Currently, USD/JPY is trading at 113.37, down -0.67% or (77)-pips on the day, having posted a daily high at 114.31 and low at 113.12.

Yesterday's roaring US data was not enough to allow the greenback to make a clean break above the always relevant 50-DMA resistance and as a consequence, the pair was stabbed at 114.94 handle. Furthermore, the US dollar index experienced the same faith as the buck challenged its moving average and could not trade pass 101.36 after clocking a weekly high at 101.74.

As expected, the American dollar vs. Japanese yen is under selling pressure as market participants triggered a healthy 'profit taking' due to the mixed position among Federal Reserve members that cannot align their 2017 hike expectations. On the other hand, if Trump's 'phenomenal tax' does not strike in the next 2-weeks or fails miserably to impress, then that could be the catalyst to trigger a massive dollar sell-off.

On the last minute, the US generic government 10 Year Yield, erased 1% in losses that pull the greenback from the ground.

USD/JPY: A more balanced outlook for the yen - BTMU

Historical data available for traders and investors indicates during the last 7-weeks that USD/JPY pair had the best trading day at +1.76% (Jan.18) or 201-pips, and the worst at -1.65% (Jan.05) or (190)-pips.

Technical levels to consider

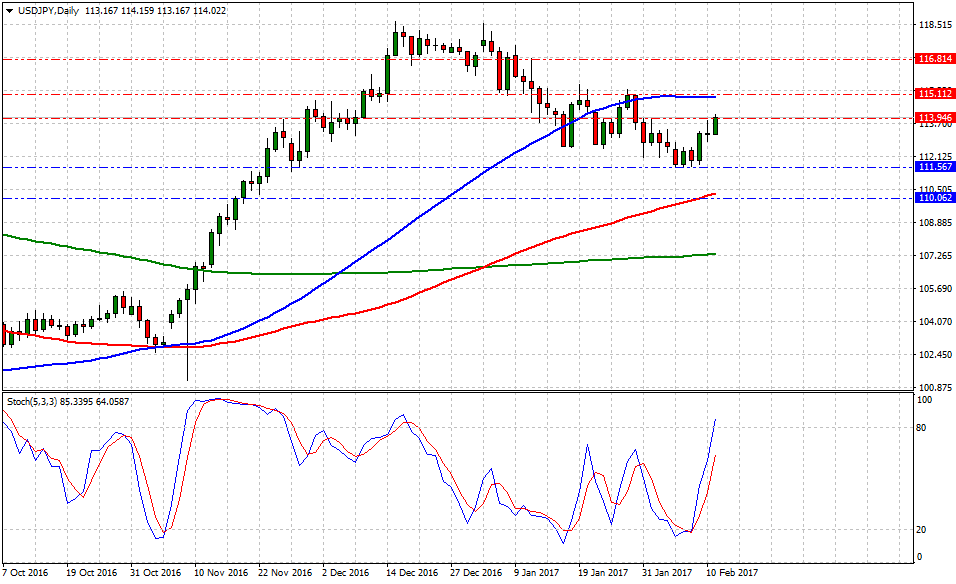

In terms of technical levels, upside barriers are aligned at 114.99 (50-DMA) - yesterday prices failed to close and open above the level - and above that at 116.85 (high Jan.11). While supports are aligned at 112.85 (low Feb.10), later at 110.70 (100-DMA) and below that at 107.40 (200-DMA). On the other hand, Stochastic Oscillator (5,3,3) seems to drift lower and head south. Therefore, there is evidence to expect further US dollar losses in the near term.

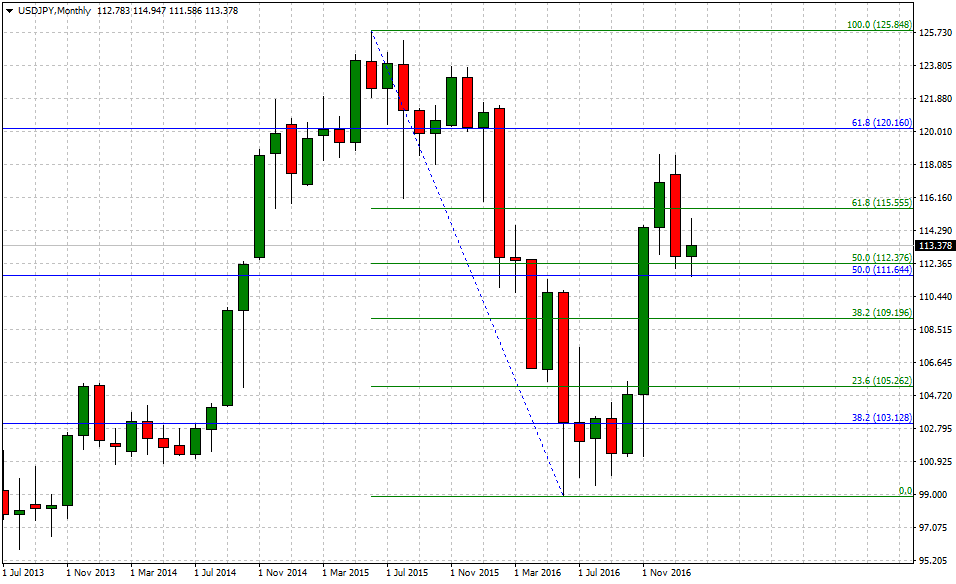

On the long term view, if 118.59 (high Jan.1) is in fact, a medium-term top, the upside seems limited for the pair at 115.55 (short-term 61.8% Fib). To the downside, supports are aligned at 111.64 (long-term 50.0% Fib), then at 109.19 (short-term 38.2% Fib) and finally below that at 105.26 (short-term 23.6% Fib). Also, 112.37 (short-term 50.0% Fib) would be a new support as long as prices close above it.

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.