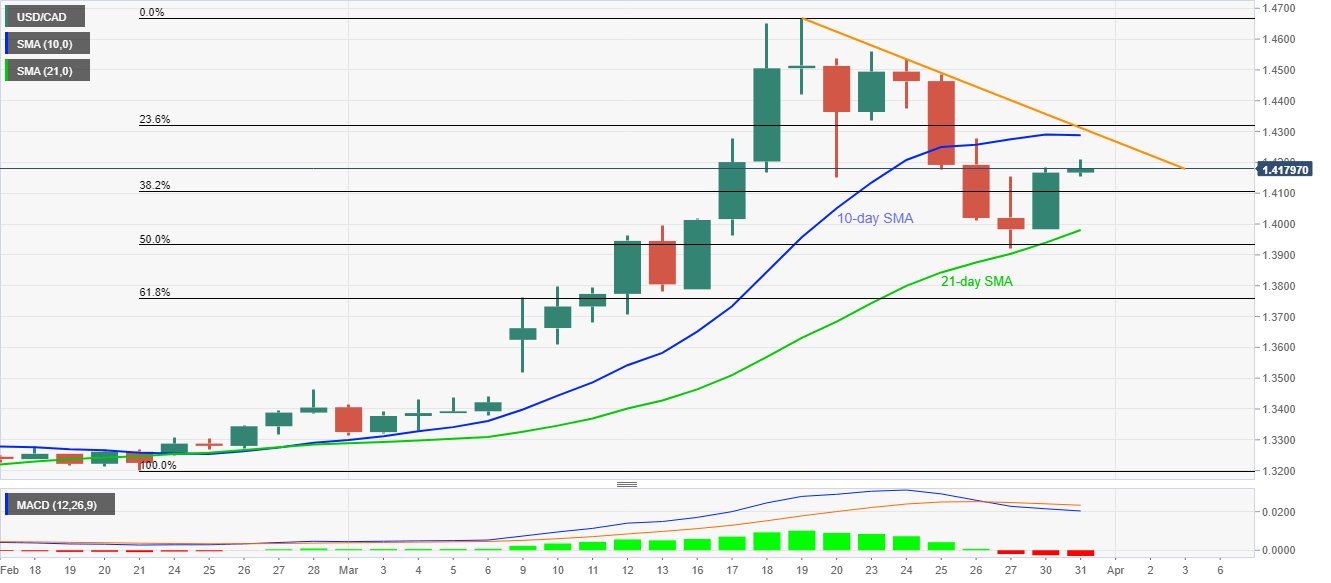

- USD/CAD remains mildly bid near the three-day top.

- The pair extends run-up from 21-day SMA but stays below 10-day SMA amid bearish MACD.

- 23.6% Fibonacci retracement, eight-day-old falling trend line adds to resistance.

USD/CAD registers 0.10% gains while extending the previous day’s pullback from 21-day SMA to 1.4180 amid the pre-Europe session on Tuesday.

While 10-day SMA near 1.4290 is on the buyers’ radars, 23.6% Fibonacci retracement of the pair’s upside between February 21 and March 19, coupled with short-term falling trend line around 1.4320/25 will limit the pair’s further upside.

If at all buyers manage to cross 1.4325 on a daily closing basis, 1.4370, 1.4420 and 1.4560 can check buyers ahead of offering them the monthly top near 1.4670.

On the contrary, bearish MACD can help the sellers question 61.8% Fibonacci retracement level of 1.3760 if USD/CAD prices flash a daily close past-21-day SMA level of 1.3980.

It should also be noted that the early-month gap near 1.3440 will be in the market’s attention if the quote stays weak below 1.3760.

USD/CAD daily chart

Trend: Sideways

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.