- Tesla stock falls as job loss news escalates.

- Tesla has shut its San Mateo office, and 200 staff working on autopilot systems have been let go.

- TSLA stock waits on delivery data due this week.

Tesla's (TSLA) stock fell on Thursday as more job loss news hit sentiment on the name and the broad equity market remained nervous ahead of upcoming earnings. Tesla will report its earnings on July 20, but delivery data is due probably on Friday, which will be keenly watched by investors as that dictates quarterly revenue. We remain negative on the stock and have a $400 price target based on our deep-dive research into Tesla, which you can read here. We went through some detailed valuation methods using cash flow and P/E comparisons. As a result, your author is short Tesla. You may call this bias, but I call it putting your money where your mouth is!

Also read: Tesla Stock Deep Dive: Price target at $400 on China headwinds, margin compression, lower deliveries

Tesla stock news

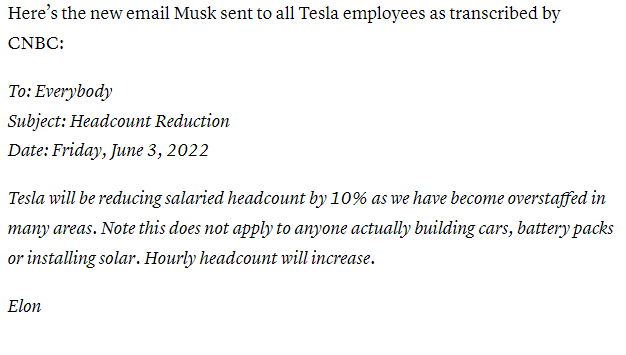

Elon Musk said he had a "super bad feeling" about the economy recently, and it appears he is following through on that feeling as Tesla reduces some areas of operations resulting in job losses. Tesla has closed its factory in San Mateo, California, and this has resulted in 200 job losses for workers who were mainly focusing on autopilot systems. Tesla has also planned to cut the salaried workforce by about 10%, according to reports earlier this month.

Source: CNBC.com

This week Wall Street has taken the knife to Tesla delivery estimates, which we expect to get on Friday. Mizuho wrote to clients: “We have conservatively lowered [second quarter] EV unit delivery estimates for [Tesla] (NASDAQ: TSLA), [Rivian] (NASDAQ:RIVN), and Nio Inc. (NYSE:NIO), given Shanghai shutdowns and supply chain constraints.”

Citi lowered EPS estimates by approximately 2% for 2022 based on Shanghai lockdowns.

Deutsche Bank chipped in with its downgrade for delivery numbers: “We cut our 2Q deliveries estimate by 65k to 245k units, reflecting a prolonged Covid-19-related shutdown and logistical challenges in the Shanghai factory.” Last week Morgan Stanley lowered its price target from $1,300 to $1,200, still pretty bullish though! Wall Street delivery estimates are at a 270K consensus for the quarter.

Wedbush's Daniel Ives reckons anything over 260K will be taken as a positive by Wall Street.

On an apples-to-apples basis when factoring in the Giga Shanghai shutdown, we believe the line in the sand for deliveries is roughly 250k globally with anything above 260k viewed positively by the Street. We believe Model Y/3 units in the 240k/245k as "good enough" by the Street

— Dan Ives (@DivesTech) June 30, 2022

He clarified that he remains firmly bullish with a $1,000 price target.

Tesla stock forecast

$620 is the key level for TSLA stock, and with the imminent delivery report this Friday or over the weekend, action is likely to be limited until it comes out. That should then give the underlying direction until earnings in a few weeks. Breaking $620 confirms the recent weakness, and only getting above $800 ends it technically.

There is a notable volume gap from $600 to $500, which could prove volatile for Tesla stock. Ultimately our bear target near $434 back in August to November of 2020 remains our base case. Above $800, we flip!

Tesla (TSLA) chart, daily

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.