- SPY finished the week in negative territory but only just.

- The S&P 500 ETF witnessed wild swings but closed less than 1% lower last week.

- Sentiment readings are showing huge fear but bulls are taking of this being a buy signal.

The SPY finished Friday lower after an early attempt to rally was knocked back. The US employment report was about as good as hoped for by equity bulls. The wages component rose less than expected while job creation remains strong. The economy and labor market according to the Fed are red hot and can handle multiple rate rises. This employment report appeared to confirm that.

Equity futures rallied on the report, the US dollar weakened and bond yields fell. However, this attempt at a rally proved shorty lived and the equity market was looking at more steep losses before a small recovery toward the close on Friday.

SPY stock news: Companies pass price hikes to consumers

After the volatility caused by the Fed interest rate decision, the Bank of England, and Friday's jobs report, one might hope for some stability this week. Earnings season is now past and it has largely been a strong one, despite feeling otherwise. Over 70% of S&P 500 companies have beaten analyst's estimates and we are more or less through earnings season.

This week we will renew our focus on inflation when US CPI is released on Wednesday. This will once again let yields dictate equity market performance. While earnings season has been positive it has largely been down to companies passing on price hikes to consumers. This means inflation may last longer than forecast. It also means however that demand will begin to taper off so the consumer will be the recession gauge.

Sentiment gauges are massively skewed to fear. The CNN Fear and Greed Index is close to peak fear while the AAII survey was one of the lowest in years. The AAII did bounce a bit in the survey on Friday so perhaps it is time to start thinking about that dip.

SPY stock forecast: Wait a bit more before buying the dip

We too are tempted by this dip as earnings season has held up, but from purely gut instinct think it may be necessary for the market to inflict some more pain on participants just yet. After all the market runs at about 80% of participants losing money so it exists to frustrate most of us (Deemer's Law!). We have been noticing over the weekend many blogs and commentaries saying it is time to buy this dip but if we all buy it then it is likely we will see further frustration. We made our sub $400 call for SPY last week and we will stick by it.

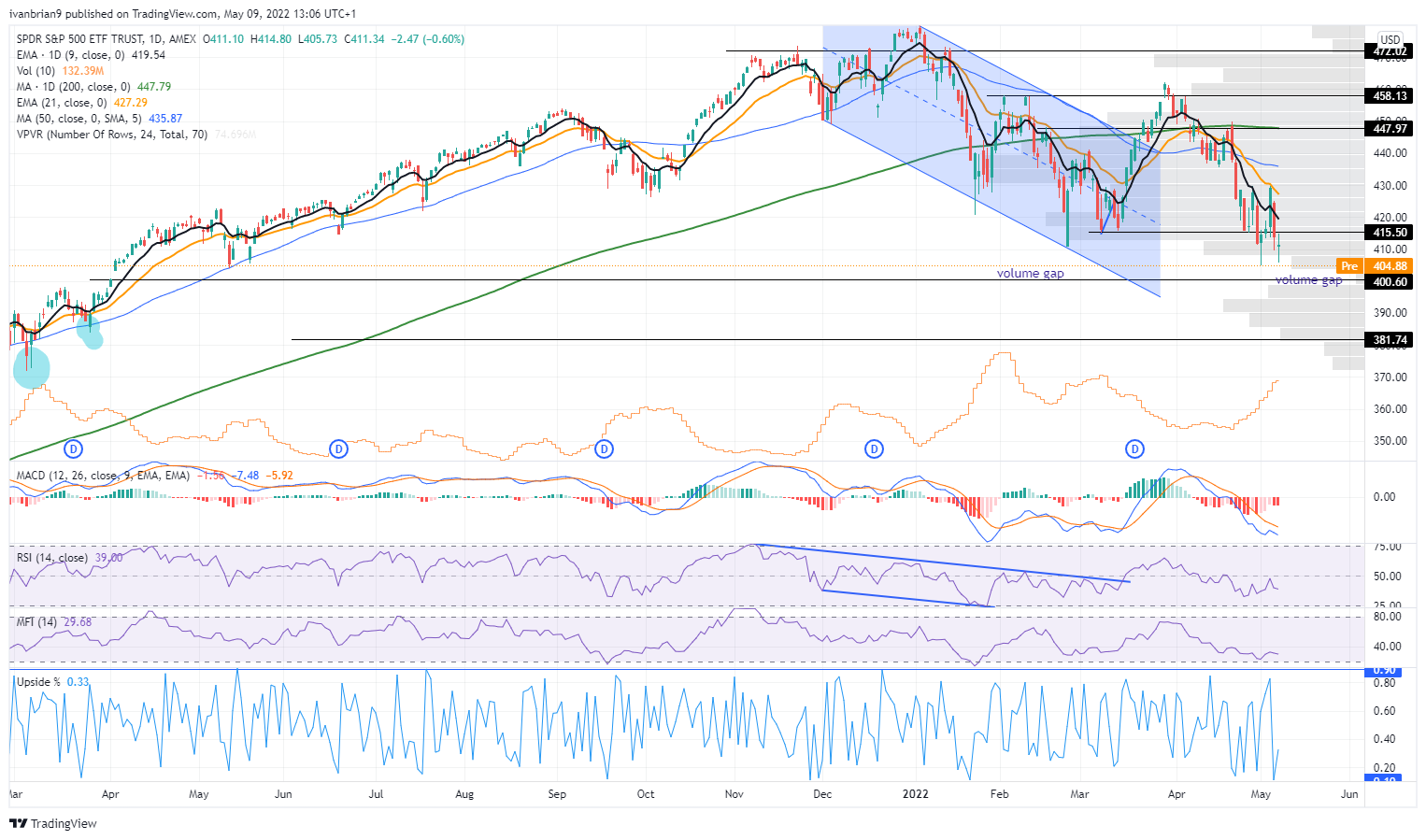

Notice also the volume gap just below $400 until $390. This is reflected in the futures markets also and in general, liquidity has been poor across many asset classes. A sharp move below $400 should accelerate to $390. This would then results in peak fear, and perhaps that is the dip to wait for.

RSI and MFI remain negative and the market breadth is also still weak. Last Thursday was a 90% down day, as in 90% of total NYSE stocks closed lower. This is a capitulation sign but we have no cause for a rally just yet.

SPY chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.