GBP/USD outlook: Bears take a breather before attempting through key supports

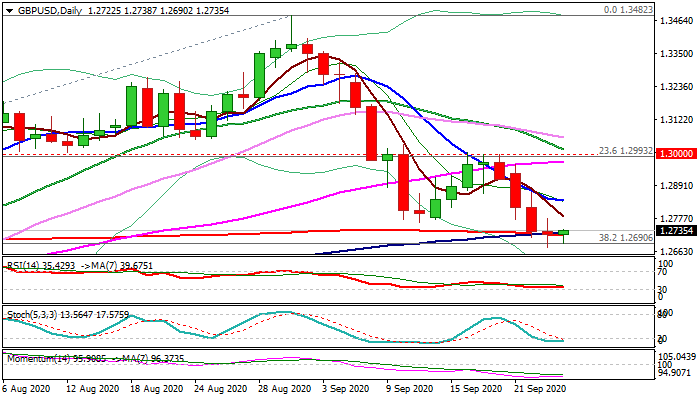

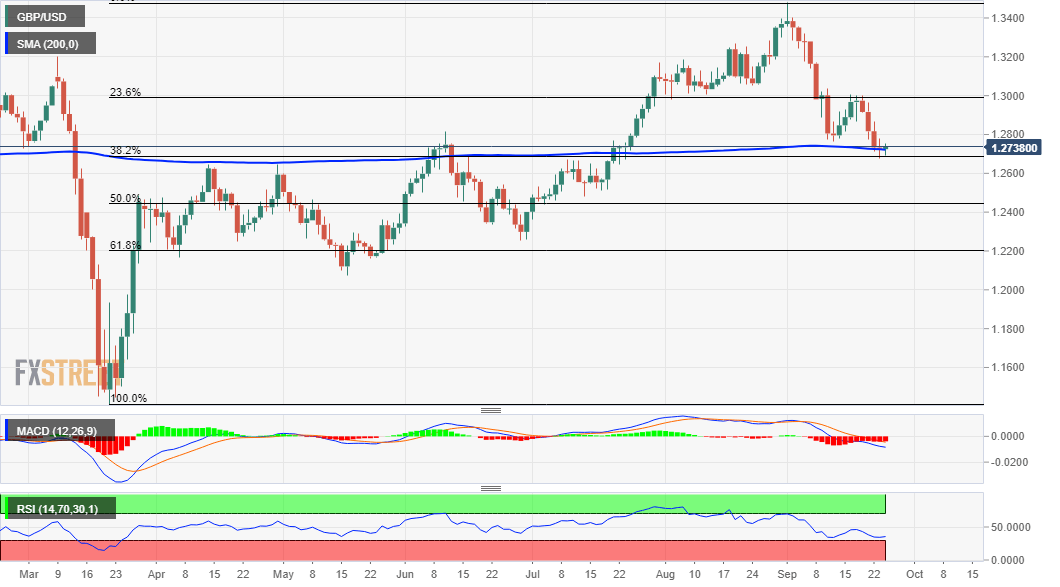

Cable is consolidating within narrow range above Wednesday’s nine week low (1.2675) after bears managed to close below the base of thick daily cloud but failed to register close below next pivotal support at 1.2690 (Fibo 38.2% of 1.1409/1.3482).

Wednesday’s long-legged Doji candle points to indecision, as bears face headwinds from key support zone at 1.2719/1.2690 (200DMA / Fibo 38.2%) and deeply oversold stochastic.

Near-term sentiment remains negative as risk aversion and drop in equities continue to inflate dollar, while some positive tones could be heard on optimism on Brexit talks.Consolidation is likely to precede final break of 1.2690 pivot that would open way for deeper correction of 1.1409/1.3482 (Mar-Aug rally). Read More...

GBP/USD treads water above 1.2700, eyes on Bailey’s speech

GBP/USD looks to extend its overnight consolidation phase above 1.2700 into Europe, having faded the recovery momentum near 1.2775 region.

The cable witnessed a good 100-pips price movement on Wednesday, initially falling to the lowest levels since July 23 at 1.2674, as investors fretted over the UK’s nascent economic recovery after Prime Minister (PM) Boris Johnson’s government announced activity restriction on Tuesday to contain the virus spread. Even so, the Kingdom reported 6,178 new infections, the biggest daily jump since May. Read More...

GBP/USD Forecast: Not out of the woods yet amid coronavirus jitters, Brexit uncertainties

The GBP/USD pair seesawed between tepid gains/minor losses through the early European session and consolidated its recent fall to two-month lows. Investors remain worried that the second wave of coronavirus infections could lead to the return of severe lockdown restrictions and derail the global economic recovery. This, in turn, continued driving some haven flows towards the US dollar. However, warnings by various Fed officials, stressing the need for more fiscal stimulus to sustain the recovery, kept a lid on any strong gains for the USD and helped limit any deeper losses for the major.

On the other hand, the British pound was trying to find its footing amid persistent Brexit-related uncertainties. It is worth reporting that the EU's chief Brexit negotiator, Michel Barnier in London for informal talks until Friday. Investors now seemed reluctant and preferred to wait for fresh Brexit updates before placing any aggressive bets. This, in turn, led to the pair's subdued/range-bound price action through the first half of the trading action on Thursday. Nevertheless, increasing odd of a messy Brexit at the end of the transition period should keep a lid on any strong gains for the pair. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.