GBP/USD Forecast: Break or bounce ahead of double-top? Boris holds the keys

Opening optimism – that is the downward driver of the dollar and what is causing cable to climb – but the double-top of 1.2645 could be too much to ask. The next steps depend on UK Prime Minister Boris Johnson on several fronts.

Brexit: Hopes for mutual concessions have so far failed to materialize. Talks between the EU and the UK continue via video and the current round is set to end on Friday. Brussels has its hopes on a dramatic intervention by Johnson, similar to his agreement to allow a customs border between Northern Ireland and the rest of Britain. Read More...

GBP/USD Forecast: Seems poised to retest 200-DMA around mid-1.2600s

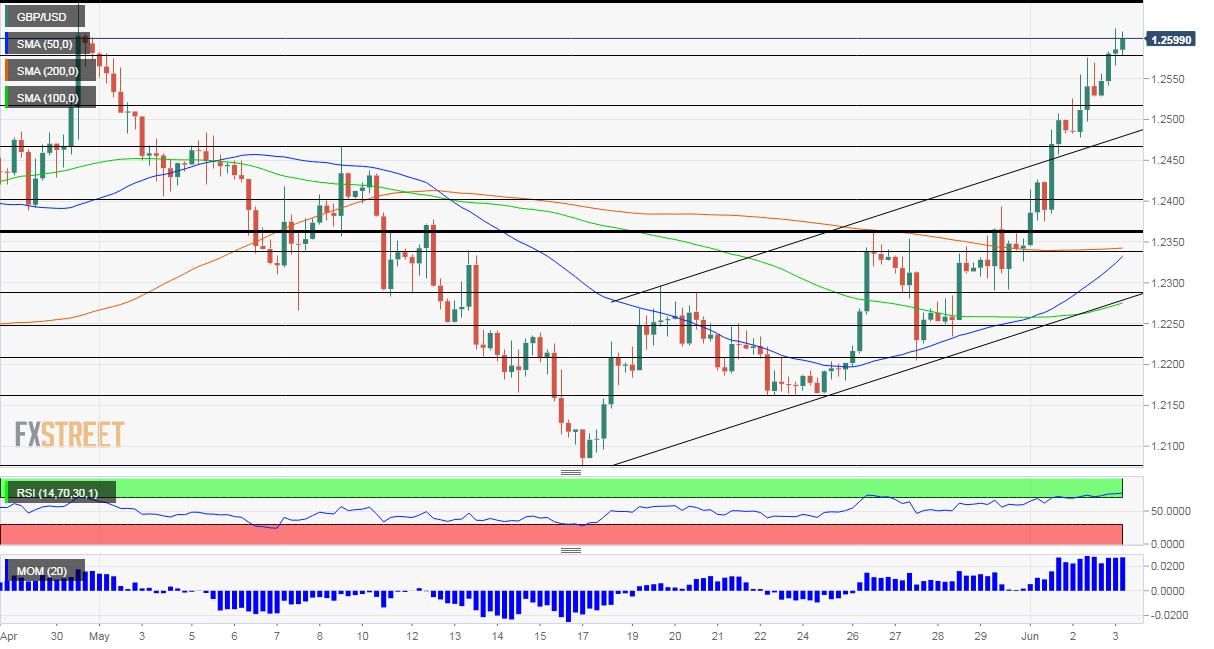

The GBP/USD pair continued scaling higher for the fifth consecutive session on Wednesday and cracked through 100-day SMA barrier during the Asian session. Growing optimism about the global economic recovery kept the safe-haven US dollar under pressure and remained supportive of the ongoing momentum to the highest level since late April. The risk-on mood seemed rather unaffected by heightened concerns over US-China tensions and rising social unrest in the United States.

Bullish traders even shrugged off the increasing risk of a hard Brexit ahead of the month-end deadline to extend the transition period beyond this year. In the latest Brexit-related development, the UK dismissed reports that Prime Minister Boris Johnson was ready to compromise on key sticking points such as fisheries and the level playing field. Negotiators kicked off the fourth round of Brexit talks on Tuesday and there has been no hint of any meaningful progress. Read More...

GBP/USD is going up towards daily ATR

The GBP/USD is bullish we should see a continuation towards higher levels. The daily ATR is sitting at the 1.2655, so this could be the target.

GBP/USD is the fifth consecutive day in uptrend. At this point we see that 1.2600 has been broken and continuation points to higher levels. Bullish impulse is still strong and if the price manages to hold above 1.2540-1.2580 we should see another wave up. Read More...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.

-637267624229444320-637267713470768931.png)