- USD/CAD bulls looking for a significant correction in the days ahead.

- Hourly inverse H&S is compelling in USD/CAD, eyes on daily 61.8% Fibo.

- US CPI is the next key event following BoC and ahead of Fed next week.

USD/CAD popped and stopped overnight as the Bank of Canada left interest rates unchanged although signalled concerns over elevated inflation that could persist longer than previously thought. USD/CAD ended around 1.2650 after reaching a high of 1.2666 on the day.

The stag is being set by the BoC for a shift in policy early next year. Inflation “is elevated and the impact of global supply constraints is feeding through to a broader range of goods prices,” governor Tiff Macklem wrote in the central bank's updated statement. “The effects of these constraints on prices will likely take some time to work their way through, given existing supply backlogs.”

Nevertheless, the Lonnie fell as traders that had positioned for a more hawkish outcome pulled their positions expecting that the BoC will not move until at least the second quarter of 2022. “We will provide the appropriate degree of monetary policy stimulus to support the recovery and achieve the inflation target,” the central bank reiterated in its new statement.

Key themes in play

Meanwhile, risk appetite remained resilient amid Omicron vaccine optimism which helped Wall Street, Treasury yields and commodities extended their recent gains. The greenback subsequently fell as traders looked ahead into the US Consumer Price Index on Friday and a series of BoE, ECB, and Federal Reserve rate decisions the following week.

USD/CAD daily chart

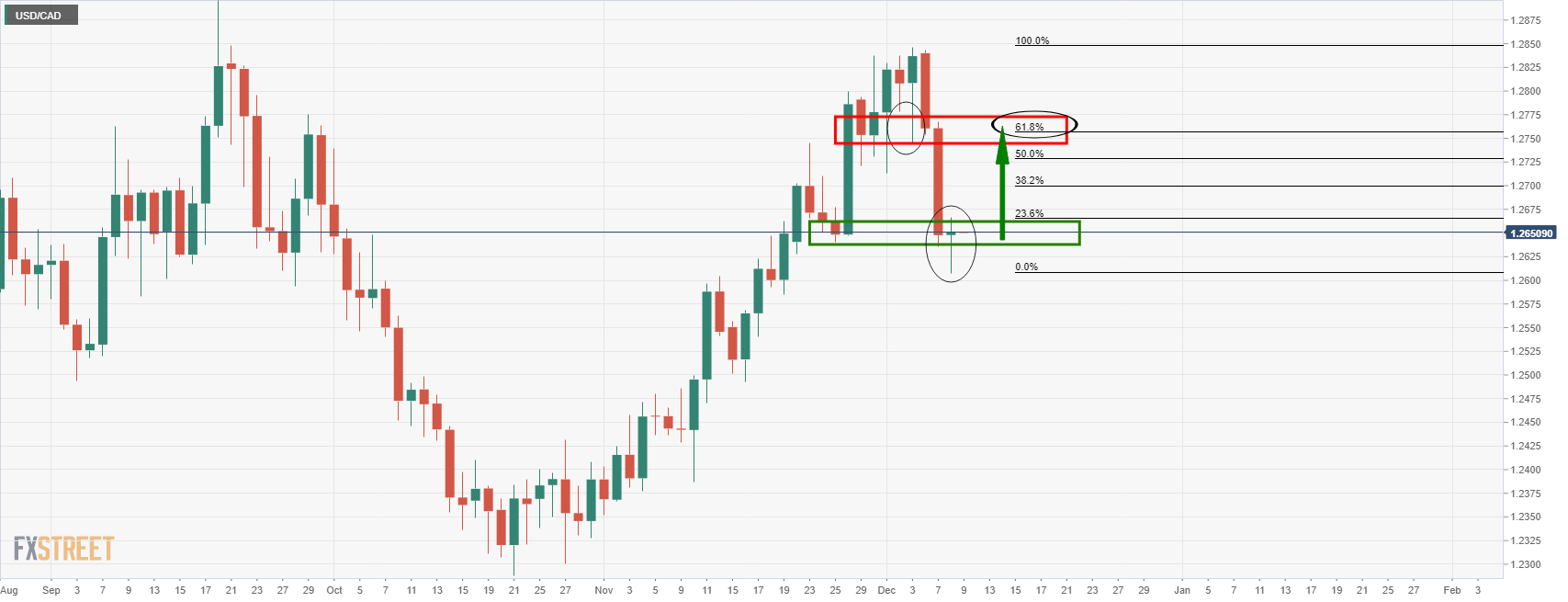

The price is meeting support at this juncture and a reversal in the US dollar is all that would b needed to see the price correct and potentially move in towards the 61.8% Fibonacci retracement level.

USD/CAD H1 chart

The inverse head and shoulders pattern on the hourly chart is a potentially bullish prospect for the sessions ahead.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays weak near 1.0650 ahead of Eurozone PMI data

EUR/USD remains on the back foot near 1.0650 in European trading on Tuesday. Resurgent US Dollar demand amid a cautious risk tone weighs on the pair. Investors stay wary ahead of the preliminary Eurozone and US business PMI data.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.