- USD/CNH drops to four-day low after China’s official PMIs flashed upbeat data.

- China’s passage of the Hong Kong National Security Law failed to defy the Yuan bulls.

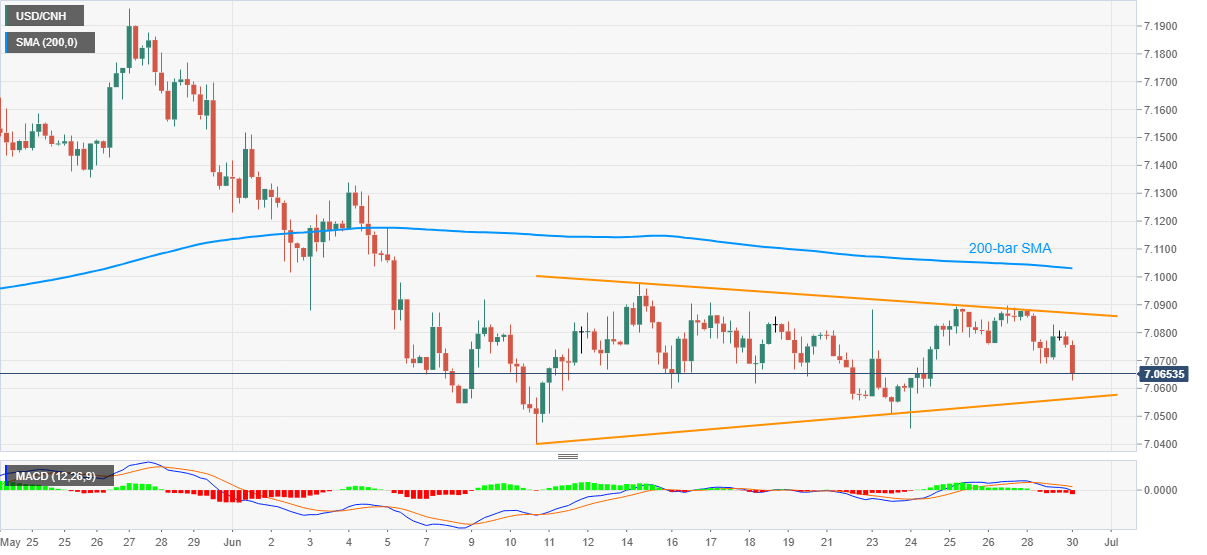

- Bearish MACD suggests further weakness inside a three-week-old symmetrical triangle formation.

USD/CNH declines to 7.0652, down 0.17% on a day, amid the initial hours of China open on Tuesday. The pair recently weakened after China’s official PMIs rose well beyond the downbeat forecasts and prior. In doing so, the quote pays a little heed to the expected geopolitical tussle between Beijing and Washington following the passage of the Hong Kong National Security Law by the Chinese parliament.

Technically, the pair extends pullback moves from the upper line of a short-term symmetrical triangle amid bearish MACD signals. This suggests an additional downside of the quote towards the formation’s support of 7.0500.

However, any further weakness by the pair below 7.0500 might not refrain from challenging the monthly bottom near 7.0400. In doing so, June 24 low near 7.0455 might offer an intermediate halt.

Alternatively, the pair’s break of the said triangle’s resistance line, at 7.0870 now, could propel the buyers to aim for a 200-bar SMA level of 7.1030. Though, the early-month top and late-May bottoms might restrict extended rise around 7.1340/50.

USD/CNH four-hour chart

Trend: Further weakness expected

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.