GBP/USD Forecast: Selling opportunity? Dead-cat bounce leaves critical support in danger

Every trend has a countertrend – yet if the move in the opposite direction has no justification, it could prove short-lived. GBP/USD has bounced off the fresh five-month low of 1.3570 as the dollar has taken a break from gains. The greenback is falling as Treasury yields rise – a change in correlation. It seems that demand for bonds and the dollar are now linked.

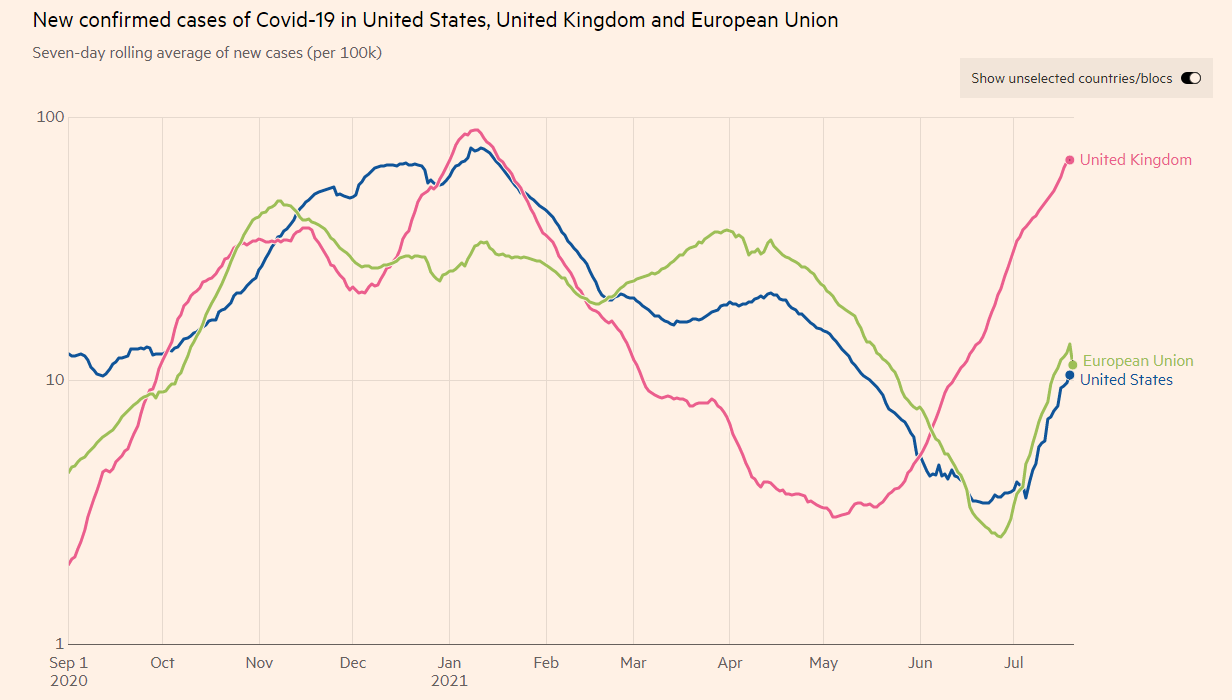

Markets' "Turnaround Tuesday" has helped cable climb from the abyss, but it is hard to find any noteworthy fundamental change that justifies an upswing. First and foremost, COVID-19 cases remain elevated in Britain, nearing 50,000 per day once again. Vaccinations slow the increase in hospitalizations and deaths, but cannot fully keep them down. Read more...

GBP/USD Price Analysis: Remains vulnerable to slide further

The GBP/USD pair once again showed some resilience below the 1.3600 mark and quickly recovered around 40-50 pips from the daily swing lows. The pair climbed back closer to the top end of its daily trading range, though lacked any follow-through buying and was last seen hovering around the 1.3630 region.

A generally positive risk tone – as depicted by a strong follow-through rally in the equity markets – prompted some profit-taking around the safe-haven US dollar. This, in turn, was seen as a key factor that extended some support to the GBP/USD pair. That said, the impasse over the Northern Ireland Protocol of the Brexit deal, along with the resurgence of the COVID-19 infections in the UK acted as a headwind for the British pound and capped gains. Read more...

GBP/USD struggles near multi-month lows, around 1.3600 mark

The GBP/USD pair remained on the defensive through the early European session and was last seen hovering near the lower end of its intraday trading range, just below the 1.3600 mark.

The pair struggled to capitalize on the previous day's bounce from the lowest level since February 4 and edged lower for the fifth consecutive session on Wednesday. This also marked the seventh day of a negative move in the previous eight and was sponsored by a combination of factors. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds gains above 1.0600, focus on ECB/ Fed speeches

EUR/USD is holding gains above 1.0600 in European trading on Wednesday. The US Dollar has entered a consolidative mode, allowing the Euro to heal its wounds. The EUR/USD rebound appears limited amid Fed-ECB policy divergence. ECB and Fed speeches awaited.

GBP/USD rises through 1.2450 after UK inflation data

GBP/USD gains traction and rises above 1.2450 in the European morning on Wednesday. The UK's ONS reported that the annual inflation edged lower to 3.2% in March. This reading came in above the market expectation of 3.1% and helped Pound Sterling find demand.

Gold price turns sideways as Fed Powell hawkish guidance limits upside

Gold price balances below $2,400 in Wednesday’s European session. The precious metal struggles to recapture new all-time highs around $2,430 as Fed Chair Jerome Powell emphasised maintaining the restrictive policy framework for a longer period.

XRP tests $0.50 resistance after Ripple CLO clarifies that no pretrial conference took place with SEC

XRP is stuck below $0.50 resistance after failing to close above this level since Monday. Ripple CLO Stuart Alderoty said late Tuesday there was no pretrial conference since the SEC dropped charges against executives.

World economy: To cut or not to cut (simultaneously)?

US inflation March figure, again higher than expected, put an end to the scenario of a simultaneous first rate cut by the Fed, the ECB, and the BoE in June.