- S&P 500 (SPY) dumps again on Wednesday after the CPI shock.

- Nasdaq (QQQ) falls over 3% on Wednesday as investors exit everything.

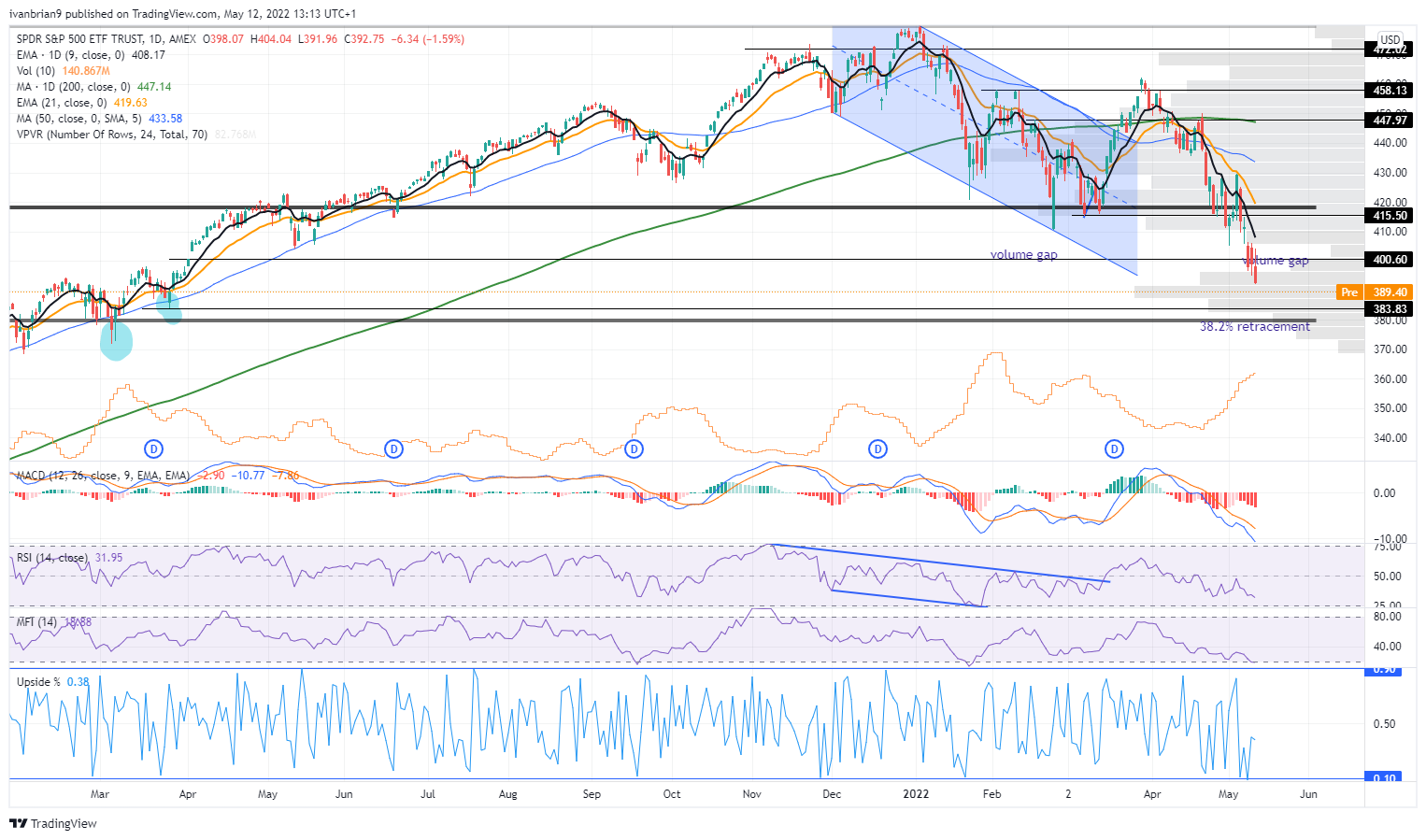

- SPY breaks $400 and closes below that level.

Equity markets remain on high alert after Wednesday's CPI shock. The market had moderately positioned itself for a slightly better than hoped-for number. Instead, we got a worse than expected number, and off we went to the sell-side again. Fear and panic were evident everywhere. The US 2-year yield spiked a massive 30 basis points on the SPI release, and the dollar went on a charge. Equities naturally suffered.

S&P 500 (SPY) News

Again as is the trend, it was technology and the Nasdaq that were the big losers on Wednesday. For once it was not total industry-wide selling, and some sectors finished in the green. Defensive sectors like energy (XLE), utilities (XLU) and materials (XLM) all finished the day positively. This was witnessed in the market breadth indicator with 62% of stocks closing lower. This is a noted improvement from 90% on Tuesday.

However, things remain firmly bearish this morning with all US futures markets pointing sharply lower and European indices also lower. We have had some distinctly hawkish commentary from the Bank of England, and the ECB now is on the interest rate hiking warpath. Despite this, bond yields have fallen back. Most likely bond markets are now pricing in a recession and a subsequent lowering of rate hike predictions. That is also why the yield curve flattened somewhat on Wednesday. The front-end yields rose as the Fed will still have to hike quickly, but the back end (far dated) sees a recession ahead and rates cooling in 2023.

Neither is a great outcome for stocks. Higher rates in the short term followed by a recession are not exactly music to equity investors' ears. Earnings season was pretty strong, but already forward earnings are looking likely to come under increasing pressure based on conference calls after said earnings reports.

S&P 500 (SPY) Forecast

We are now slightly less sure of where we go from here. We did issue our sub-$400 call last week, and now that we have reached our target, it is time for a reassessment. The SPY is entering a slightly larger volume zone, which should give it some support. For those Fibonacci fans among you, we are coming up on one of the more significant retracement levels, the 38.2% pullback. From the pandemic's March 2020 low to the January 4, 2022 high, this 38.2% retracement is at $379.80. Added to this are the Relative Strength Index (RSI) and the Money Flow Index (MFI) both showing the SPY as oversold. Does this mean it is time to rally? Our only caveat is the number of people looking for this imminent rally. Markets generally do prefer to surprise us, so we may get some more torrid days before everyone is flushed out or fed up. Then we can rally.

SPY chart, daily

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.