GBP/USD Forecast: Pressured ahead of US CPI

The GBP/USD pair nears the 1.3800 level, as the greenback retains its strength. The American currency keeps advancing on the heels of Tuesday’s news, as the US Senate passed the infrastructure bill, now in the House. Fresh financial support hints at steeper growth in the country. Hence, the dollar strengthens alongside Wall Street, with major indexes flirting with record highs.

The UK macroeconomic calendar had nothing relevant to offer this week, with the focus still 0n the US. After the country published an upbeat employment report on Friday, it will provide an inflation update today. The July US Consumer Price Index was preliminarily estimated at 5.4% YoY, now expected to be confirmed at 5.3%. Read more...

GBP/USD Analysis: Remains at the mercy of USD price dynamics, focus turns to US CPI

The GBP/USD pair struggled to preserve its modest intraday gains and finally settled in the red on Tuesday amid sustained US dollar buying interest. Investors have been pricing in the prospects for an early tapering of the Fed's massive pandemic-era stimulus amid signs of substantial further progress in the labor market recovery. This, in turn, was seen as a key factor that continued acting as a tailwind for the USD and exerted some downward pressure on the major.

Bets for an earlier action by the US central bank were further boosted by Atlantic Fed President Raphael Bostic and Boston Fed President Eric Rosengren's comments on Monday. Separately, Chicago Fed President Charles Evans said on Tuesday that the economy is on track to satisfy the Fed's threshold to begin tapering its $120 billion in monthly purchases of Treasury and mortgage bonds. Read more...

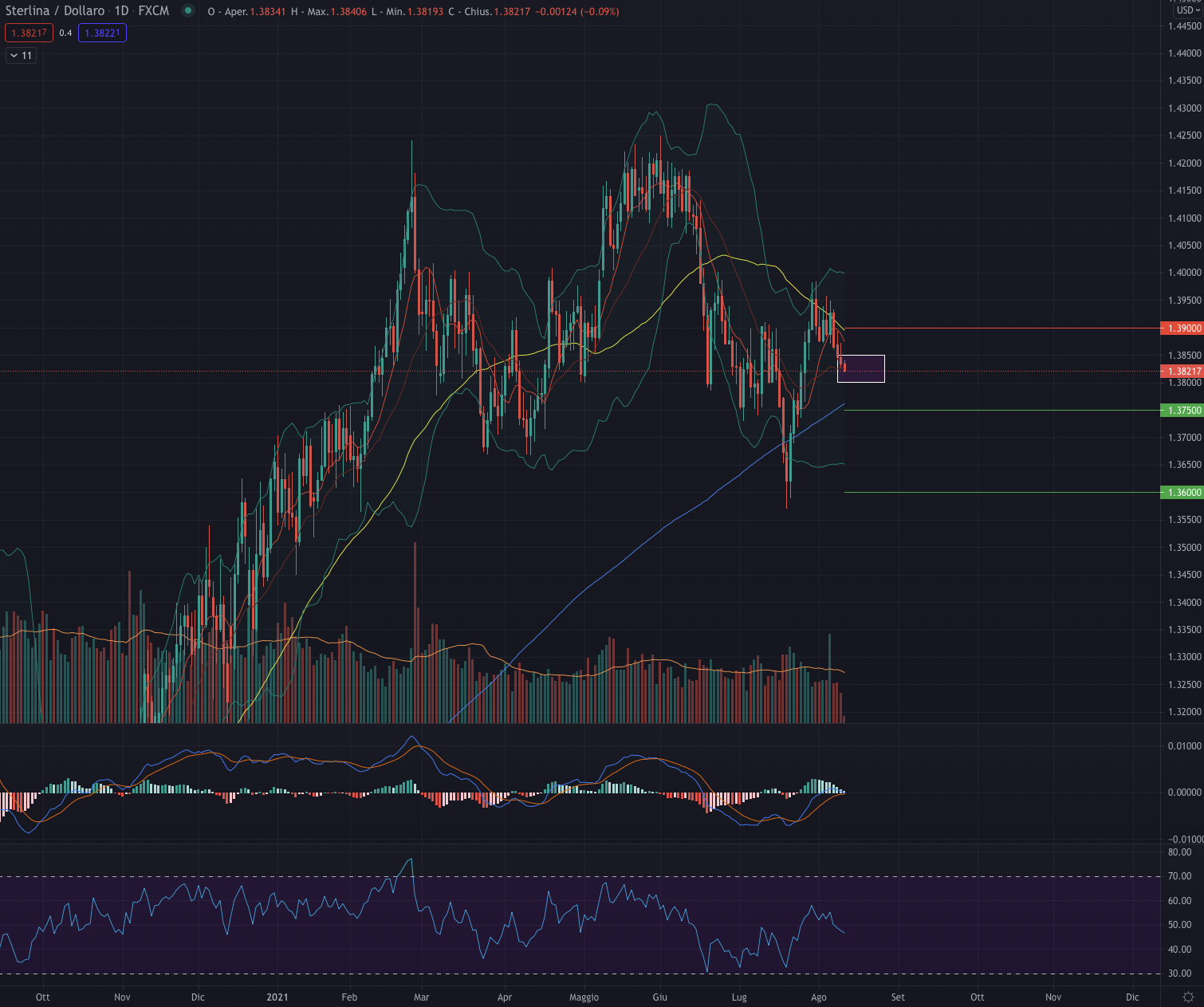

GBP/USD: The downtrend continues

The GBP/USD after reaching 1.4250 in June has entered into a bearish trend which we believe might continue into the short term. Cable recently backtested and got rejected by the 50MA strengthening our idea that is soon due to another downside. We will put our first target just above the 200MA and if the level is broken we could easily reach 1.36.

If it actually managed to fall till 1.36 we could assist at a double bottom formation, increasing the chances for a long position. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.