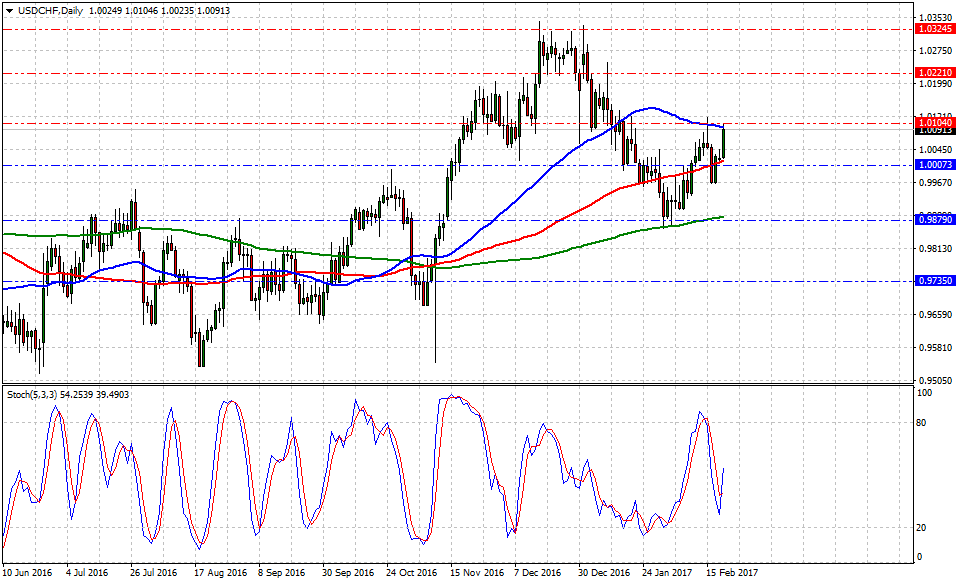

Currently, USD/CHF is trading at 1.0097, up +0.71% or 71-pips on the day, having posted a daily high at 1.0105 and low at 1.0023.

The American dollar vs. Swiss franc had reverted last month's speculation of a possible deeper or trend correction as the pair has accumulated 80-pips in the last 15 trading days. Furthermore, the US dollar index clocked higher near 101.60 signaling traders the opportunity to add more risk in the short-term.

Why markets should expect a weaker franc?

Boris Dzhingarov at Emerging Europe noted, "Switzerland has one of the highest standards of living in the world and is home to many exporting companies. When the Franc is expensive, it hurts Switzerland because exports are worth 70 per cent of its GDP. Before removing the valuation cap, the Swiss National Bank had increased the supply of Francs to meet the Euro-Franc ratio. Removing the cap ended the need to print more Francs and reduced the money printing that some feared would lead to hyperinflation in Switzerland."

Bond market still not on board with a March rate hike

Historical data available for traders and investors indicates during the last 8-weeks that USD/CHF pair had the best trading day at +0.80% (Jan.6) or 81-pips, and the worst at -1.05% (Jan.5) or (105)-pips. As of writing, the US 10yr treasury yields had a trading range 2.43% to 2.45%, up +0.74% on the day or +0.0179.

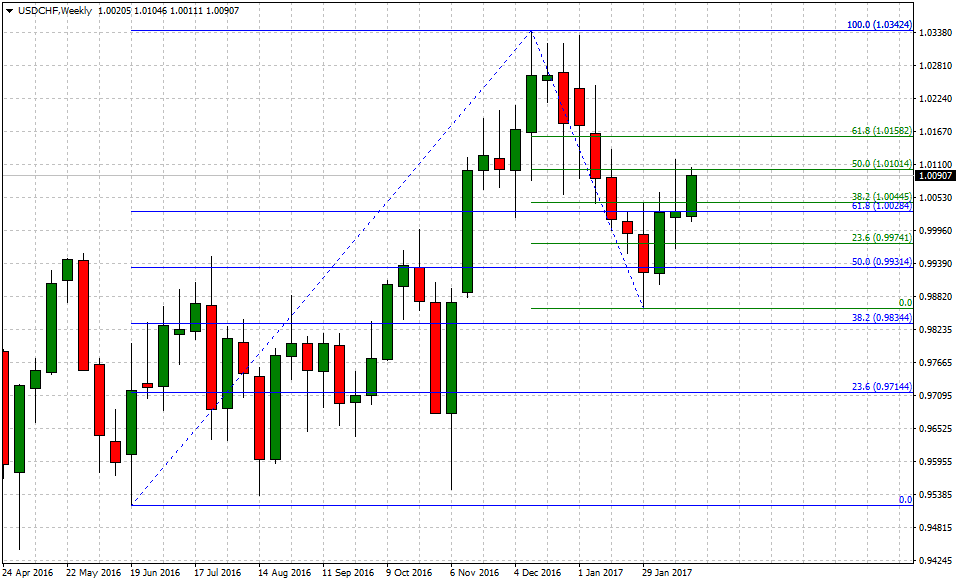

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 1.0095 (50-DMA), then at 1.0219 (high Jan.5) and above that at 1.0320 (high Dec.28). While supports are aligned at 1.018 (100-DMA), later at 0.9886 (200-DMA) and finally below that at 0.9734 (low Nov.8).

On the long-term view, upside barriers are aligned at 1.0101 (short-term 50.0% Fib) and above that level at 1.0158 (short-term 61.8% Fib). While supports are aligned at 1.0044 (short-term 38.2% Fib), later at 1.0028 (long-term 61.8% Fib) and below that at 0.9974 (short-term 23.6% Fib).

© 2013 "FXstreet.com. The Forex Market" Todos los Derechos Reservados. Todos nuestros esfuerzos están destinados a proporcionar información precisa y completa. Aún así, con los centenares de documentos disponibles, a menudo publicados con poco margen de tiempo, no podemos garantizar la falta de errores en los mismos. Cualquier publicación o redistribución de contenido de FXstreet.com está absolutamente prohibido sin el consentimiento previo por escrito de FXstreet.com.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.