- DXY reverses recent weakness in the 90.00 neighbourhood.

- US 10-year yields look side-lined near the 1.55% level.

- The NFIB Index, Balance of Trade, JOLTs Job Openings next on tap.

The greenback, when tracked by the US Dollar Index (DXY), trades slightly into the positive territory and hovers around the 90.00 mark so far on turnaround Tuesday.

US Dollar Index focused on data, yields

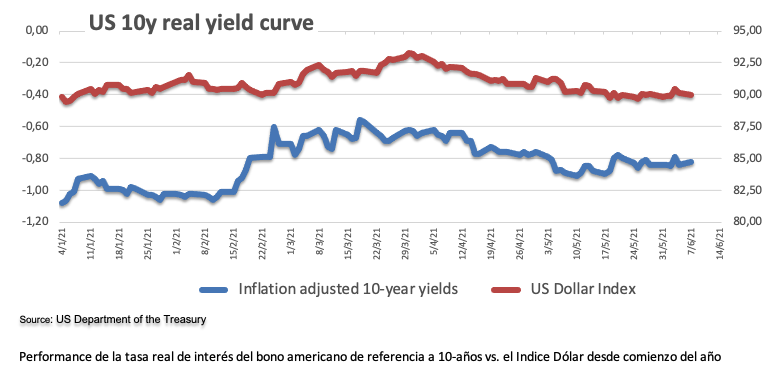

Following two consecutive daily pullbacks, the index now attempts to regain some upside traction above the key 90.00 yardstick amidst steady/lower yields and with investors cautiously looking to the upcoming release of US inflation figures.

Indeed, yields of the key US 10-year reference now attempt a consolidative theme in the lower end of the range near 1.55% following the sharp drop post-Payrolls at the end of last week. In the meantime, the inflation narrative appears to have returned to the investors' debate and could act as some kind of support vs. occasional bearish moves in the buck.

Later in the NA session, the NFIB Index is due in the first turn seconded by Balance of Trade figures for the month of April, JOLTs Job Openings and the weekly report on US crude oil supplies by the API.

What to look for around USD

The index seems to have met a tough barrier in the 90.50/60 band for the time being. Disappointing NFP figures in May now underpin the Fed’s narrative that it is still premature to start the tapering talk. In spite of the recent strength in the dollar, the outlook for the currency remains on the negative side in the longer run. This view stays supported by the perseverant mega-dovish stance from the Federal Reserve (until “substantial further progress” in inflation and employment is made) in place for the foreseeable future and rising optimism on a strong global economic recovery.

Key events in the US this week: Balance of Trade (Tuesday) – Inflation figures tracked by the CPI, Initial Claim (Thursday) – Flash June Consumer Sentiment.

Eminent issues on the back boiler: Biden’s plans to support infrastructure and families, worth nearly $6 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating?

US Dollar Index relevant levels

Now, the index is gaining 0.10% at 90.06 and a breakout of 90.62 (weekly high Jun.4) would open the door to 90.90 (weekly high May 13) and finally 91.05 (100-day SMA). On the other hand, the next contention emerges at 89.53 (monthly low May 25) followed by 89.20 (2021 low Jan.6) and then 88.94 (monthly low March 2018).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.