- USD/CAD holds lower ground after reversing from the key SMA.

- Easing bullish bias of MACD and failures to cross immediate hurdles keep bears hopeful.

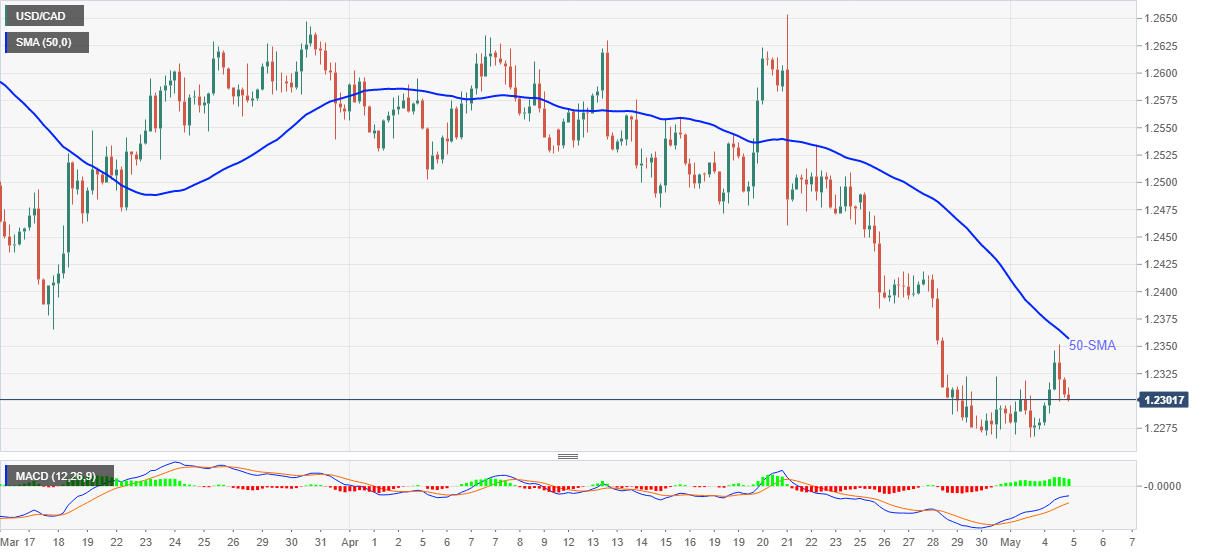

USD/CAD remains depressed around 1.2300, down 0.08% intraday, amid Wednesday’s Asian session. The loonie pair jumped to the highest in four days the previous day before reversing from 50-SMA.

The pullback moves join recently easing MACD strength in favor of the bulls as well as sustained trading below important resistances to back the USD/CAD sellers.

As a result, the latest weakness could eye for the multi-month low marked in April around 1.2265.

However, any further moves will have to conquer the 2018 bottom surrounding 1.2250-45 before testing the late 2017 lows close to 1.2065-70.

Alternatively, the 50-SMA level of 1.2356 becomes the nearby hurdle for the USD/CAD buyers to tackle ahead of March lows around 1.2365.

Also likely to challenge the pair’s recovery moves are the 1.2420 and 1.2465 levels to the north.

USD/CAD four-hour chart

Trend: Bearish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD climbs above 1.2450 after US data

GBP/USD extended its recovery from the multi-month low it touched near 1.2400 and turned positive on the day above 1.2450. The modest selling pressure surrounding the US Dollar after dismal housing data supports the pair's rebound.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.