- The VIX has fallen 5.16% on Thursday to hit a low of 28.74.

- Equities have moved higher as the risk-sentiment improved once again.

Fundamental Backdrop

In another day if ignoring the negative coronavirus news the US bourses have ticked higher once again. There has been a news story doing the rounds that Pfizer has produced a vaccine that is showing "very promising" results when fighting the coronavirus. There has also been news that the EU is in talks with Gilead about reserving some of the Remdesivir for its citizens.

Around the world, there has also been some encouraging PMI data. China and the US showed improvements with the US ISM reading beating the initial estimates of 49.8 to print at 52.6.

Fed's Daly also added some dovish comments to the mix by saying he would hesitate to call some of the recent US data "showing recovery". ECB's Lane, however, is sounding more optimistic saying he is looking for two steps forward and one step back in regards to the economic recovery with some periodic interruptions.

VIX 4-hour chart

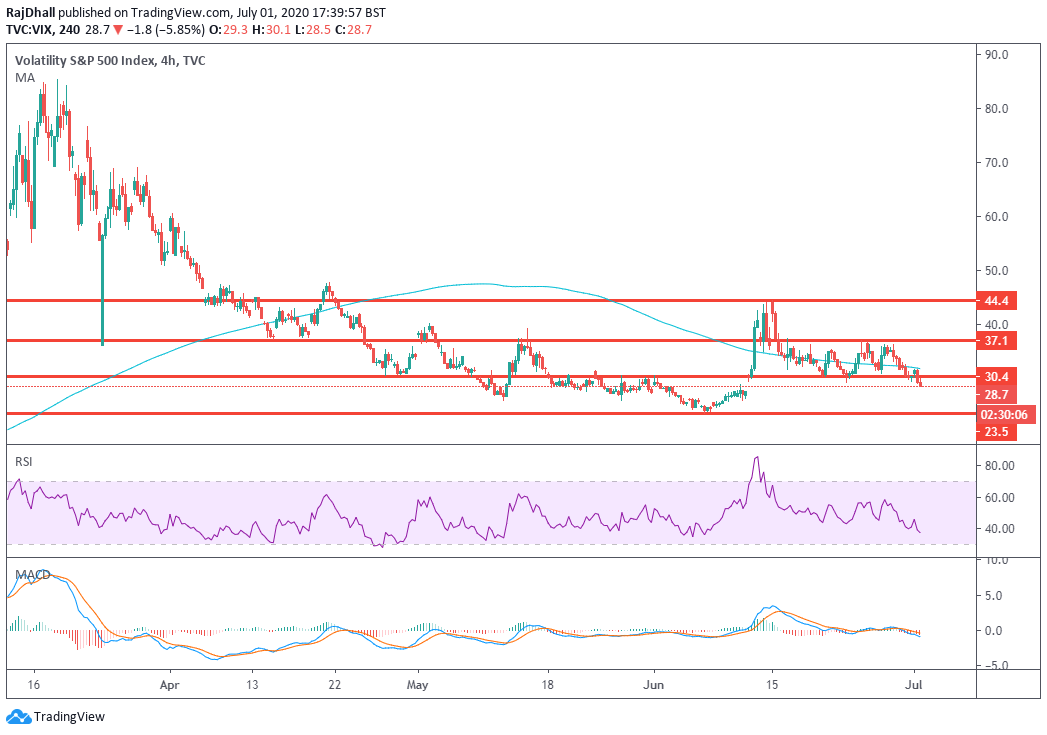

Looking at the VIX chart on the 4-hour timeframe and there has been an important break of the 30.00 level. Next up on the support side is 23.6 and a break of this level would take the price of the volatility index to "more normal" levels.

Although the VIX is lower is has not broken through the 200 period Simple Moving Average as it has done on the 4-hour chart below. The Relative Strength Index indicator has broken below the 50 line and the MACD histogram has also broken below zero. The MACD signal lines have touched the zero level but have not breached the zone just yet.

All information and content on this website, from this website or from FX daily ltd. should be viewed as educational only. Although the author, FX daily ltd. and its contributors believe the information and contents to be accurate, we neither guarantee their accuracy nor assume any liability for errors. The concepts and methods introduced should be used to stimulate intelligent trading decisions. Any mention of profits should be considered hypothetical and may not reflect slippage, liquidity and fees in live trading. Unless otherwise stated, all illustrations are made with the benefit of hindsight. There is risk of loss as well as profit in trading. It should not be presumed that the methods presented on this website or from material obtained from this website in any manner will be profitable or that they will not result in losses. Past performance is not a guarantee of future results. It is the responsibility of each trader to determine their own financial suitability. FX daily ltd. cannot be held responsible for any direct or indirect loss incurred by applying any of the information obtained here. Futures, forex, equities and options trading contains substantial risk, is not for every trader, and only risk capital should be used. Any form of trading, including forex, options, hedging and spreads, contains risk. Past performance is not indicative of future FX daily ltd. are not Registered Financial Investment Advisors, securities brokers-dealers or brokers of the U.S. Securities and Exchange Commission or with any state securities regulatory authority OR UK FCA. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest, with or without seeking advice, then any consequences resulting from your investments are your sole responsibility FX daily ltd. does not assume responsibility for any profits or losses in any stocks, options, futures or trading strategy mentioned on the website, newsletter, online trading room or trading classes. All information should be taken as educational purposes only.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.