SPDR S&P 500 ETF Trust (SPY) Forecast: CPI playbook

- SPY closes lower again on Wednesday as PPI disappoints.

- SPY and QQQ are set to tread water before the big CPI report on Thursday.

- Equities face challenges from rising oil and yields.

Here we go with the big day finally here. Yes, it is CPI day, and we get some more clues as to the future path of inflation and thus interest rates. Where interest rates go, stocks follow inversely. From my initial research, I believe the SPI could remain stubbornly high. Rent and shelter prices appear to be still rising with some eye-watering data from New York earlier. Oil prices as we know are back on an upward path, so this may not yet be peak inflation. The latest Fed minutes appear to show that the Fed members are getting used to the idea of higher rates for longer to combat inflation. This will be a long-term fight, not a quick fix. The labor market remains tight, so they do for now have more room for rate hikes.

SPY news

Earnings season is upon us, and already it looks more promising. We have mentioned this several times now that the bar has been set low. EPS revisions were marked lower over the past few weeks.

further adds to the bear rally thesis. October effect, mid terms effect, sentiment, buybacks we just need to get over CPI. https://t.co/97KxZfKr4P

— Ivan Brian (@IvanBrian9) October 12, 2022

FedEx and Nike got a lot of the bad news out of the way early. Now we see some positivity from Pepsi (PEP) and the airlines. Delta (DAL) has just upped its forecasts. The strong dollar will help transatlantic travel, and we already saw that with strong earnings from LVMH on Wednesday.

American purchasing power is on the rise with the dollar, but all the focus now is on the CPI. Last time out the reaction was aggressive to the downside. It was one of the strongest sell-offs in two years. This time I expect a high number but not as big a reaction. The market has in my view front run a lot of bad news. Positioning is bearish, and sentiment is bearish. A number in line or even lower than expected will lead to a massive risk-on rally in my view.

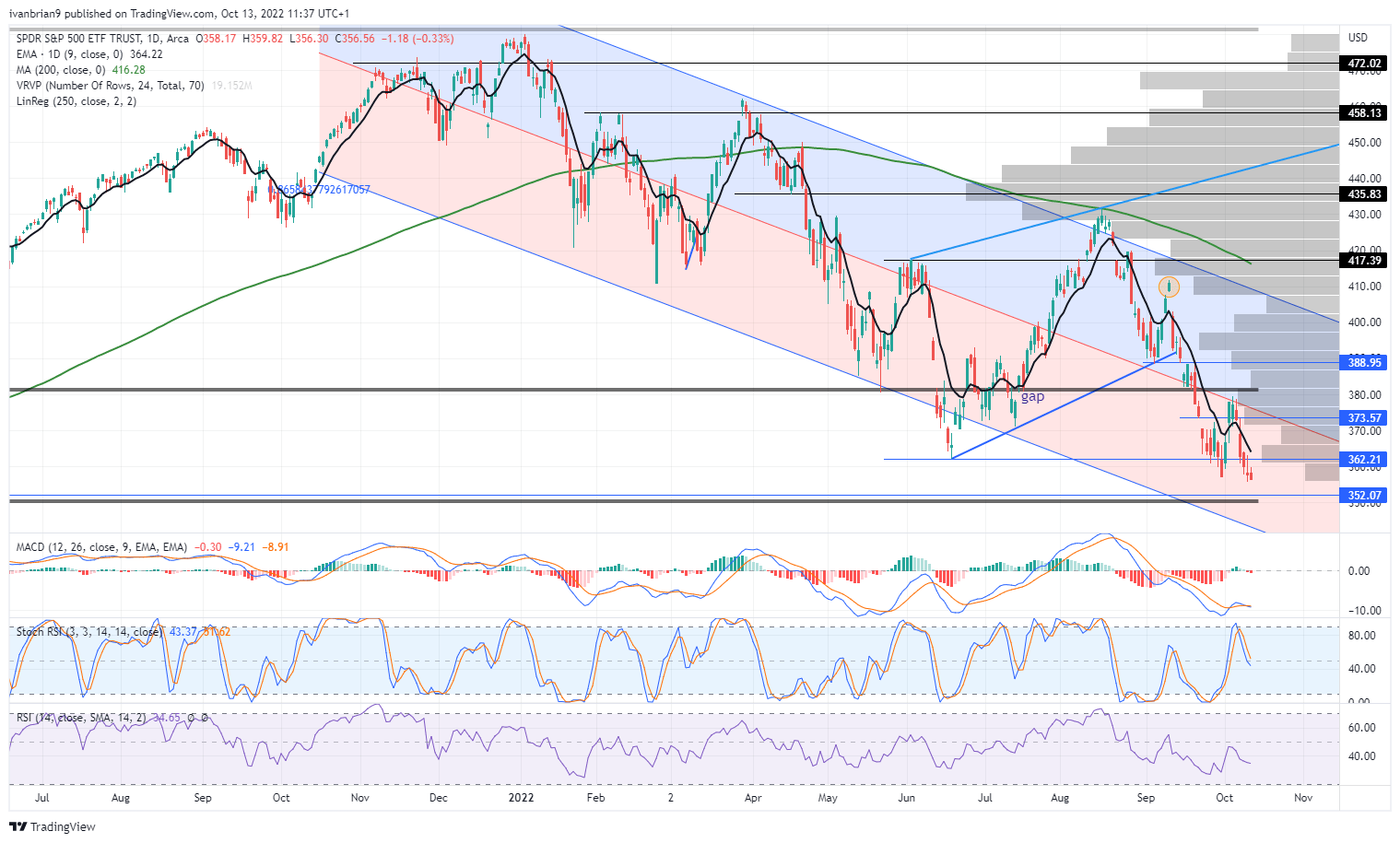

SPY forecast

I would feel more comfortable in my contra-bullish view if we had washed out to $352. I remain bearish on the longer time horizon as valuations are too high. We have more rate hikes to come with market participants pricing in 75 bps in November and 50 bps in December. That will play to a massive reduction in equity risk versus bond risk. $373 remains my pivot, but the longer we hold these levels then the more excited I get over a bullish double bottom. Breaking $373 should see a quick move to $389.

SPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.