Here is what you need to know on Friday, April 16:

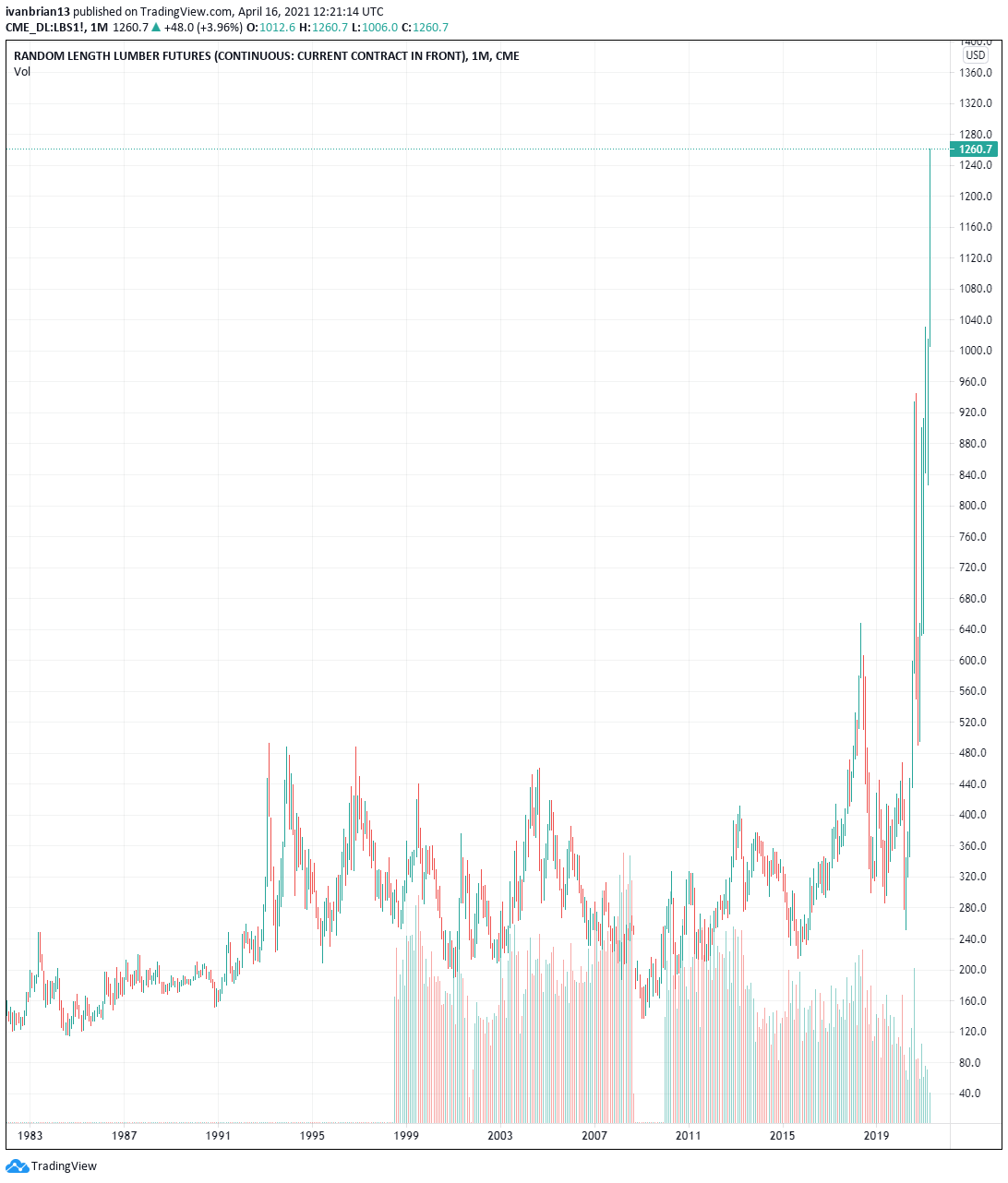

Markets are dull, volatility is asleep but Putin mulls over countermeasures to Biden's tariffs. The ten-year yield may be falling, back to 1.55% now but look at lumber! Not something you near too often but if you want to build it might come in handy! But it is going to cost you a lot more to build that house now! But fear not, the Fed has reassured us there is no inflation right! No irrational exuberance to see here! Banks are fully capitalized, yes an EU regulator said that in 2008! Anyway, lumber prices are obviously strongly linked to housing prices, particularly in the US Pacific Northwest. Check out the chart below and see if you think prices are stable! Just for comparison, it shows prices back to 1983! Back in February, the National Association of Home Builders said rising Lumber prices were concerning and adding up to $24,000 to the price of a house. Then Lumber prices had just broken $1,000 now they are 30% higher still!

Anyway that was interesting right? Now back to the markets and see if anything is awakening. The dollar is still stuck trying to break 1.20 versus Euro and still failing! All the hedgies have covered shorts now according to CFTC data so expect it to go back down! Yields are lower with the ten year at 1.55%. Gold bounces slightly to $1782 while Bitcoin dumps as Turkey bans it, last at $60,800.

European markets are all higher as the Dax gains 1%, FTSE 0.5%, and EuroStoxx 0.6%.

US futures are also all green. The Nasdaq is +0.3% while the Dow and S&P 500 are +0.2%.

S&P 500 (SPX SPY) Nasdaq (NDX QQQ) top news

US Housing starts 1.739m versus 1.613m forecast. Housing starts up 19.45 month on month.

Putin is to decide on countermeasures against the US in relation to US sanctions.

Germany says Britain is no longer a covid risk zone.

Chinese GDP registered a huge 18.3% growth in Q1.

Swiss National Bank does not agree with the US Treasury Dept's new study on FX policies.

WHO says covid is at a record high globally.

BlackRock CEO Larry Fink says he is incredibly bullish on the stock market. They are the biggest money manager in the world!

Google (GOOGL) misled customers over data collection from location data according to Australia's competition regulator.

Morgan Stanley (MS) results beat but says large loss attributed to a single client. We can name them now as the CEO says on the conference call all losses related to Archegos are reflected in Q1 earnings. So the blowout would have been even bigger! see more.

Bank of New York Mellon (BK) beats on earnings, see more.

Citizens Financial Group (CFG) beats on earnings, see more.

GameStop (GME): CNBC reports Roaring Kitty set to net $7 million from options expiration today, nice! see more.

PNC Financial beats earnings, don't they all!

Coinbase (COIN) Cathie still swoons for them as ARK buys more, see more.

Tesla (TSLA) settles a lawsuit against a former employee over copying of source code for autopilot technology.

Kansas City Southern (KSU) missed earnings, yes you read that right some companies can miss earnings!

Ups and downs

Coinbase COIN: Loop starts with a buy rating.

Roku: Bank of America reiterates buy rating.

McDonalds: UBS is lovin it, raises price target.

Microsoft: Oppenheimer names as a top pick.

Bank of America: RBC raises price target.

Citigroup: Barclays raises price target.

Apple: Morgan Stanley raises price target.

American Eagle Outfitters: Morgan Stanley raises price target.

Amazon: Credit Suisse raises price target.

United Airlines: Argus research upgrades.

Economic releases

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.

.png)