GBP/USD Forecast: Near-term support holds, fundamentals point to additional gains

The British pound has started the last day of the week on the back foot pressured by the disappointing Retail Sales data from the UK, which showed a contraction of 0.2% in September vs the market expectation for an increase of 0.5%. Nevertheless, the upbeat October PMI figures seem to be helping the GBP stay resilient against the dollar.

IHS Markit reported on Friday that the economic activity in the UK's private expanded at a stronger pace in early October than it did in September with the Manufacturing PMI and the Services PMI improving to 57.7 and 58, respectively. Read more...

GBP/USD outlook: Cable eases further after downbeat UK Retail Sales

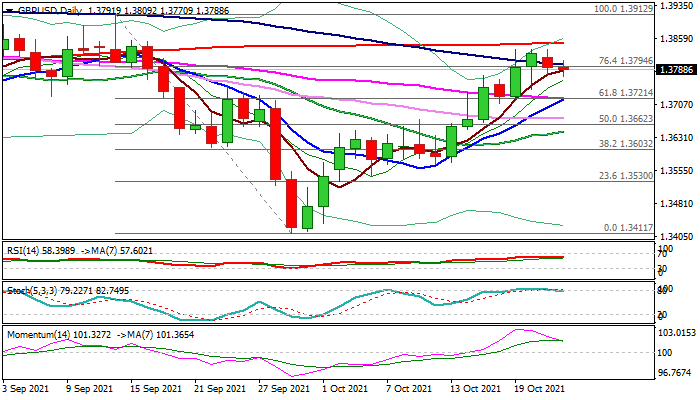

Cable remains in red in early Friday following Thursday’s bearish close after larger bulls lost traction on approach to 200DMA (1.3848). Return below broken 100DMA (1.3798) and Fibo 76.4% barrier (1.3794) adds to initial signal of stall and shift near-term focus lower.

Weaker than expected UK retail sales data (Sep 0.2% vs 0.5% f/c m/m; -1.3% vs -0.4% f/c y/y) increased pressure on pound, warning of corrective pullback after the pair hit new one-month high (1.3834) earlier this week. Rapid loss of bullish momentum on daily chart and stochastic reversing from overbought territory support scenario, but rising thick weekly cloud continues to underpin the action, with cloud top (1.3694) offering solid support. Read more...

GBP/USD remains confined in a range around 1.3800 mark

The GBP/USD pair lacked any firm directional bias and seesawed between tepid gains/minor losses, around the 1.3800 mark through the mid-European session.

The pair witnessed some intraday selling and dropped to two-day lows near the 1.3770 area in reaction to dismal UK Retail Sales figures, which unexpectedly dropped by 0.2% in September. Excluding the auto motor fuel sales, the core retail sales decline by -0.6% MoM and added to signs of weakness in the economic recovery.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.