- Rivian stock holds steady on Tuesday despite market sell-off.

- RIVN has been outperforming in this recent sell-off.

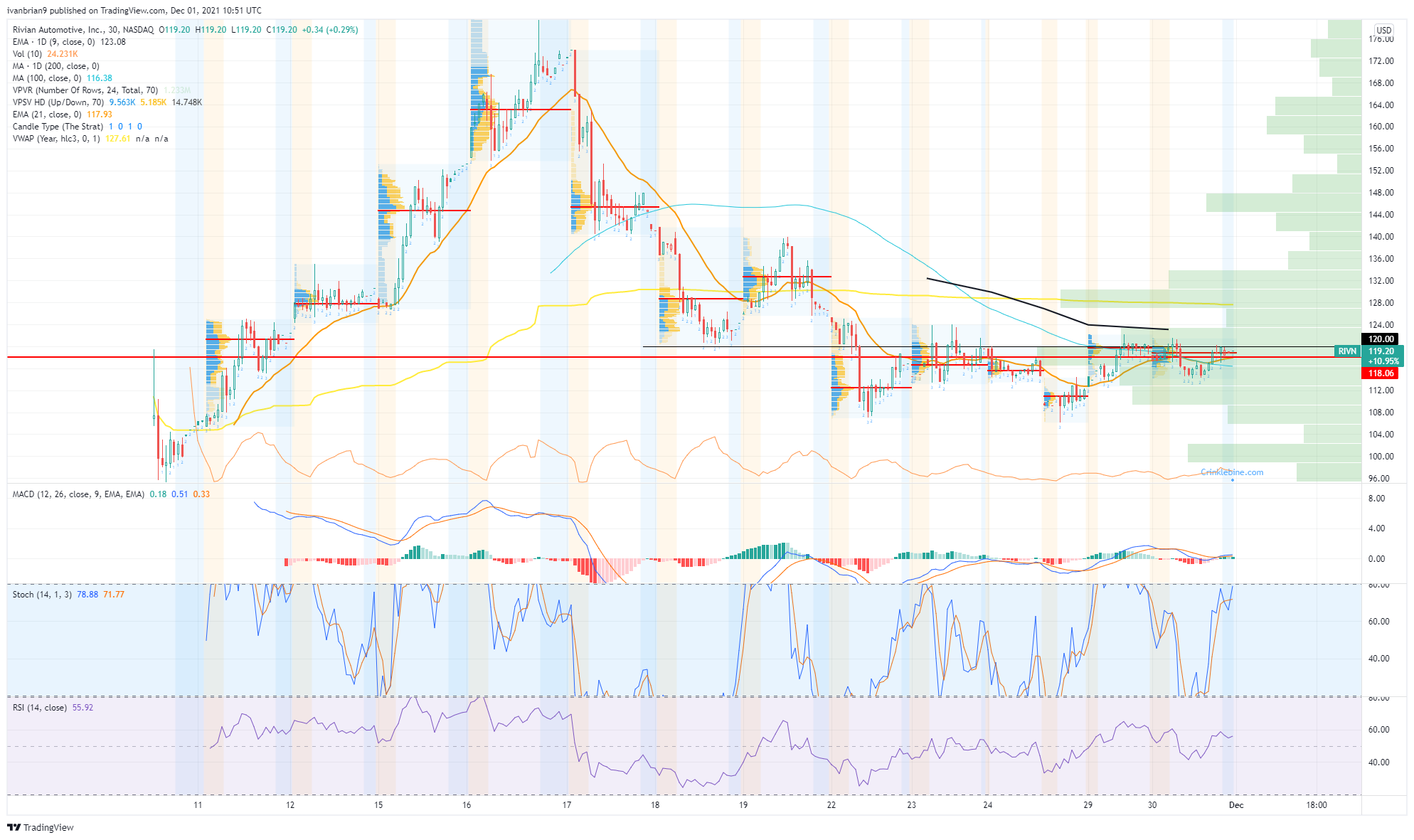

- RIVN shares are about to break key resistance at $120.

Rivian (RIVN) kept the losses to a minimum on Tuesday despite some more panic selling spreading across equity markets. This time it was friendly fire from Fed Chair Powell that did the trick as he persisted with the taper talk though acknowledged inflation as being more permanent than first thought. If you can make sense of that, you are one up on me, but the Fed appears to have finally woken up to the inflation genie in the room and is now trying to put it back in the bottle. Too late most likely, and equities dumped.

Rivian, however, had withstood recent volatility and sell-offs quite well. Last Friday the stock only fell 2.3% as equity markets plunged over 4% on Omicron fears. It swiftly recovered on Monday, up nearly 7%, and yesterday the stock was more or less flat while indices fell nearly 2%. Rivian stock finished flat on Tuesday at $119.76.

When a stock goes up on good news but holds steady on bad news we have to take that as a positive sign, so we expect more gains to come. RIVN is a momentum name. Value investors keep away.

Rivian (RIVN) stock news

Of course, what would a retail momentum name be without a bit of wild speculation? Twitter lit up on Tuesday with reports that Rivian was about to ramp up production. Of course, there was no news from the company on this, and we note by contrast the last news we had was that deliveries were being delayed until March 2022.

Rivian (RIVN) stock forecast

From the chart $120 is still holding firm as resistance. If this breaks, expect a move to $130 as the next heavy volume resistance level. The Volume-Weighted Average Price (VWAP) since IPO is also around that level, further demonstrating its volume-based resistance. Above $135 things start to open up, and volume resistance dries up. Failure at $120 is ok. It is not until below $108 that volume weakens and hence so does support. A break of $108 will likely see a quick move to $100.

RIVN 30-minute chart

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD bounces back from five-month lows

AUD/USD ends its three-day decline on Wednesday, bouncing back from levels not seen since mid-November. Nevertheless, hawkish remarks from Federal Reserve officials and the influx of safe-haven flows could bolster the US Dollar and potentially limit the upside of pair in the short term.

USD/JPY trades with mild losses below 155.00 on risk-aversion

USD/JPY trades with mild losses near 154.65 on Wednesday during the early Asian trading hours. The robust US economy and sticky inflation data have triggered the expectation that the Fed might delay the easing cycle to September from June, which provides some support to the US Dollar.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Fetch.ai Price Prediction: FET must hold above $1.70 for strength

Fetch.ai is trading with a bearish bias. It comes as chatter about the proposed integration with the Ocean Protocol and the SIngularityNET ecosystem remains fresh.

UK CPI March Preview: Inflation pressures to dissipate further, adding to bets of BoE rate cuts

The March UK CPI report will be released by the Office for National Statistics on Wednesday. United Kingdom’s headline and core annual inflation are set to ease in March. The UK CPI report could hint at the BoE’s interest rate cut, rocking the Pound Sterling.