- Sundial (SNDL) has been a star performer but the trend is weakening.

- SNDL drops nearly 20% on Friday as retail trade suffers.

- Sundial (SNDL) and other cannabis stocks are in the news for 2021

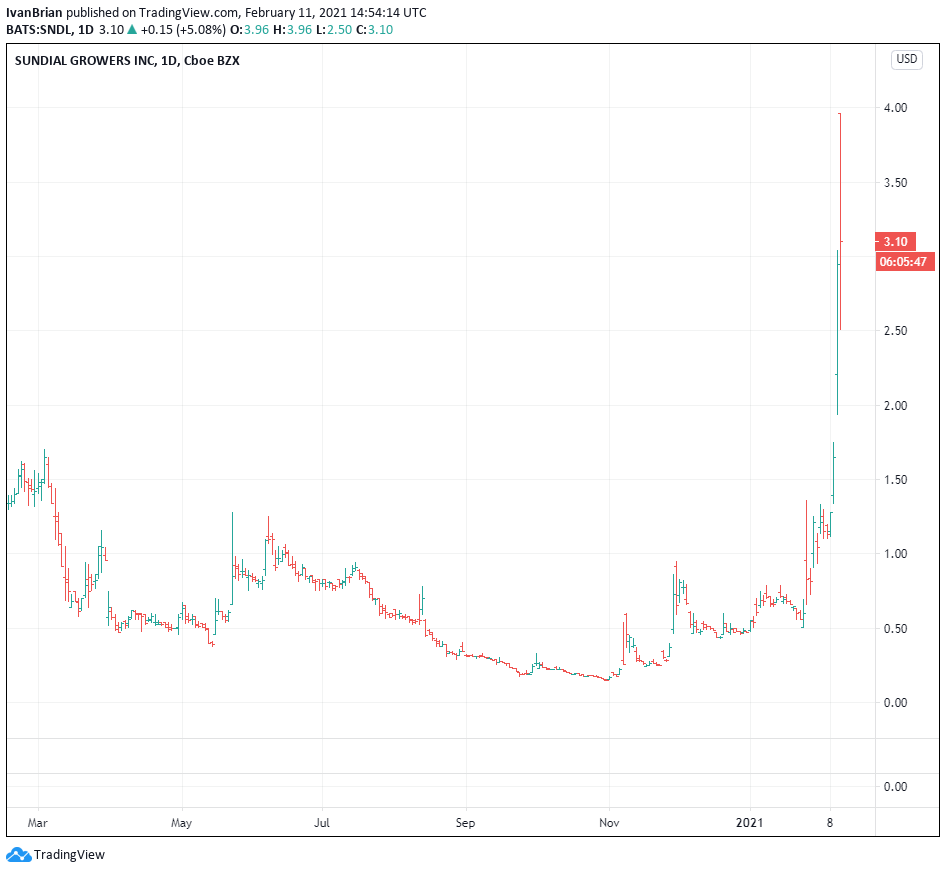

Update Friday Feb12: SNDL shares suffered a weak Thursday, losing nearly 20% to close at $2.38. Unfortunately for retail traders, the trend is continuing on Friday with SNDL shares down at $1.90 at the time of writing, another loss of 20%. SNDL shares have been on a run in 2021 as the Reddit revolution set sights on pot stocks.

Update: NASDAQ: SNDL have closed Thursday's session with a fall of 19.32% to close at $2.38, but they may be experiencing a happy Friday. Premarket figures are pointing to a bounce. It is essential to note that the cannabis company's shares were changing hands as a penny stock – under $1 – as late as two weeks ago. The meteoric rise since then was bound to hit a speed bump, but the fundamental case remains intact. Follow more stocks news here

Update: Sundial Growers Inc (SNDL) shares rose nearly 40% in premarket trading on Thursday and opened at its highest level since November 2019 at $3.96. However, profit-taking forced SNDL to lose its traction after the opening bell and the stock was last seen trading at $2.75, where it was down 8% based on Wednesday's closing price. Cannabis stocks seem to be attracting retail investors since the start of the week with Reddit's WallStreetBets shifting the focus to the sector. Reuters on Thursday reported that cannabis stocks were among the most traded by German retail investors on Thursday, confirming the rising interest.

Sundial Growers has been in the news this week and in the sights of retail traders in 2021. Largely a combination of its very low, penny stock status, price, and also its position as a cannabis growth stock. Retail traders have been hot on the cannabis sector in 2021 as traders bet that the US will follow Canada and open up the US cannabis market. In this regard, President Biden's administration is seen to be more amenable to this than former President Trump.

Sundial Growers Inc Nasdaq (SNDL) is a Canadian cannabis producer with a number of products aimed at the inhaled cannabis market.

Sundial (SNDL) stock news

Sundial Growers (Nasdaq: SNDL) news had been slow and until recently the stock had been a pretty average performer. It is not one of the main players in the Canadian cannabis market with far larger competitors.

But Sundial has taken advantage of investor interest in the stock to strengthen its financials and balance sheet. On February 2, Sundial announced the news that it had raised $100 million in a share offering. In November 2020, Sundial had a market cap of just $60 million so this is a significant capital raise for the company. At the time of writing, the market cap of Sundial has soared to nearly $6 billion after the share price surge.

Sundial Growers (Nasdaq: SNDL) stock forecast

After recent capital raises Sundial Growers now has over CAD$600 million in cash. Sundial recently announced news that it was looking for opportunities to maximize value, ie an acquisition of another cannabis business.

So, should I buy shares in Sundial (SNDL)?

Well, again this is another example of the current frenzy surrounding much of the stock market. A classic case of new retail traders with time to spare and new stimulus money to invest. Money can be made in stocks where traditional valuation metrics seem to be totally ignored. But this should be money that can be afforded to be lost. If nothing happens, as in Gamestop, the shares will return to earlier levels. However, opportunity does exist, the US may open up the cannabis market and/or Sundial may acquire another business to fund growth. Just invest wisely and monitor risk carefully, this is another highly speculative play. Sundial news flow is key as it is a highly volatile space.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.