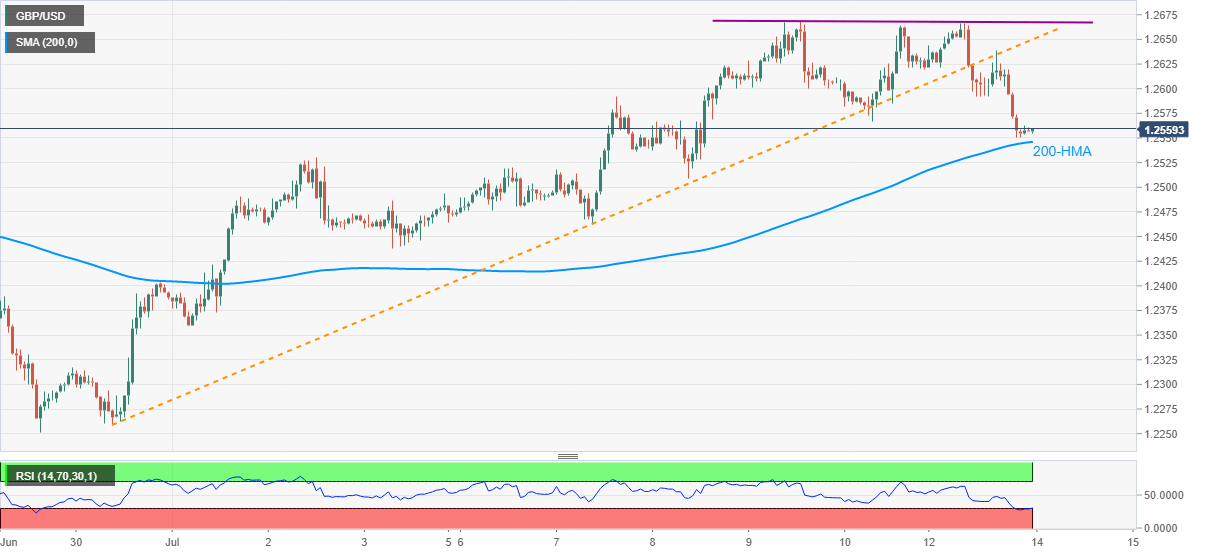

GBP/USD Price Analysis: 200-HMA probes break of two-week-old trendline under 1.2600

GBP/USD keeps the early-day bounce off 1.2550 while trading around 1.2560 ahead of the Tokyo open on Tuesday. Although the break of a two-week-old rising trend line dragged the quote to a four-day low, 200-HMA gain supports from oversold RSI conditions to challenge the bears.

As a result, the quote’s bounce to regain 1.2600 can’t be ruled out. However, any further upside depends upon how well the buyers manage to conquer 1.2665/70 area comprising highs marked on Thursday and Monday.

Should the bulls successfully clear 1.2670 resistance, 1.2715 and June month top near 1.2815 will be on their radars. Meanwhile, a downside break below 200-HMA level of 1.2545 will attack 1.2500 round-figures to portray the bears’ dominance.

GBP/USD Forecast: Pound weakens despite limited dollar’s demand

The GBP/USD pair traded as high as 1.2665 on the back of risk-appetite but was unable to hold on to gains, spending most of the last two sessions battling to retain the 1.2600 threshold, to finally plunge to the current 1.2570 price zone. Chatter on possible negative rates and the lack of progress in Brexit talks towards a trade deal with the EU weighed on Pound. Bank of England Governor Bailey was on the wires this Monday, saying that there are signs of economic recovery, but adding that there’s a long way to go. Meanwhile, UK PM Johnson said that the government got the virus under control across the country, adding the importance of wearing a face-covering in closed environments. Johnson added guidance on face marks will be out in the next few days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD: The first upside target is seen at the 1.0710–1.0715 region

The EUR/USD pair trades in positive territory for the fourth consecutive day near 1.0705 on Wednesday during the early European trading hours. The recovery of the major pair is bolstered by the downbeat US April PMI data, which weighs on the Greenback.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.