Update: The first ninety minutes of trading sees all US indices lower with the Nasdaq leading the way with a 0.95% loss, S&P down 0.6%, and Dow Jones down 0.5%.

Energy stocks again outperform with the XLE Energy ETF up 0.3% with financials being the next best performer. Tech stocks again lose ground as does the real estate sector.

Selected Winners: Rocket up 18%, Nielsen Holdings up 6%, Carnival and Royal Carribean up 4%, Square up 6%, GM up 2%, MorganStanley up 2%, BHP up 1.7%, RioTinto up 1.7%.

Selected Losers: Novavax down 10%, NIO down 8%, LiAuto down 5%, DoorDash down 4%, Target down 4%.

Here is what you need to know for Tuesday, March 2:

Markets power hour on Monday lasts the whole session as US stocks have their best day in nine months. But the technical picture still gives hope to bears and inflation still remains a threat. The Dollar remains bid, breaching 1.20 versus Euro earlier on Monday. Oil slides modestly to $60.60 as higher OPEC supply fears grow. The US 10 year yield remains subdued by recent standards at 1.44%.

European markets remain calm on Tuesday as the rally in US stocks was tempered somewhat by weakness in Asia. The EuroStoxx is up 0.2%, Dax up 0.5% and FTSE up 0.4%.

US futures are all lower, after yesterday's gains hardly that surprising. The Nasdaq is down 0.1%, S&P down 0.1% and the Dow is down 0.07%.

Stay up to speed with hot stocks' news!

S&P 500 News

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission warned about bubbles in foreign markets and properties, contributing to a downturn in Asian stocks.

US airlines remain in "dire straits" according to Airlines for America which represents American Airlines, Delta, and United among others. The trade group is to ask for a third round of government assistance according to Reuters.

Eurozone inflation comes in as expected, calming recent investor fears. Eurozone core HICP (Harmonized Index of Consumer Prices) was 1.1% year on year, 0.2% for the month.

German unemployment also comes in as expected with the unemployment rate at 6%.

ECB Board member Fabio Panetta speaks currently.

US Senate to begin debating President Biden's stimulus bill this week.

BlackRock, the world's largest asset manager said it still remains positive on equity markets despite recent inflationary concerns. "We still believe the new nominal will support equities and risk assets over the next six to 12 months," BlackRock's Investment Institute economists said.

Chicago Mercantile Exchange (CME) saw Average Daily Volumes (ADV) up 28% in February versus January. CME saw a record single-day volume for micro e-mini contracts on Feb 26.

Target posted better than expected fourth-quarter results but declined to provide guidance. EPS was $2.67 versus $2.54 expected. Shares are up 1% in pre-market.

Zoom Video (ZM) crushed it as EPS came in at $1.22 versus $0.79 expected. Shares are up 6% in Tuesdays pre-market.

NIO posted disappointing results after the close on Monday. EPS was $0.16 loss versus $0.074 loss expected. Shares are down 5% pre-market.

A US Wealth tax is back on the agenda thanks to Elizabeth warren. She is one of the sponsors of the Ultra-Millionaire Tax Act which proposes an annual tax of 2% on wealth from $50 million to $1 billion and 3% over $1 billion. Bernie Sanders is alos a co-sponsor of the bill.

Novavax Inc could see its covid-19 vaccine approved in the UK shortly and would then soon likely follow in the US the CEO said. Q4 results were weaker on top-line EPS at $2.70 loss versus $1.49 expected. Revenue rose to $279.7 million versus $8.8 million for the previous year. Shares are down 4% in the pre-market.

AstraZeneca's covid-19 vaccine with Oxford University is showing to be 80% effective in preventing hospitalizations in the over 80's group. Numerous countries have resisted using the vaccine in older age categories due to worries over its effectiveness.

Walt Disney is seeing strong growth in its streaming service Disney + from adults without children according to CEO Bob Chapek. 50% of Disney+ market do not have kids he said, giving opportunities for content.

JP Morgan lists its top stocks to watch for March. StateStreet, Nextera Energy, Marathon Petroleum, and Jones Lang LaSalle-CNBC.

Roku is buying Nielsens digital advertising business-CNBC.

Ups and Downs

Zoom Video, PiperSandler and Rosenblatt raiese their price target.

Beyond Meat was upgraded by Citi to buy from neutral.

TripAdvisor was upgraded by Citi to buy from neutral.

Disney was named by Bank of America as a favoured stock to watch on the reopening of the economy.

Marriot Vacations price target raised at Stiefel.

Economic Releases Today

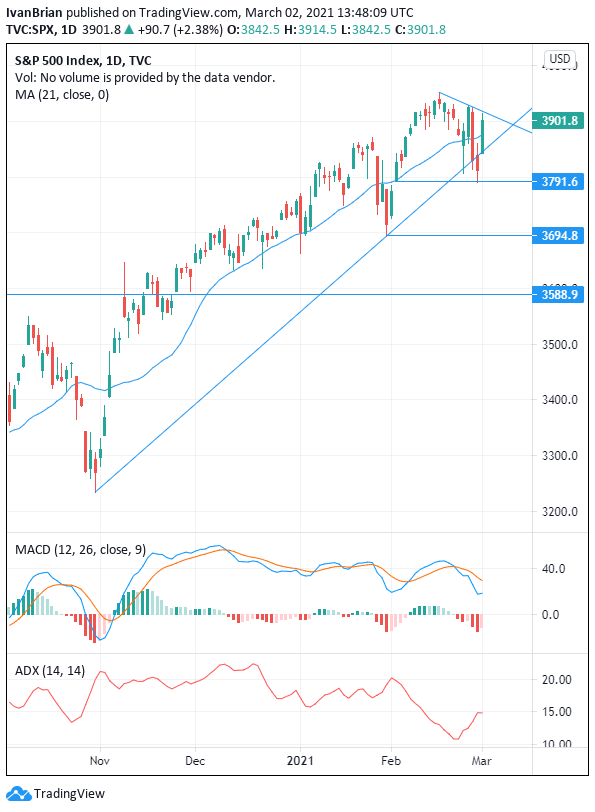

S&P 500 Technical analysis

The S&P really needs to break trendline resistance in the next few sessions if the bullish momentum from Monday is to mean anything. Failure will lead to a re-test of 3791 support and then 3694.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

-637502895979670775.png)