- S&P 500 closes down again on Thursday by 0.88%.

- SPY falls 20% in the first half of the year.

- Bonds also fall in the first half, making it a terrible year for asset portfolios.

The S&P 500 or SPY ETF closed out the half-year in a subdued fashion on Thursday as the anticipated repositioning did not materialize. Long-only investors and mutual funds opted to remain underweight equities. July is historically one of the better months for S&P 500 performance and is the best performing month historically in the third quarter.

S&P 500 SPY stock news

As we can see, this half of the year has been a terrible one for stock and bond portfolios. The Fed has been behind the raging inflation curve and has pivoted way too late to a hawkish policy.

The last 8 times the S&P 500 was down in a calendar year, Bonds finished the year up, cushioning the blow.

— Charlie Bilello (@charliebilello) July 1, 2022

Very different story thus far in 2022 with Stocks and Bonds both down over 10%, something we've never seen. pic.twitter.com/QypyjXuROs

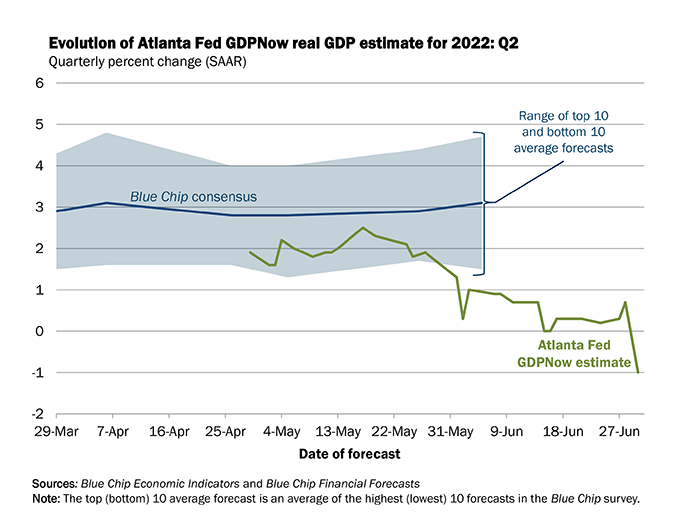

Now financial markets are betting on recession, and the latest GDPNOW figure from the Atlanta Fed is not exactly comforting. It is showing expected Q2 GDP falling 1%.

Source:atlantafed.org

The bond market as mentioned is convinced the Fed is hiking into a recession and has been pricing rate cuts for early 2023. Given that the Fed is late to the party, we see that as highly unlikely. They always over-hike and then over-cut. They have largely moved inflation from transitory by their policies and are now likely to engineer a deep recession by hiking for too long. All this means of course that equities and risk assets will again find H2 to be a tough ask.

S&P 500 (SPY) stock forecast

We do not expect a huge amount of volatility now as we enter earnings season. We expect this earnings season to be when the penny drops with Wall Street analysts as EPS forecasts will be cut and the S&P 500 will naturally then edge lower. Remember macroeconomics impacts EPS which in turn impacts stock prices. Macro remains poor in most regions and the global economy is slowing markedly. International trade is more expensive, there are more barriers to trade, and energy costs are pricing sticky.

Corporate earnings in the US will also be hit by conversion charges of overseas currency earnings into a strong US dollar. There is a strong correlation between lower earnings for corporate America and a strong dollar.

Still, SPY has a gap to be filled from $395 to $401. Resistance above is $415 which is key.

SPY stock chart, daily

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.