- Royal Caribbean Cruises trades over 20% higher on Wednesday.

- The whole sector has received a boost on vaccine optimism.

Royal Caribbean Cruises Stock Price

The whole of the travel sector is the US is trading higher as hopes of a vaccine boost US stock markets. The travel sector has much to gain as if the vaccine is successful people will be able to travel again. This may be slightly premature but it did not stop the volume coming in and backing the move.

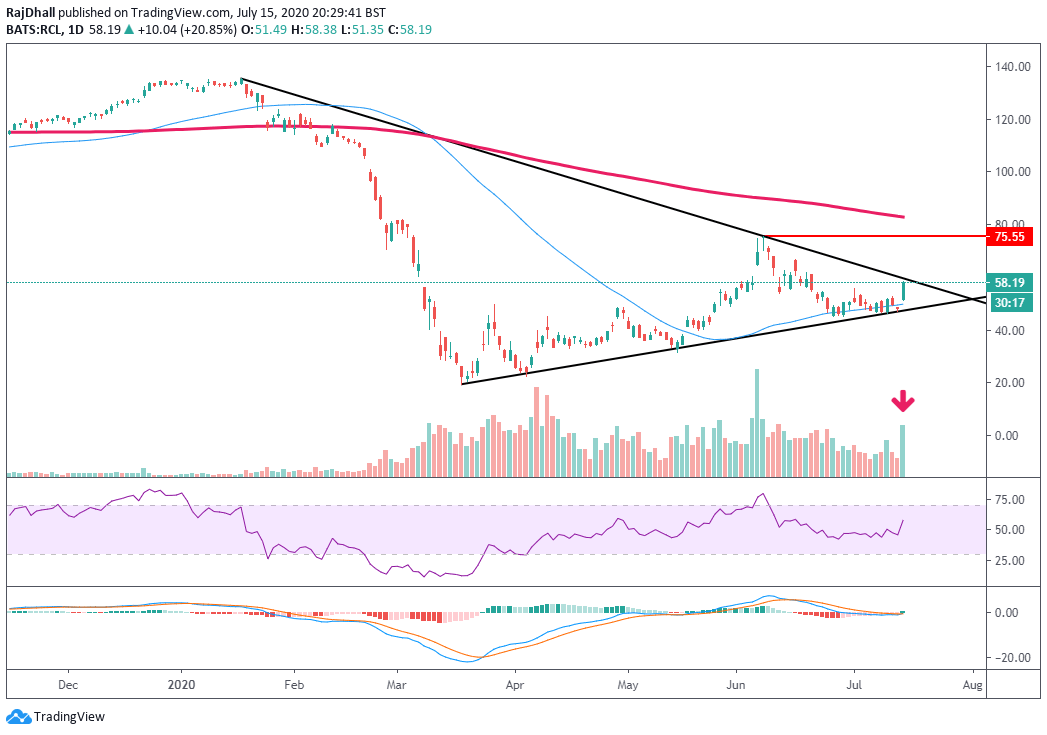

Looking at the daily price (NYSE:RCL) chart below, the arrow represents the amount of volume traded on the session. As you can see there is only a couple of other occasions on the chart where the volume was higher than it was today. Looking at some of the other more technical points the price is hanging above the 55 Simple Moving Average and it could be used as a support if the bears do step in.

The MACD indicator has recently turned up as the histogram is now in the green. The Relative Strength Index is conclusively above the 50 line too. One of the key features on the chart is the triangle pattern and if the trendline breaks to the upside it could be another very bullish signal. The price could then look to target the red resistance zone at 75.55 per share.

Other travel names have also performed well today too. The Norwegian Cruise Line (NYSE: NCLH) and American Airlines (NYSE:AAL) share prices are both above 15%. Although Boeing (NYSE:BA) shares are not at the top of the leaderboard in terms of performance they are when it comes to volume. Despite the market backing this move with great support, many analysts will be keeping a close eye on Moderna (NASDAQ:MRNA) news, as if there is any negative news on the vaccine front the price of all of the travel companies could come back down to earth once again.

All information and content on this website, from this website or from FX daily ltd. should be viewed as educational only. Although the author, FX daily ltd. and its contributors believe the information and contents to be accurate, we neither guarantee their accuracy nor assume any liability for errors. The concepts and methods introduced should be used to stimulate intelligent trading decisions. Any mention of profits should be considered hypothetical and may not reflect slippage, liquidity and fees in live trading. Unless otherwise stated, all illustrations are made with the benefit of hindsight. There is risk of loss as well as profit in trading. It should not be presumed that the methods presented on this website or from material obtained from this website in any manner will be profitable or that they will not result in losses. Past performance is not a guarantee of future results. It is the responsibility of each trader to determine their own financial suitability. FX daily ltd. cannot be held responsible for any direct or indirect loss incurred by applying any of the information obtained here. Futures, forex, equities and options trading contains substantial risk, is not for every trader, and only risk capital should be used. Any form of trading, including forex, options, hedging and spreads, contains risk. Past performance is not indicative of future FX daily ltd. are not Registered Financial Investment Advisors, securities brokers-dealers or brokers of the U.S. Securities and Exchange Commission or with any state securities regulatory authority OR UK FCA. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest, with or without seeking advice, then any consequences resulting from your investments are your sole responsibility FX daily ltd. does not assume responsibility for any profits or losses in any stocks, options, futures or trading strategy mentioned on the website, newsletter, online trading room or trading classes. All information should be taken as educational purposes only.

Recommended content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.