GBP/USD Forecast: Falling out of the channel has good reasons, and more may come

Ten days instead of seven – of self-isolation in case of showing coronavirus symptoms. That is likely to be the new announcement from the British government, and GBP/USD is also confined under 1.30.

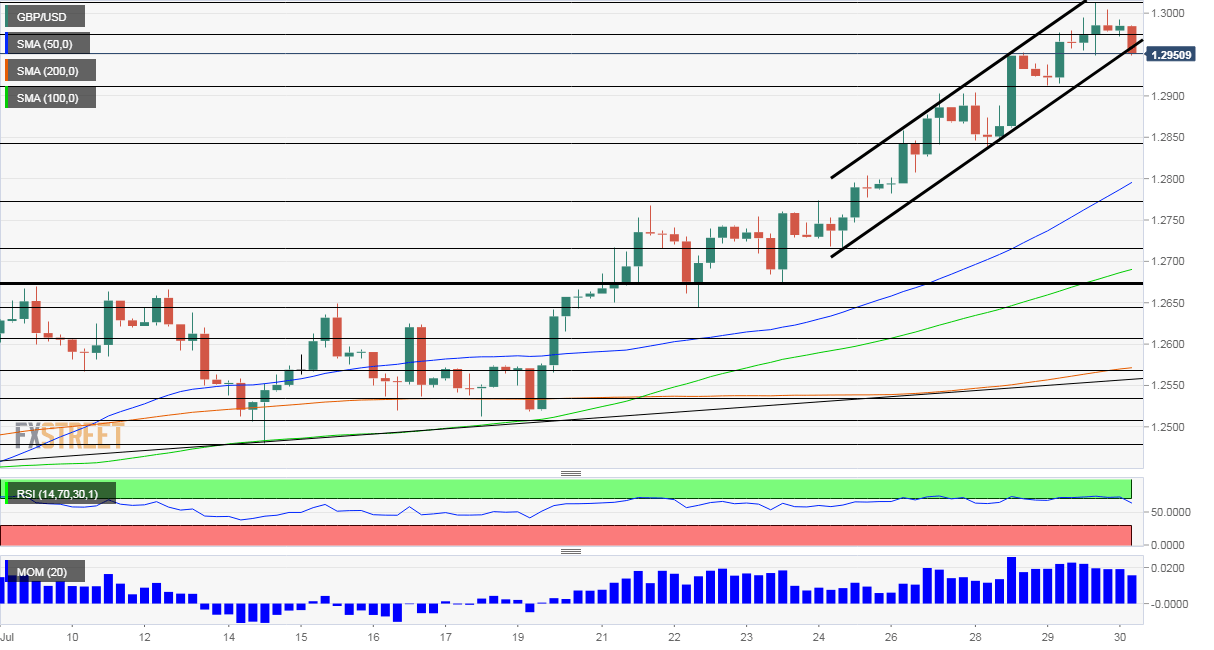

The Federal Reserve's dovish decision triggered a false break above 1.30 – as expected – and the downfall is sending it below the uptrend channel.

What did the Fed do? The world's most powerful central bank left its policy unchanged but painted a gloomier picture of the economy. Jerome Powell, Chairman of the Federal Reserve, said that high-frequency data is softer since coronavirus cases increased from mid-June. Read More...

GBP/USD Analysis: Struggles to find acceptance above 1.3000, US GDP eyed for fresh impetus

