UnitedHealth Group (UNH) which is traded on the New York Stock Exchange, is a healthcare company that aims to help everyone live a healthier life and make the health system work better. UnitedHealth Group offers a wide range of products and services through two different platforms, namely UnitedHealthcare, which provides health protection and benefits services, and Optum, which provides information technology services in healthcare. UNH will report its 3rd quarter financial report on Thursday October 14, 2021, before the market opens.

In its Q2 earnings report published last July, UNH reported stronger growth and more diversity. The economic recovery and increasing demand for healthcare showed an encouraging recovery in 2021 after it experienced a decline in demand during the movement restrictions at the beginning of the Covid-19 pandemic. UNH reported revenue increased 15% to $71.30 billion. Return per share (EPS) in the 2nd quarter was reported at $4.70 (versus the $4.43 projection). Overall, UNH reported consistent sales and EPS results and has exceeded analyst projections over the past four quarterly reports, and it is expected to once again report positive financial results for the third quarter.

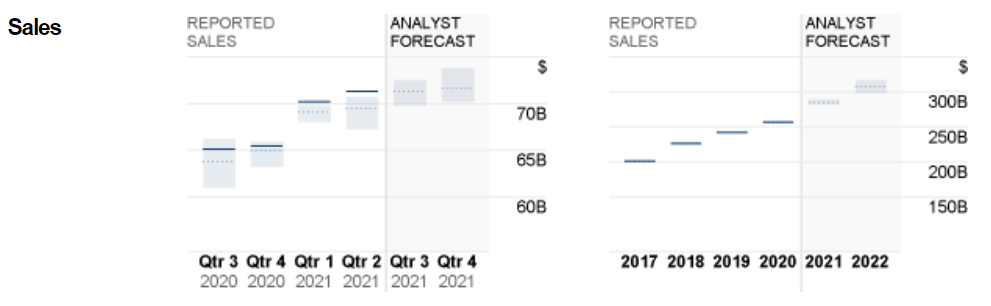

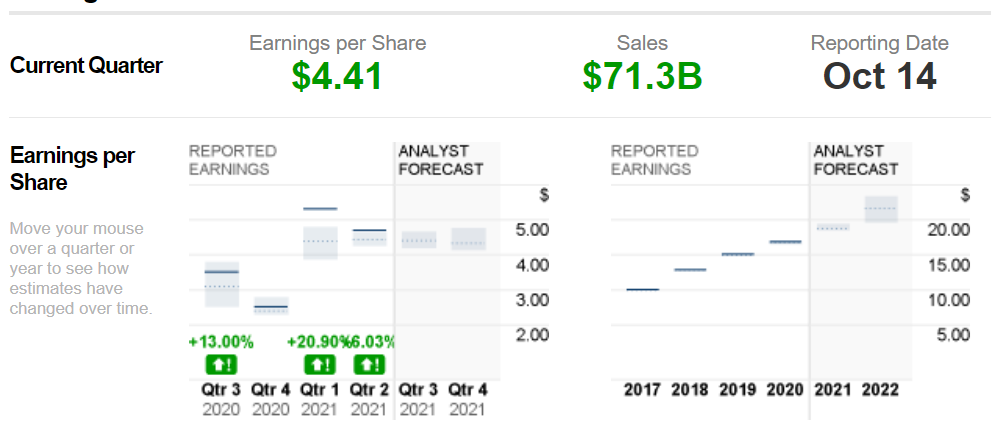

Market analysts at Zacks project UNH to be among the companies with the potential to sustain growth and release encouraging financial reports in the 3rd quarter following UNH’s history of consistently surpassing market analysts’ projections. Based on projections from CNN Business, UNH analysts’ consensus projections are expected to report sales revenue of $71.3 billion in the 3rd quarter, unchanged from the 2nd quarter, while the EPS consensus is for $4.41, down slightly by -6.9% from the previous quarter. The annual EPS projection for 2021 is expected at $18.75, up from $16.88 in 2020 (an increase of 11.09%).

SUMBER: CNN Business

Technical analysis #UnitedHealth (MT5)

Shares of #UnitedHealth have shown an encouraging rise in 2021, recording the highest price level in its history at 431.36, a 35% increase from the lowest price of 2021 in January at 320.00. This increase is in line with the increase in the major US bourses, namely US30 and US500, which also recorded increases. But now it is down a bit at 402.97, slightly below the daily MA50. The 382.88 level (Oct 1 low) is the nearest support.

CNN Business forecasts put #UnitedHealth shares as expected to rise for the next 12 months with the median price at 465.00, the highest projection at 522.00 while the low projection is 421.00. 23 analysts place the stock in the BUY rating category with only one placing the stock “underperform”.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.