- Silver remains positive after breaking previous resistance line on Tuesday, recently refreshed weekly top.

- Key SMA hurdles probe bulls, 61.8% Fibonacci retracement , one-week-old support line can challenge the sellers.

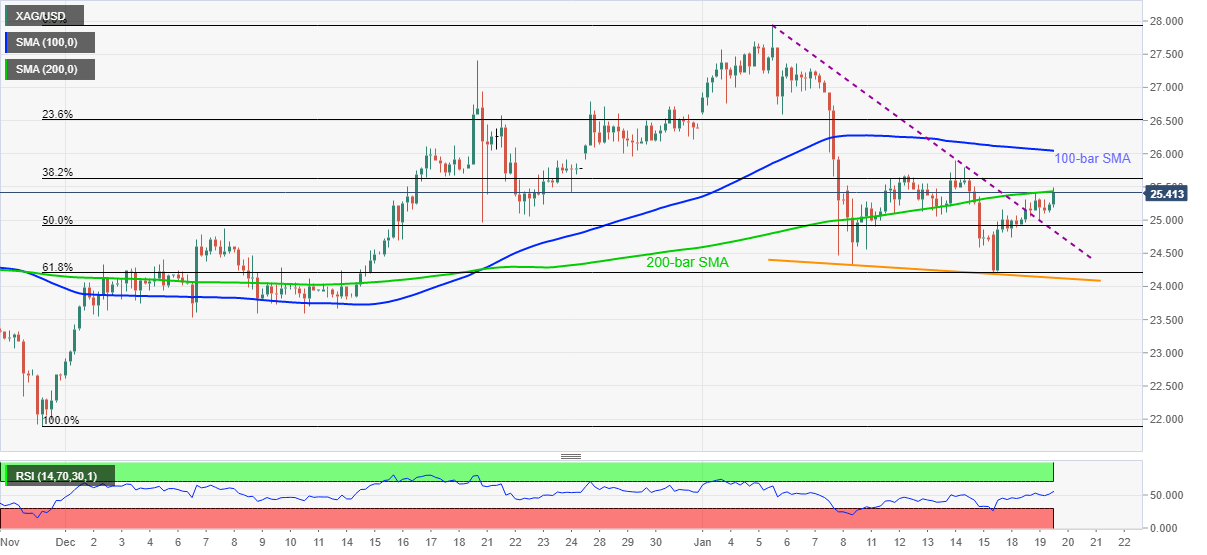

Silver refreshes weekly top to $25.48, currently up 0.90% around $25.40, during early Wednesday. The white metal broke a downward sloping trend line from January 06 the previous day but is currently battling the 200-bar SMA amid normal RSI conditions.

Given the commodity’s sustained break of prior resistance, silver is likely to cross the 200-bar SMA level near $25.50.

Following that, 100-bar SMA level of $26.05 and December-end tops near $26.60/65 can test the silver bulls ahead of directing them to the multi-day high of $27.92 and the $28.00 threshold.

On the flip side, a downside break below the immediate support line around $24.85 will highlight the $24.20/10 support zone comprising the 61.8% Fibonacci retracement of late-November 2020 to the early January 2021 upside and a descending trend line from January 11.

In a case where the bullion declines below $24.10, multiple supports around $23.60 can entertain silver sellers.

Silver four-hour chart

Trend: Bullish

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0650

EUR/USD trades in positive territory near 1.0650 on Wednesday. The US Dollar sees a modest retreat, helping the pair recover previous losses. The EUR/USD rebound, however, appears limited amid Fed-ECB policy divergence. ECB and Fed speeches eyed.

GBP/USD holds above 1.2450 after UK inflation data

GBP/USD is holding onto the latest upside above 1.2450 in the European session on Wednesday. The UK's ONS reported that the annual inflation edged lower to 3.2% in March. This reading beat the market expectation of 3.1% and helped Pound Sterling stay afloat.

Gold fluctuates near $2,390 as markets keep an eye on geopolitics

Gold trades in a relatively tight range near $2,390 in the second half of the day on Wednesday. In the absence of high-tier data releases, investors keep a close eye on headlines surrounding Iran-Israel conflict.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.