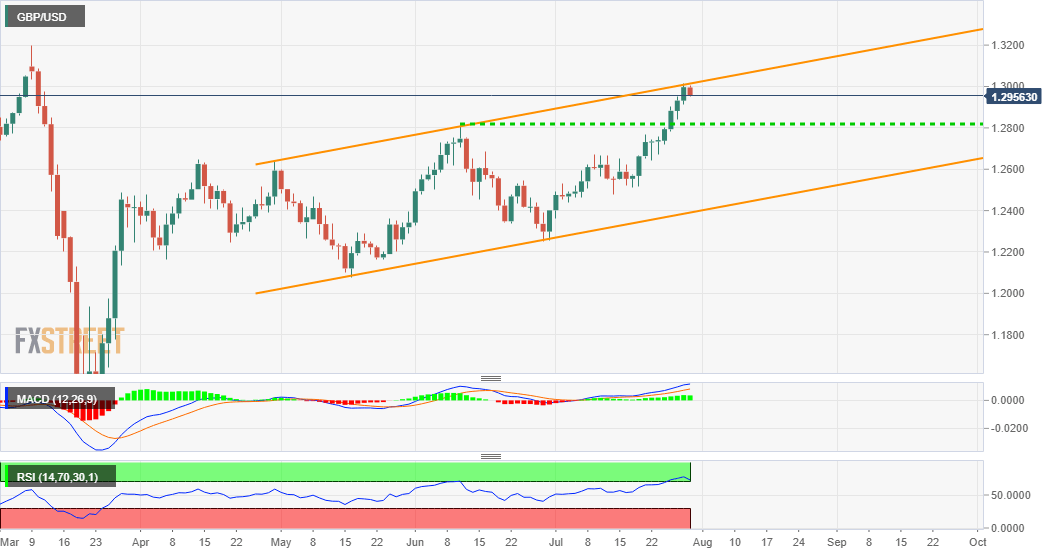

The GBP/USD pair prolonged its recent strong bullish momentum and continued scaling higher on Wednesday amid the emergence of some fresh US dollar selling. The pair moved back above the key 1.30 psychological mark during the US session after the Fed delivered a more dovish message. As was widely expected, the US central bank decided to leave the Fed funds target rate unchanged at 0-0.25%. The Fed also pledged to keep rates near zero until it is confident that the economy has weathered the recent events and is on track to achieve its maximum employment and price stability goals.

The accompanying policy statement indicated that members tied the pace of recovery on the developments surrounding the coronavirus pandemic. In the post-meeting virtual press conference, the Fed Chair Jerome Powell that there are signs that the continuous increase in COVID-19 cases is weighing on the economic activity and reiterated to use a full range of tools to support the economy. Read More...

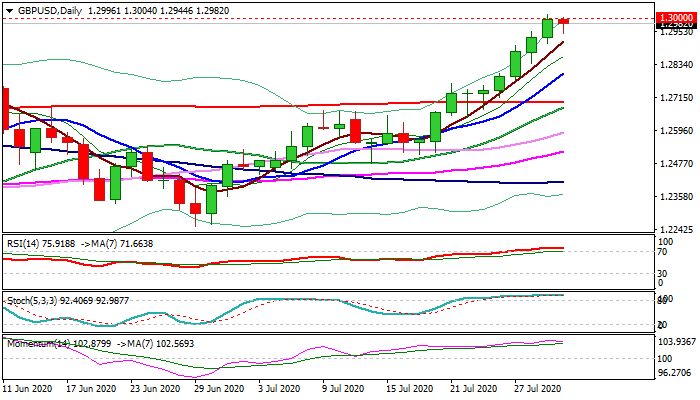

GBP/USD outlook: Bulls look for renewed attack at 1.3017 Fibo barrier after consolidation

Cable is consolidating under new nearly five-month high at 1.3013, posted on Wednesday's initial probe through psychological 1.30 barrier. Today's action so far showed shallow dip, keeping immediate focus at 1.3017 Fibo barrier (76.4% of 1.3514/1.1409), but overbought daily techs continue to warn. Bids are seen at 1.2915/1.2887 (rising 5DMA / Fibo 23.6% of 1.2479/1.3013), with deeper pullback to find footstep above 1.2813/00 zone (former high / Fibo 38.2% / rising 10DMA) to keep bulls intact. Firm break above 1.3000/17 pivots would open way towards targets at 1.3199 (9 Mar high) and 1.3209 (2020 high, posted on 31 Jan). Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.