- The index keeps intact the firm note above the 96.00 handle.

- US Industrial/Manufacturing Production surprised to the upside.

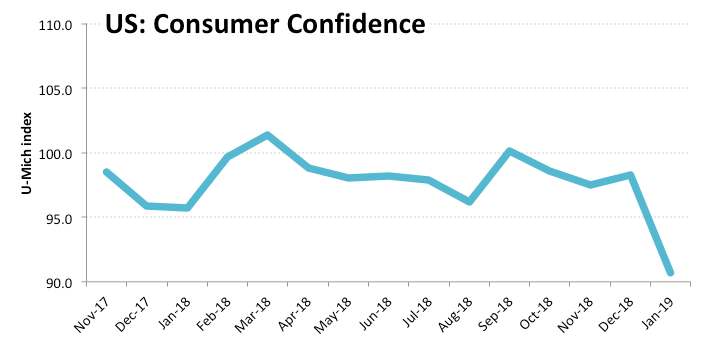

- U-Mich index disappointed at 90.7 for the month of January.

The greenback, in terms of the US Dollar Index, is now adding to earlier gains and is testing once agains the 96.20/30 band in spite of the poor release of the U-Mich index.

US Dollar Index keeps the bid tone

The index managed to clinch fresh tops in the 96.20/25 band following auspicious results from US Industrial Production, Manufacturing Production and Capacity Utilization, all coming in above estimates.

However, the preliminary print of US Consumer Sentiment tracked by the U-Mich index surprised to the downside at 90.7 for the current month.

Earlier in the session, FOMC’s Williams stressed the ongoing shutdown would have implications on Q1 growth, expecting growth to pick up once shutdown is solved. Williams also said that policy on the balance sheet could be reassessed in case conditions change.

What to look for around USD

The ongoing context of marginal volatility and lack of catalysts leaves the scenario unchanged for the greenback in the very near term. That said, the prospects of a ‘no-hike’ by the Federal Reserve this year coupled with speculations of a slowdown in the US economy remain the centre of attention among investors. In addition, the US partial shutdown is entering its fourth consecutive week and could start weighing on sentiment, while cautiousness remains high around the US-China trade talks.

US Dollar Index relevant levels

At the moment, the pair is up 0.16% at 96.23 and a break above 96.26 (high Jan.17) would target 96.60 (55-day SMA) en route to 96.96 (2019 high Jan.2). On the downside, the next support arises at 95.77 (10-day SMA) seconded by 95.03 (2019 low Jan.3) and finally 95.04 (200-day SMA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.