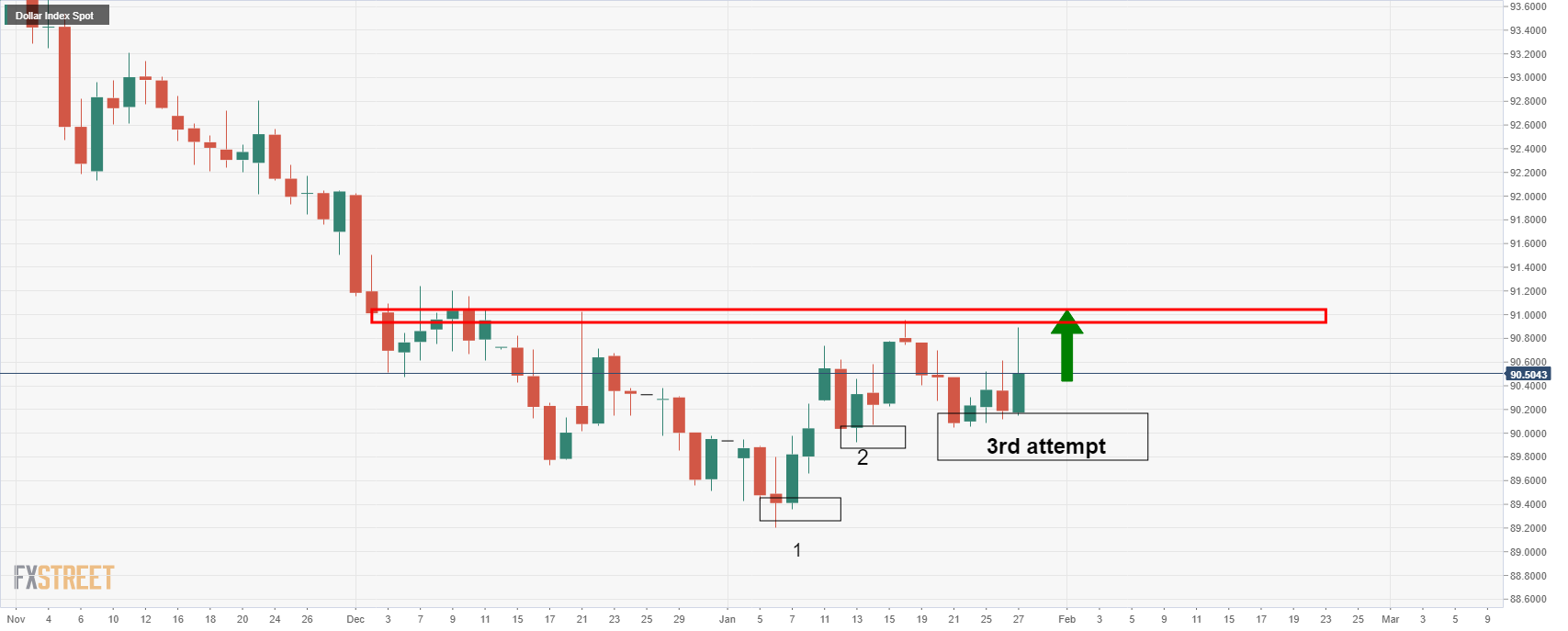

Should there not be a downplay in the taper theme, then the US dollar could well find a second or third wind even, as it continues to correct from the cycle lows, targeting a break of 91 in the DXY:

DXY daily chart

As for the yen, the play around the Fed, from a swing trading perspective and a deep stop loss, could be to buy dips.

From a 4-hour perspective, the price has rallied beyond resistance in an over extended W-formation.

A downside correction would be expected to reach at least a 38.2% Fibonacci retracement of the 4-hour bullish impulse.

However, a 50% mean reversion has a confluence with structure prior highs.

If there is significant volatility of a 20 pip move to the downside, then a stop loss below the 78.6% Fibo of the prior bullish impulse as well as the 4-hour structure could well safeguard a position executed during the volatility.

Example set-up as follows:

Bulls can target a -0.272% Fibonacci of the daily corrective range for a 1:3 risk to reward high probability trade setup.

The Fed is a high-risk event, which moves can be exaggerated and volatility higher.

Therefore, reducing risk is recommended, so trading half the percentile risk could and scaling in on a bullish outcome could be a safeguard as part of one's trading plan

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.