- USD/CAD bulls taking back the baton and breaking resistance.

- Bullish conditions on the daily chart favour a bias to the target.

In what has been a gruelling sideways chop, the price is finally making a more of a decisive move to the upside against a bullish backdrop on the longer-term time frames.

At the time of writing, USD/CAD is trading at the highest level since September 11th and testing the 1.32 area with a high of 1.3206.

The following offers a bullish bias and offers yet another opportunity to take advantage of a bullish environment on the 4Hr time frame to catch what is expected to be a bullish wave and completion of a bullish reverse head and shoulders.

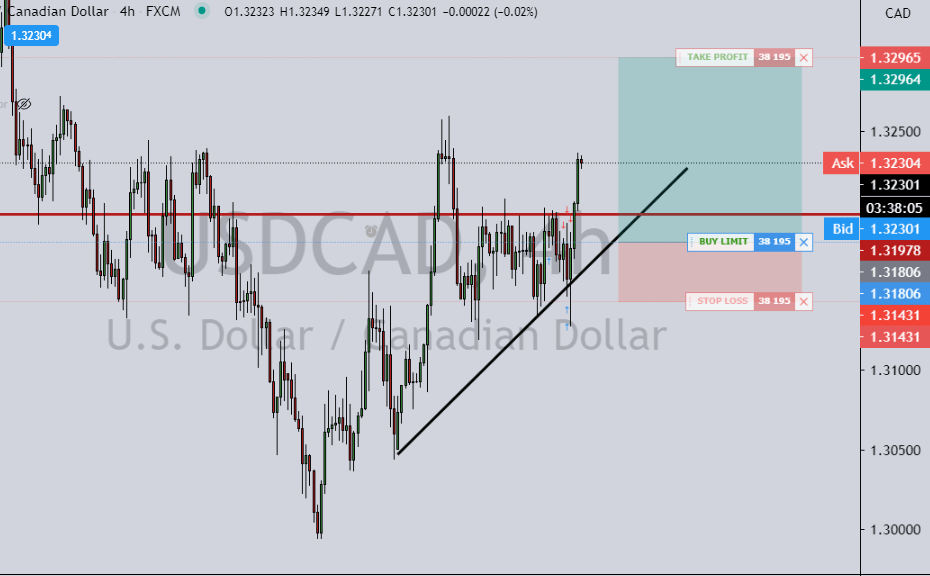

Starting with the prior 4HR analysis from an earlier article, that can be read here, USD/CAD continues to tread dynamic trendline support, bulls eye 1.33 area, the bulls have bust out from below the resistance:

A buy limit order can now be placed at 1.3181 support structure with a stop at 1.3143.

Update: Order filled, monitoring for breakeven

Update: Target moved to breakeven

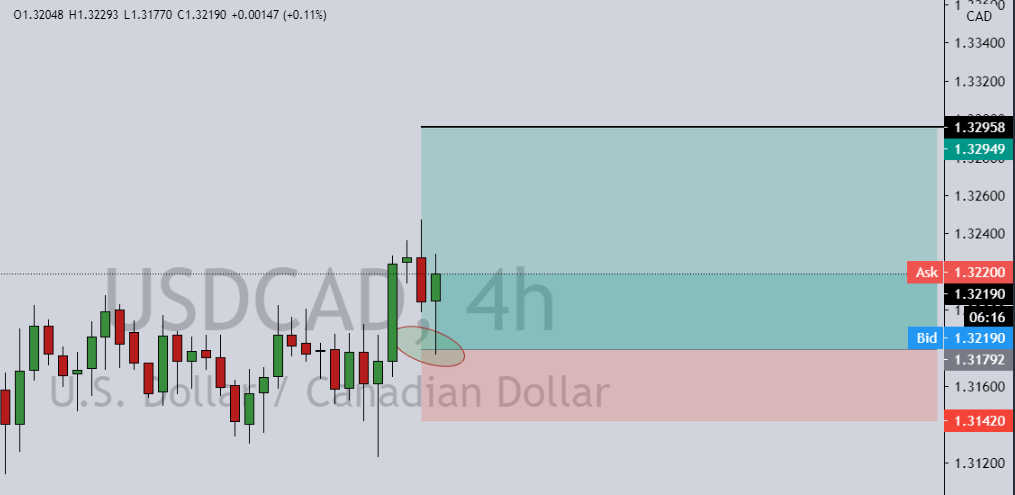

The price has fallen back into the consolidation zone and close to stopping the trade out.

The daily chart has resulted in a huge bearish wick which totally invalidates the bullish outlook for the time being.

Good trading is gauged by trading a proven strategy in the right way, not by winning or losing on individual trades.

The trade will potentially result in a loss.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.

-637359024287065000.png)

-637359022290423760.png)