- SPY falls as yet more yield hikes finally see equities rollover.

- Fed speakers are now in blackout until the Fed rate decision.

- Euro rallies on President Macron winning French reelection.

The week ended on a sour note for equity investors and it looks to be a continuation of that theme on Monday as investors wake up to the news of yet more restrictions and lockdowns in China. Parts of Beijing and significant areas in Shanghai are in lockdown and as a result, industrial production from the global powerhouse that is Shanghai is set to fall further. Consumption from Beijing is also set to take a hit and Chinese stocks suffered some sharp falls on Monday. Last week ended poorly for equity investors with the Nasdaq being the leading index despite it closing Friday lower by 2.65%. Sectoral performance again saw every sector finish in the red. Materials (XLM) and Healthcare (XLV) suffered the most while Consumer Staples (XLP) and Real Estate (XLRE) were the top performing sectors. The momentum (MTUM) versus value (VLUE) debate saw value just about come out ahead but neither sector can exactly be happy, MTUM -3.125 and VLUE closed -2.74%.

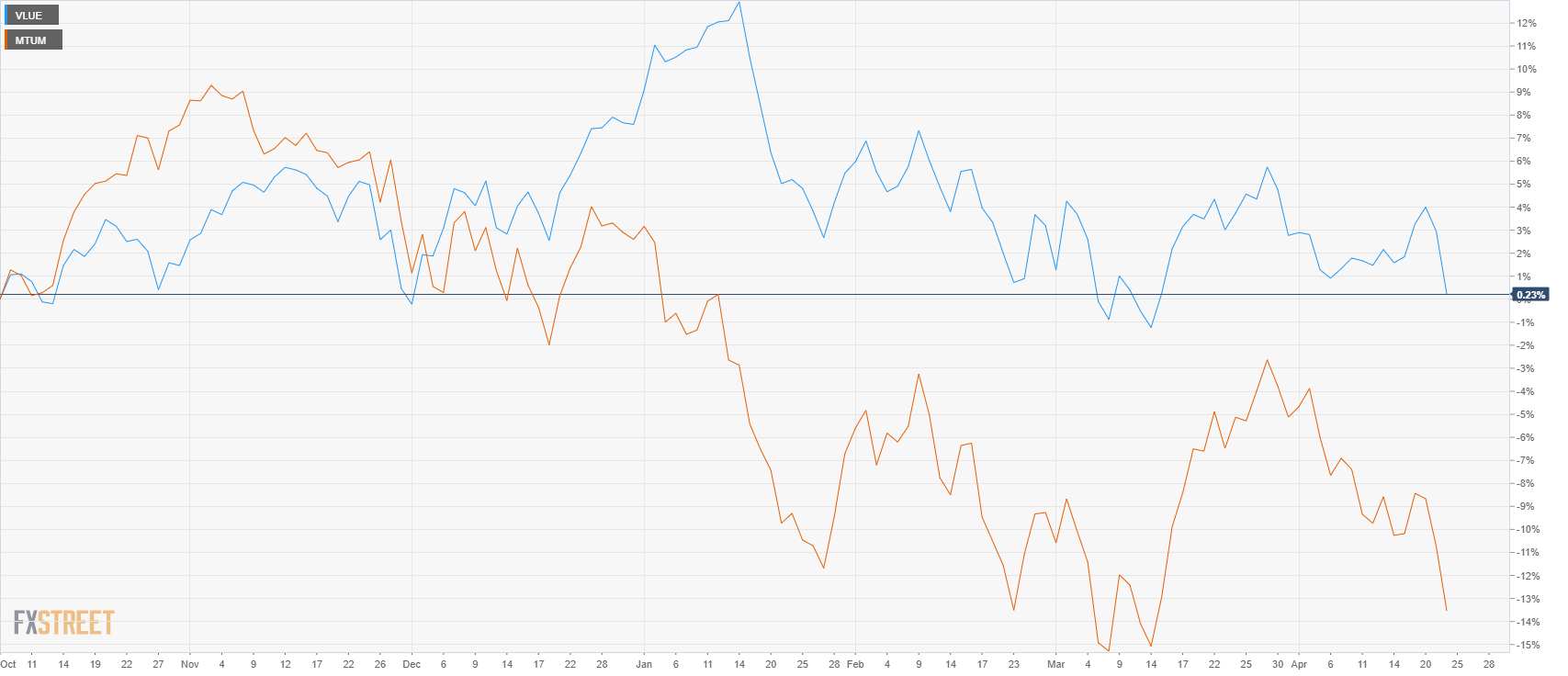

Momentum stocks (MTUM) versus Value stocks (VLUE) show how the tide has turned back towards value investing as yields and inflation pick up. Value is now nearly 14% ahead over the past 6 months. For those that do not follow these sectors that closely, momentum (MTUM) stocks are higher risk equities while value is seen as boring and underperformed in the supercycle from March 2020 to October 2021.

SPY stock news

This week is the big week in terms of earnings with nearly 170 of the S&P 500 companies reporting. This week is also big because it's tech earnings week. Facebook (FB), Apple (AAPL), Microsoft (MSFT), Google (GOOGL) and Amazon (AMZN) all report earnings this week. With the SPY lacking any impetus a strong week of earnings this week is crucial to next quarter's performance. Also, commentary around supply chains and outlook will be crucial as Shanghai port remains gridlocked. Bond markets will likely calm this week as Fed speakers are now in blackout before the May interest rate decision in ten days. So a combination of strong tech earnings and a lack of hawkish commentary could cause a relief rally for the SPY.

SPY stock forecast

$415 is our key support right now. This was the strong double bottom that led to the contrarian rally that confounded many investors. If we are to rally that needs to hold. Otherwise, a test of the spoke Ukraine invasion low at $410 is obvious and that will really be the last stand for bulls to support that level. Breaking $410 and it is on to $393 pretty quickly due to a volume vacuum. $437 is interim resistance and beyond that $448.

SPY chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.