- Stocks are set for more gains as earnings season ramps up.

- SPY rallies as risk returns and yields stabilize.

- SPY hopes for a recession to boost sentiment!

The stock market has begun to bottom out, according to some analysts, and certainly risk appetites have returned this past week. Earnings season is up and running without too many surprises just yet but with the caveat of the big dogs of tech reporting next week in a make-or-break season. In a curious framing of narrative, equity markets are recovering as hopes for a recession increase. This is a counterintuitive argument, but so much of equity performance has been tied to low rates this past decade that investors are addicted to free money. The sudden shock of rising rates was unfamiliar territory and caused a sharp sell-off, especially in risk-sensitive names that usually include tech and the Nasdaq. Now hopes for a recession have seen 10-year yields penciled lower. Lower rates mean the TINA trade (there is no alternative) would be back on in favor of equities despite a recession.

SPY stock news

So there you have it: a counter-intuitive rally. It is also helping that so far earnings season is relatively upbeat. Tesla (TSLA) last night beat on EPS and was only marginally behind on revenues. There were some caveats, notably margin compression and a Bitcoin sale, but overall with some huge headwinds from China lockdowns and supply issues the growth rate is still impressive. We will update our deep dive Tesla analysis shortly, so keep an eye out. Economically speaking it appears as though the US housing market is about to roll over. No surprise really as house prices had surged to records both in nominal terms and in wage multiples. With rising rates and thus mortgages, it was not surprising that demand would fall just as inventories have been rising in response to rising prices. A classic Econ 101 lesson: rising prices increase supply and dampen demand.

The question remains though is this a bottom or a bear market rally. Certainly, short covering is outperforming long-only names. This leads us to believe it is early. Short covering ahead of earnings season is there, but there is no correlation yet from long-only buying.

The stock market bounce has been supported by short covering. pic.twitter.com/Rv1IY0D1F8

— (((The Daily Shot))) (@SoberLook) July 21, 2022

If earnings season goes some way better than expected, then we would expect the rally to broaden and continue. But earnings estimates are moving in the opposite direction.

The aggregated earnings outlook looks steady but, under the hood, estimates are eroding. Here we see the percentage of companies in the S&P 500 with rising estimates from three months ago. There clearly is slippage here. pic.twitter.com/LJ5Fea3WhX

— Jurrien Timmer (@TimmerFidelity) July 20, 2022

US corporate earnings downgrades have accelerated. pic.twitter.com/iKYtowdHz4

— (((The Daily Shot))) (@SoberLook) July 21, 2022

This largely explains why the market is so choppy, and when you add in the clouded interest rate outlook, we are definitely in choppy waters.

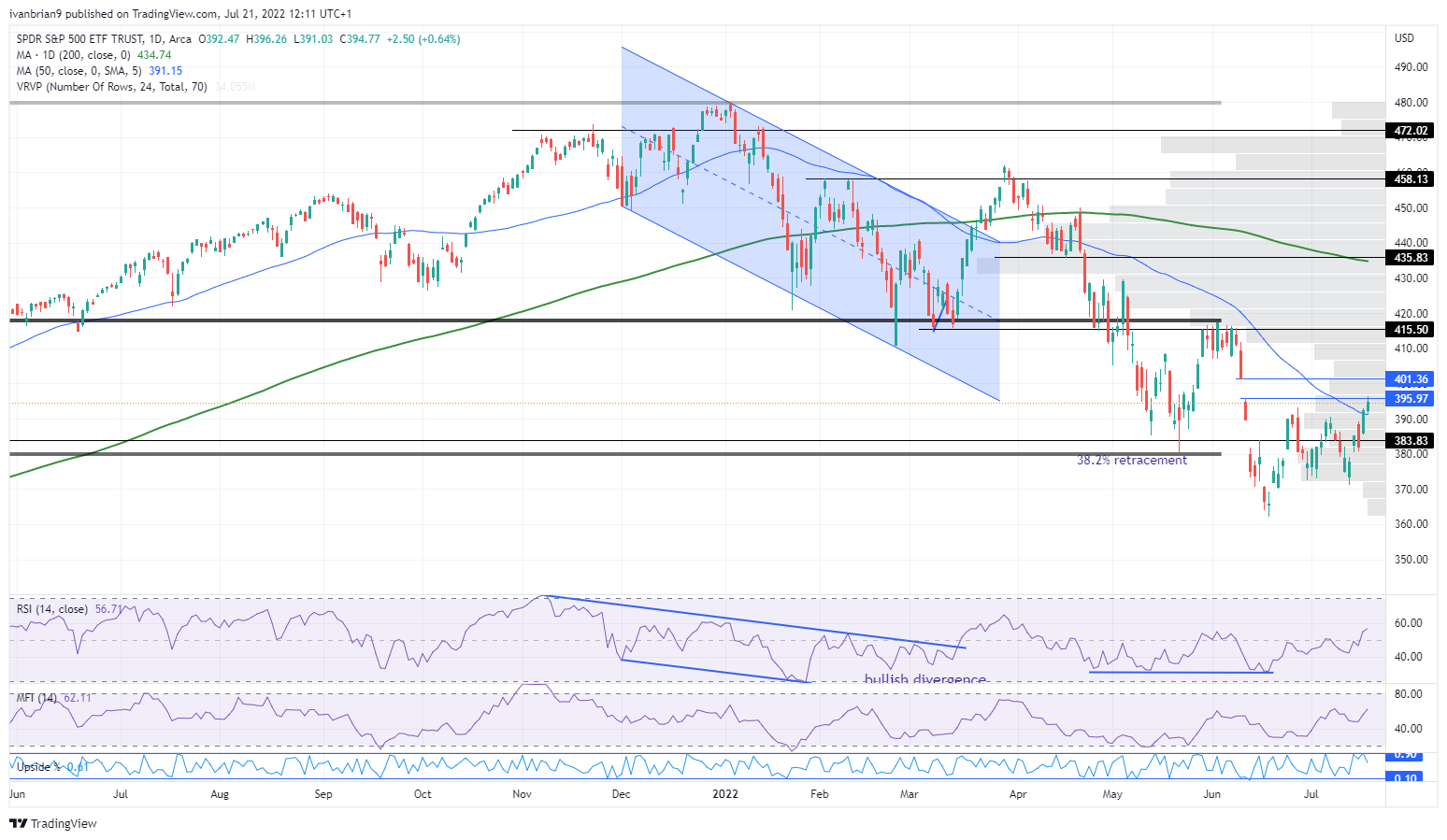

SPY stock forecast

We have reached our first target and resistance at $395 and now have to fill the gap to $401. After that, it is on to resistance at $415 and a much strong resistance level. Tuesday was a high volume day and market breadth was strong with nearly 90% of NYSE-listed stocks closing higher.

SPY chart, daily

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.