GBP/USD plummets below 1.3700, on US dollar strength, ahead Fed and BoE week

The GBP/USD slides for the third time in the week, looking forward to ending the week in the red, down 0.67%, trading at 1.3696 during the New York session at the time of writing. Worse than expected, heavy-tech US Q3 corporate earnings on Thursday and concerns about inflation and tight monetary policy dampened market sentiment, weakening risk-sensitive currencies like the British pound. Read more...

GBP/USD Weekly Forecast: Duo of central banks and Nonfarm Payrolls promise wild action

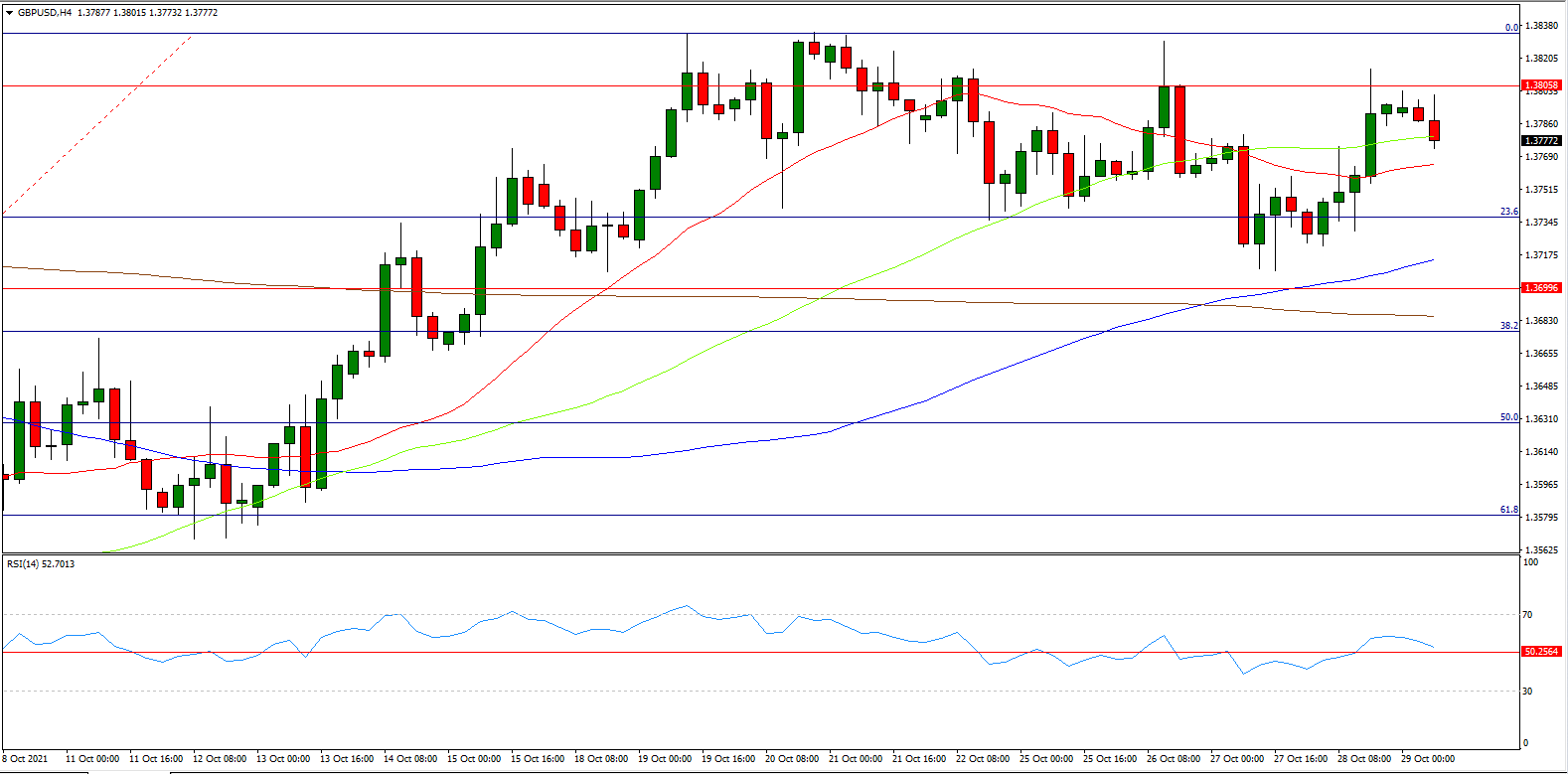

GBP/USD has been edging higher on weak US GDP and falling bond yields. Inflation seems to bite – at least the US economy, which has suffered weaker growth. The dollar struggled in response to GDP data and the yield curve flattened, allowing GBP/USD to advance despite ongoing Brexit issues. The FX Poll is pointing to short-term gains and falls afterward. Read more...

GBP/USD Forecast: British pound to weaken with Brexit headlines taking center stage

The GBP/USD pair has managed to erase a portion of its weekly losses on Thursday but failed to recapture the 1.3800 mark. However, the fact that the EUR/GBP pair registered gains for the second straight day on Thursday suggests that GBP/USD's recovery was fueled by the broad-based USD weakness rather than GBP strength. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold ascends but remains shy of testing $2,400 amid hawkish Fed remarks

Gold prices edged higher late in North American session, gaining 0.22% following a hawkish tilt by Fed Chair Jerome Powell. Economic data from the United States was mixed, though Monday’s Retail Sales report and Powell’s remarks kept US Treasury yields higher, capping the yellow metal’s advance.

Bitcoin price outlook amid increased demand and speculation pre-halving

Bitcoin price is edging lower as markets count only days to the halving. Nevertheless, the dump has not shaken the faith of large holders as they continue to cling to their holding even after a month of steady dumps.

UK CPI inflation data ahead: Sterling hovering north of key support

Following today's mixed bag of employment and wages data, today’s attention is directed to the March UK CPI inflation release. Both headline and core measures have surprised to the downside in the previous two releases and are expected to demonstrate further evidence of disinflation.

-637711026536907074-637711262558660324.png)