- Silver is attempting to recover but there is a long way to go until the bulls will be in the clear.

- The US dollar is down, but there are prospects of a recovery.

At the time of writing is trading at $25.50 and flat on the day, stuck at an end of month tight range of $25.49 and $25.50.

The price has pulled back from the overnight highs of $25.80 made earlier in the New York session that it achieved after rallying from a low of $24.96.

Since the Federal Reserve, investors have continued to move out of the US dollar, likely squaring long positions at month-end on the back of a more dovish Fed chair.

The US dollar on Thursday was shot down all the way down into a strong area of liquidity as measured against a basket of six other currencies, DXY.

The index was 0.4% lower at 91.85, its lowest since June 28.

The US dollar is now sitting at a discount for the bullish of bulls after the weaker hands were shaken out.

Bulls will recognise the divergence between central banks and how the greenback is favoured at times of extreme risk aversion in comparison to its counterparts.

This leaves a low bar for a correction from the current demand area below 92.00:

As the Fed has indicated, there are only a few more months of crisis-era QE left for markets.

Real rates would be expected to rise on the back of nominal yields moving higher over time as investors once again begin to factor in a rate hike from the Fed.

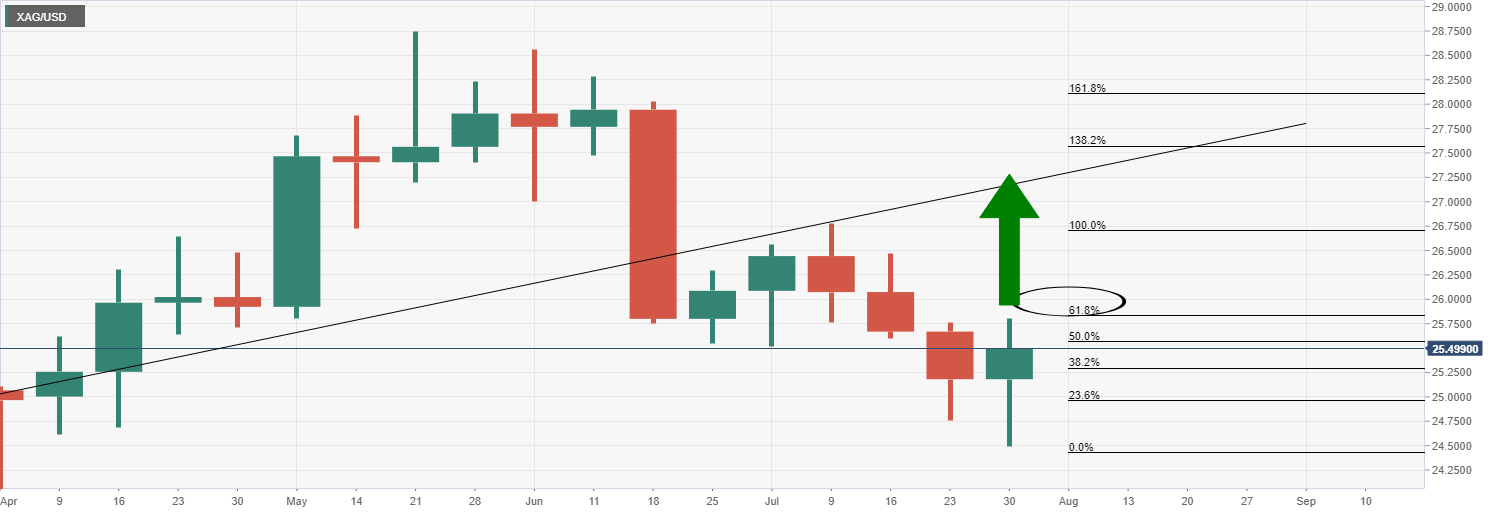

Silver technical analysis

A break above the 61.8% Fibo near 25.90 of the weekly bearish impulse will leave the bulls in good stead for higher highs.

Bulls will be looking for a break to back above the weekly counter trendline and within the bullish trend again.

Hourly chart

The bulls will be keen to hold onto this support or face giving over control to the bears.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.