-

NASDAQ:OCGN shoots up 19.33% during Friday’s trading session.

-

Ocugen is the latest penny stock to win the favor of retail investors looking for the next big thing.

-

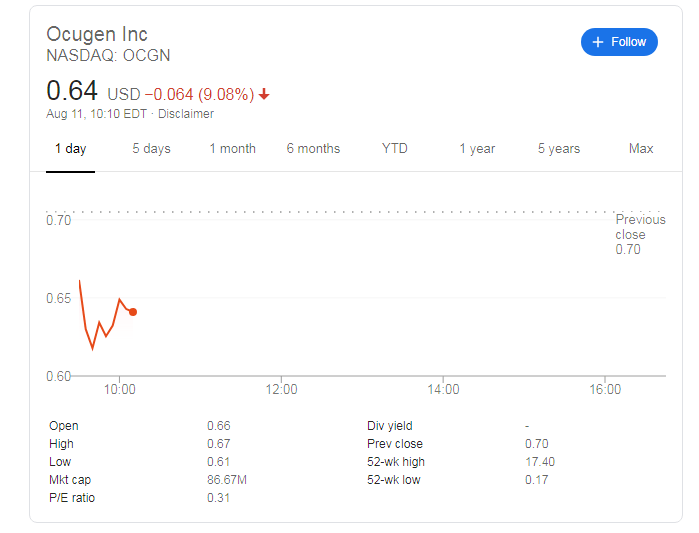

OCGN is moving down some 9% on Tuesday, shrugging off the FDA news.

Update: Tuesday's trading session is unfavorable to OCugen investors, with shares falling some 9% to around $0.64. The sell-off comes despite the FDA boost the company recently received, described below. Another reason for he fall may come from Russia, where President Vladimir Putin announced his country has a coronavirus vaccine.

NASDAQ:OCGN has been a roller coaster for investors over the last few years – to say the least. The 52-week high of $17.40 may be confusing to people at first glance – especially since Ocugen is considered a penny stock biotech company. One needs to only look back six years when the firm debuted, with a split-adjusted price level of just under $800 per share. Last September, the stock underwent a 1:60 reverse split to try and salvage some financial legitimacy – but even after the split the stock price continued to plummet.

On the surface, Ocugen’s professional goal is to develop gene therapies that would provide cures for numerous diseases that cause blindness. Its website shows that it has three different therapies at various stages of pre-clinical studies. While that sounds promising, it also is a clear message that none of these treatments are currently bringing any revenues for Ocugen. Nevertheless, one of its treatments, OCU400 has just received orphan drug status from the FDA.

A deeper dive into Ocugen’s financials quickly paints a troubling picture for the firm ahead of its quarterly earnings call next week. There are several red flags that show the financial weakness of the company including an EBITDA loss of 13.9 million and a ROA (return on assets) of -119.20%. Both numbers are key indicators of financial instability and poor management – just two of the many reasons why the stock has a devastating -95.91% return over the last year.

OCGN Stock Forecast

Ocugen has caught the attention of retail investors, particularly those that use the popular Robinhood platform. On Friday, OCGB recorded a trading volume that was nearly double the normal average volume for this stock. High volume is usually a motivator that causes a share’s price to fluctuate higher or lower with more extreme volatility. Investors should expect the rollercoaster ride to continue for Ocugen – starting with the high chance of a pullback when the markets open on Monday.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.