GBP/USD Forecast: Petrol problems pound the pound, BOE and upbeat mood could turn it up

Running dry – the UK Petrol Retailers Association has said 50-90% of stations are running dry in some areas, and the crisis may derail the recovery. Calls to avoid panic-stocking have only served to highlight the issue and to trigger long lines at pumps.

Contrary to natural gas, there is no shortage of fuel, but rather one of truck drivers, many of whom are EU nationals. Prime Minister Boris Johnson suspended rules relating to hiring foreigners, is contemplating sending the army to help and also suspended competition rules. The longer the crisis lasts, the greater the pressure on the pound. Read more...

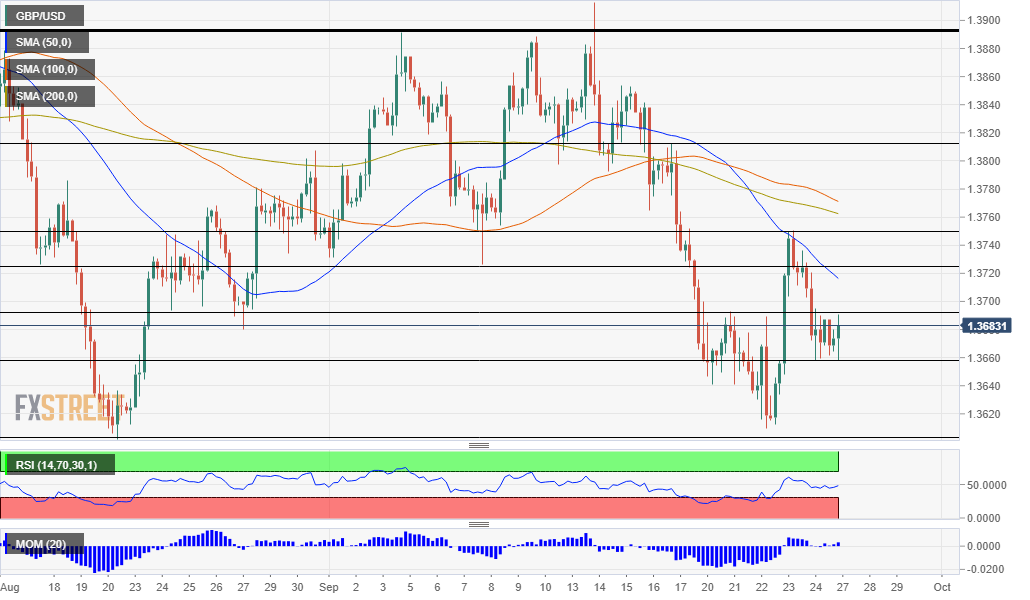

GBP/USD analysis: Finds support in 1.3660

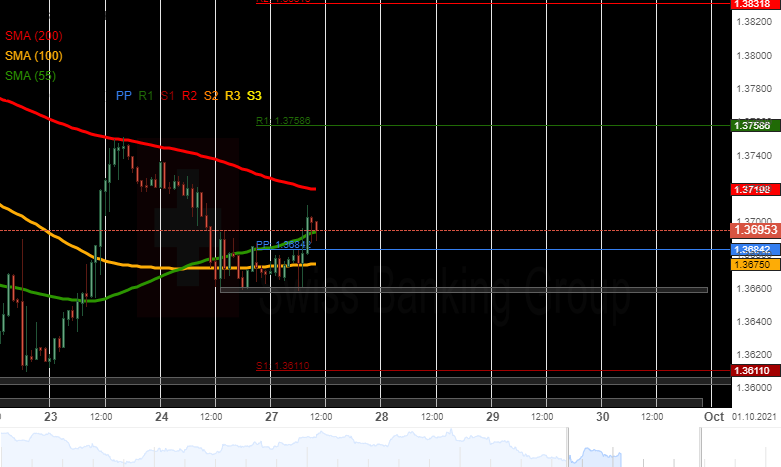

At mid-day on Friday, the GBP/USD started to find support in the 1.3660 level. On Monday, the rate bounced off the support level and began a surge. The surge passed the resistance of the 55, 100 and weekly simple pivot points from 1.3675 to 1.3690. Next target for the surge was the 200-hour simple moving average near 1.3720.

In the case that the resistance of the 200-hour SMA fails to push the rate down, the pair would aim at the resistance of the 1.3750 mark and the weekly simple pivot point at 1.3759. Read more...

GBP/USD jumps to 1.3700 neighbourhood, fresh session tops

The GBP/USD pair shot to fresh daily tops during the early European session, though lacked any follow-through and remained below the 1.3700 mark.

The pair attracted some dip-buying on the first day of a new trading week and rallied over 35 pips from the daily swing lows, near the 1.3660-55 region. The uptick allowed the GBP/USD pair to recover a part of Friday's losses and was sponsored by a subdued US dollar price action. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.