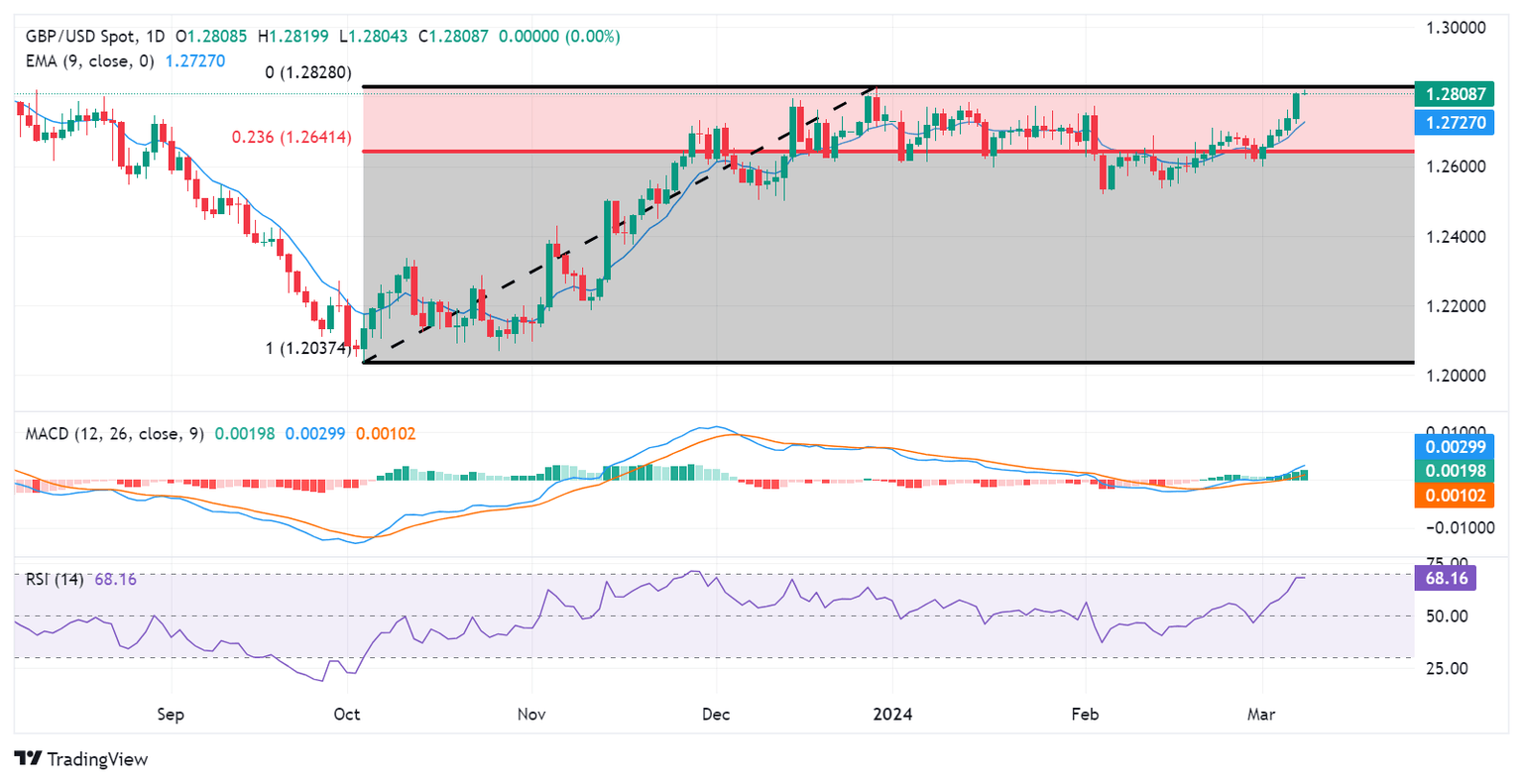

Pound Sterling Price News and Forecast: GBP/USD targets December high at 1.2828 and August high at 1.2841

GBP/USD Price Analysis: Appreciates to near 1.2810 followed by December’s high

GBP/USD seems to continue its winning streak that began on March 1, hovering around 1.2810 during the Asian session on Friday. The GBP/USD pair receives upward support as the US Dollar (USD) faces challenges on improved risk appetite amid lower US Treasury yields.

The GBP/USD pair finds the immediate barriers at December’s high at 1.2828 and August’s high at 1.2841. A break above these levels could support the pair to test the major level of 1.2850, followed by the psychological resistance area around the 1.2900 level. Read more...

GBP/USD clinches fresh 2024 highs above 1.2800 ahead of US NFP data

The GBP/USD pair holds ground above the 1.2800 psychological barrier during the early Asian trading hours on Friday. The selling pressure in the US Dollar (USD) provides some support to the major pair. The highlight on Friday will be the US labor market data for February. GBP/USD currently trades around 1.2810, up 0.01% on the day.

The Federal Reserve (Fed) Chairman Jerome Powell presents the Monetary Policy Report and responds to questions before the Senate Banking Committee on Thursday. Powell said that interest rate cuts may not be too far off if inflation signals cooperate. Fed Chair didn’t provide a precise timetable for rate cuts but noted that the day could be coming soon. Investors expect the first cut to come in June, with four reductions totaling a full percentage point by the end of 2024. Read more...

Author

FXStreet Team

FXStreet